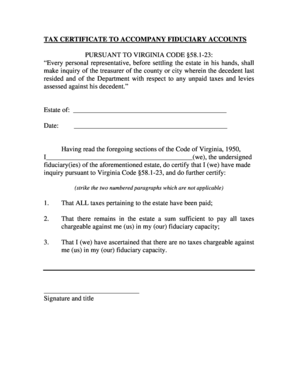

Tax Certificate to Accompany Fiduciary Accounts Form

What is the Tax Certificate to Accompany Fiduciary Accounts

The tax certificate to accompany fiduciary accounts is a crucial document used by fiduciaries to report income and expenses related to the management of a trust or estate. This form provides essential information to the Internal Revenue Service (IRS) and ensures that all tax obligations are met. It typically includes details about the fiduciary's identity, the beneficiaries, and the financial activities of the fiduciary account. Understanding this certificate is vital for compliance and accurate tax reporting.

How to Use the Tax Certificate to Accompany Fiduciary Accounts

Using the tax certificate to accompany fiduciary accounts involves several steps. First, gather all necessary financial information related to the fiduciary account, including income, deductions, and distributions. Next, accurately fill out the form, ensuring that all details are complete and correct. Once completed, the form should be signed by the fiduciary and submitted to the appropriate tax authority. This process helps maintain transparency and ensures that all parties involved are aware of their tax responsibilities.

Steps to Complete the Tax Certificate to Accompany Fiduciary Accounts

Completing the tax certificate to accompany fiduciary accounts requires careful attention to detail. Follow these steps:

- Gather financial statements and records related to the fiduciary account.

- Fill in the fiduciary's name, address, and taxpayer identification number.

- Provide information about the beneficiaries, including their names and tax identification numbers.

- Report all income received by the fiduciary account, including interest and dividends.

- Document any deductions or expenses incurred while managing the account.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal Use of the Tax Certificate to Accompany Fiduciary Accounts

The legal use of the tax certificate to accompany fiduciary accounts is governed by IRS regulations. This document serves as a formal declaration of the fiduciary's financial activities and must be completed accurately to avoid legal repercussions. It is essential for fiduciaries to understand their obligations under the law, including the requirement to report income and distributions to beneficiaries. Failure to comply with these regulations can result in penalties or legal challenges.

Key Elements of the Tax Certificate to Accompany Fiduciary Accounts

Several key elements must be included in the tax certificate to accompany fiduciary accounts to ensure its validity:

- Fiduciary Information: Name, address, and taxpayer identification number of the fiduciary.

- Beneficiary Details: Names and taxpayer identification numbers of all beneficiaries.

- Financial Reporting: Comprehensive reporting of income, deductions, and distributions.

- Signature: The fiduciary's signature is required to validate the document.

IRS Guidelines for the Tax Certificate to Accompany Fiduciary Accounts

The IRS provides specific guidelines for completing the tax certificate to accompany fiduciary accounts. These guidelines outline the required information, the format for reporting income and expenses, and the deadlines for submission. It is essential for fiduciaries to familiarize themselves with these guidelines to ensure compliance and avoid potential issues with the IRS. Adhering to these regulations helps maintain the integrity of the fiduciary account and protects the interests of the beneficiaries.

Quick guide on how to complete tax certificate to accompany fiduciary accounts

Effortlessly Prepare Tax Certificate To Accompany Fiduciary Accounts on Any Device

The management of online documents has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without issues. Manage Tax Certificate To Accompany Fiduciary Accounts across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Tax Certificate To Accompany Fiduciary Accounts with Ease

- Obtain Tax Certificate To Accompany Fiduciary Accounts and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight important sections of the documents or conceal sensitive information with the specialized tools that airSlate SignNow offers.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Choose how you wish to send your form—by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your device of choice. Edit and electronically sign Tax Certificate To Accompany Fiduciary Accounts to guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a tax certificate to accompany fiduciary accounts?

A tax certificate to accompany fiduciary accounts is an official document required for tax reporting purposes. It verifies that the fiduciary account has been properly established and is compliant with tax regulations. This certificate is essential for maintaining transparency and avoiding tax-related issues for trustees and beneficiaries.

-

Why do I need a tax certificate for my fiduciary accounts?

You need a tax certificate to accompany fiduciary accounts to ensure compliance with IRS regulations. This document helps in the accurate reporting of income generated by the fiduciary account and protects you from potential audit issues. It is crucial for fulfilling fiduciary responsibilities effectively.

-

How can airSlate SignNow assist in obtaining a tax certificate for fiduciary accounts?

airSlate SignNow provides an efficient platform for electronically signing and managing documents, including those needed for a tax certificate to accompany fiduciary accounts. With our easy-to-use interface, you can quickly prepare and send documents to obtain the required certifications seamlessly. This enhances your overall experience and compliance process.

-

What features does airSlate SignNow offer for managing fiduciary account documents?

AirSlate SignNow offers features such as secure eSigning, document templates, and automated workflows tailored for fiduciary account management. You can easily create, send, and track documents, including the tax certificate to accompany fiduciary accounts. These features streamline your document handling process while ensuring compliance.

-

Is airSlate SignNow cost-effective for managing fiduciary accounts?

Yes, airSlate SignNow is a cost-effective solution for managing fiduciary accounts. Our pricing plans are flexible, allowing you to choose the best option for your business needs without sacrificing functionality. You can efficiently manage all documents, including tax certificates to accompany fiduciary accounts, without a signNow financial burden.

-

Can I integrate airSlate SignNow with other software for my fiduciary accounts?

Absolutely! AirSlate SignNow offers numerous integration options with other software solutions, enhancing your workflow and document management for fiduciary accounts. By integrating our platform, you can streamline the process of obtaining tax certificates to accompany fiduciary accounts alongside your existing tools.

-

How do I ensure the security of documents related to fiduciary accounts?

AirSlate SignNow prioritizes the security of your documents with advanced encryption and compliance measures. Our platform provides secure storage and sharing options, ensuring that sensitive materials, including the tax certificate to accompany fiduciary accounts, are protected from unauthorized access. This commitment to security helps maintain trust with your clients.

Get more for Tax Certificate To Accompany Fiduciary Accounts

- Fillable online removing the computer cover fax email form

- Fillable online 2016 interim property tax bill notice fax form

- Fillable online corporations law form 603 pacifica

- Get the application for a vehicle identity check striker form

- Jis code opf form

- Fillable online wythevillefestival registration form

- Fillable online order forms for schools drs fax email

- Fillable online application food store city of windsor form

Find out other Tax Certificate To Accompany Fiduciary Accounts

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement