Hud 1003 Form

What is the HUD 1003?

The HUD 1003, also known as the Uniform Residential Loan Application, is a standardized form used in the United States for applying for a mortgage. This form collects essential information about the borrower and the property being financed. It is a crucial document for lenders to assess the borrower's financial situation and determine eligibility for a loan. The form includes sections for personal information, employment history, income details, and asset disclosures. Understanding the HUD 1003 is vital for anyone looking to secure a mortgage, as it serves as the foundation for the loan application process.

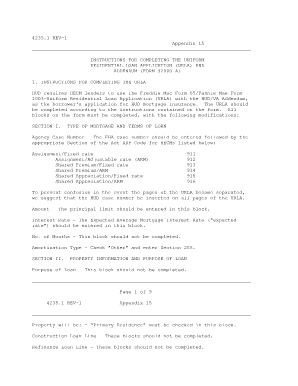

Steps to Complete the HUD 1003

Completing the HUD 1003 involves several key steps to ensure accuracy and compliance. Begin by gathering necessary documents, such as proof of income, tax returns, and asset statements. Next, fill out personal information, including your name, address, and Social Security number. Provide detailed employment history, including job titles, employer names, and durations of employment. Report your income accurately, including salary, bonuses, and any additional sources of income. Lastly, disclose your assets and liabilities, ensuring all information is truthful and complete. Review the form thoroughly before submission to avoid errors that could delay the loan process.

Legal Use of the HUD 1003

The HUD 1003 is legally binding and must be completed accurately to ensure compliance with federal regulations. It is essential for borrowers to understand that providing false information can lead to serious consequences, including loan denial or legal action. The form is governed by the Equal Credit Opportunity Act (ECOA) and the Fair Housing Act, which prohibit discrimination in lending. By using the HUD 1003, lenders and borrowers can ensure a transparent and fair mortgage application process, promoting equal access to housing finance.

Key Elements of the HUD 1003

Several key elements are essential to the HUD 1003, each serving a specific purpose in the mortgage application process. These elements include:

- Borrower Information: Personal details such as name, address, and Social Security number.

- Employment History: Information about current and previous employment, including job titles and durations.

- Income Details: Comprehensive reporting of all income sources, including wages, bonuses, and other earnings.

- Asset Disclosure: A list of assets, including bank accounts, real estate, and investments.

- Liabilities: A detailed account of existing debts, such as credit cards, loans, and mortgages.

Each of these elements plays a critical role in determining the borrower's financial stability and eligibility for a mortgage loan.

Form Submission Methods

The HUD 1003 can be submitted through various methods, depending on the lender's requirements. Common submission methods include:

- Online Submission: Many lenders offer online portals where borrowers can complete and submit the HUD 1003 electronically.

- Mail: Borrowers may print the completed form and send it via postal mail to the lender's office.

- In-Person: Some borrowers prefer to submit the form in person at their lender's branch, allowing for immediate assistance and clarification.

Choosing the right submission method can streamline the application process and enhance communication with the lender.

Eligibility Criteria

Eligibility for completing the HUD 1003 typically requires that the borrower meets specific criteria set by the lender. Generally, these criteria include:

- Age: Borrowers must be at least eighteen years old.

- Citizenship: Applicants should be U.S. citizens or legal residents.

- Creditworthiness: A satisfactory credit history is essential for loan approval.

- Income Stability: Demonstrating a stable income source is crucial for lenders to assess repayment ability.

Meeting these eligibility criteria is fundamental for a successful mortgage application process.

Quick guide on how to complete hud 1003

Complete Hud 1003 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly without delays. Manage Hud 1003 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Hud 1003 with ease

- Find Hud 1003 and click Get Form to initiate.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method of sharing your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing out new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Hud 1003 and guarantee excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a HUD 1003 form?

The HUD 1003 form, also known as the Uniform Residential Loan Application, is a standardized mortgage application form used by lenders to evaluate a borrower's creditworthiness. This form is essential for processing home loans, and airSlate SignNow makes it easy to send, sign, and manage your HUD 1003 form digitally.

-

How can airSlate SignNow help with HUD 1003 form management?

airSlate SignNow simplifies the workflow for managing your HUD 1003 form by allowing users to eSign documents quickly and securely. With its intuitive interface, you can streamline the application process, ensuring that your HUD 1003 form is completed without delays.

-

What features does airSlate SignNow offer for the HUD 1003 form?

airSlate SignNow provides features such as customizable templates, bulk signing, and real-time tracking for the HUD 1003 form. These tools enhance your efficiency, enabling you to track the status of your documents and complete transactions faster.

-

Is airSlate SignNow cost-effective for using HUD 1003 forms?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to manage HUD 1003 forms. With flexible pricing plans that cater to various business sizes, you can save time and money while ensuring compliance with mortgage application processes.

-

Can I integrate airSlate SignNow with other software for HUD 1003 forms?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, such as CRM platforms and accounting tools, to help manage your HUD 1003 forms more effectively. This integration ensures that you maintain a cohesive workflow across different business processes.

-

What are the benefits of using airSlate SignNow for HUD 1003 forms?

The benefits of using airSlate SignNow for your HUD 1003 forms include enhanced document security, easier collaboration, and accelerated approval timelines. This ensures that your mortgage application process is both efficient and secure, giving your business a competitive edge.

-

Is it easy to share the HUD 1003 form using airSlate SignNow?

Yes, sharing the HUD 1003 form is straightforward with airSlate SignNow. You can easily send the form to borrowers or collaborators via email or a secure link, allowing for quick reviews and signatures, thereby speeding up the approval process.

Get more for Hud 1003

- Consent resolution secgov form

- Bylaws of the registrant as currently in effect secgov form

- Online status division of corporations state of delaware form

- This instrument was acknowledged before me on form

- Ii waived the opportunity to conduct a risk assessment or inspection for the presence of lead based paint andor leadbased paint form

- Penalties for failure to comply with federal lead based paint disclosure laws include treble 3 form

- Method of return form

- State of delaware division of corporations gusher form

Find out other Hud 1003

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking