407 Letter Form

What is the 407 Letter

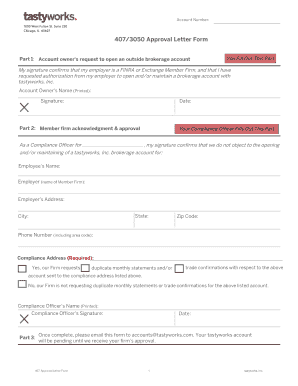

The 407 Letter, also known as the letter form 407, is a document used primarily for tax purposes in the United States. It is designed to provide essential information regarding tax withholdings and reporting for specific transactions. This form is particularly relevant for taxpayers who need to report certain types of income or deductions to the Internal Revenue Service (IRS). Understanding the purpose and requirements of the 407 Letter is crucial for ensuring compliance with tax regulations.

How to use the 407 Letter

Utilizing the 407 Letter involves a few straightforward steps. First, gather all necessary information, including your personal details and any relevant financial data. Next, complete the form accurately, ensuring that all entries are correct to avoid delays or penalties. Once filled out, the 407 Letter can be submitted electronically or via mail, depending on the specific requirements set forth by the IRS or the relevant tax authority. It is important to keep a copy for your records after submission.

Steps to complete the 407 Letter

Completing the 407 Letter requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary documents, such as previous tax returns and income statements.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details regarding the income or deductions you are reporting.

- Double-check all entries for accuracy before submission.

- Submit the form according to IRS guidelines, either electronically or by mail.

Legal use of the 407 Letter

The 407 Letter holds legal significance when it comes to tax reporting. It must be completed in accordance with IRS regulations to be considered valid. This means that all information provided must be truthful and accurate, as any discrepancies could lead to penalties or legal issues. Additionally, the form must be submitted within the designated timeframes to ensure compliance with tax laws.

Key elements of the 407 Letter

Several key elements are essential for the 407 Letter to be effective:

- Personal Information: Complete and accurate identification details.

- Income Reporting: Clear documentation of all income sources.

- Deductions: Properly itemized deductions that are eligible for reporting.

- Signature: A signature is required to validate the document.

Filing Deadlines / Important Dates

Filing deadlines for the 407 Letter are crucial to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April fifteenth for individual taxpayers. However, specific dates may vary based on individual circumstances or changes in tax law. It is advisable to check the IRS website or consult a tax professional for the most current deadlines to ensure timely submission.

Quick guide on how to complete 407 letter

Easily Prepare 407 Letter on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage 407 Letter on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The Simplest Method to Edit and eSign 407 Letter Effortlessly

- Locate 407 Letter and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then press the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign 407 Letter and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a 3050 letter print and how does it work?

A 3050 letter print is a printing solution designed to produce high-quality letters and documents quickly and efficiently. With airSlate SignNow, you can easily create and send these documents, ensuring they meet your business needs. The intuitive interface allows users to customize their letter print settings for optimal output.

-

How much does it cost to use the 3050 letter print feature?

The cost of utilizing the 3050 letter print feature with airSlate SignNow is competitive and varies based on the subscription plan you choose. Our pricing is designed to be affordable, ensuring that businesses of all sizes can benefit from the high-quality printing capabilities. For detailed pricing information, visit our pricing page.

-

What are the key features of the 3050 letter print tool?

The 3050 letter print tool offers various features, including customizable templates, bulk printing options, and secure electronic signatures. Additionally, it integrates seamlessly with our document management system, allowing for efficient workflow management. These features ensure that you can print and sign documents with ease.

-

What benefits does using 3050 letter print bring to my business?

Using the 3050 letter print feature can signNowly streamline your document workflow, saving you time and reducing operational costs. With swift printing and easy e-signing options, businesses can enhance productivity while ensuring compliance and security. It's a cost-effective solution that enhances overall efficiency.

-

Can I integrate the 3050 letter print with other software applications?

Yes, the 3050 letter print feature integrates smoothly with a variety of software applications, enhancing your existing business processes. Whether you use CRM systems, accounting software, or other productivity tools, airSlate SignNow can connect with them. This integration allows for a more cohesive workflow and improved document management.

-

Is there a limit to the number of documents I can print using the 3050 letter print?

No, there is no strict limit on the number of documents you can print using the 3050 letter print feature. However, your printing capacity may vary based on your chosen subscription plan. We encourage businesses to evaluate their expected document volume and select the plan that best fits their needs.

-

How can I get support if I face issues with the 3050 letter print?

If you experience any issues with the 3050 letter print feature, our dedicated customer support team is here to help. You can signNow out to us via email or chat for prompt assistance. Additionally, our comprehensive knowledge base offers tutorials and guides to help you troubleshoot common problems.

Get more for 407 Letter

- Two individuals husband and wife to two form

- Control number mi 040 77 form

- Control number mi 041 77 form

- Three 3 individuals to two 2 individuals form

- Affidavits state bar of michigan form

- Sworn statement state of michigan ss county form

- The undersigned an individual aan form

- Upon billing by the health care provider form

Find out other 407 Letter

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template

- Help Me With eSign New Mexico Debt Settlement Agreement Template

- eSign North Dakota Debt Settlement Agreement Template Easy

- eSign Utah Share Transfer Agreement Template Fast