$ in Late Fees Form

What is the $ In Late Fees

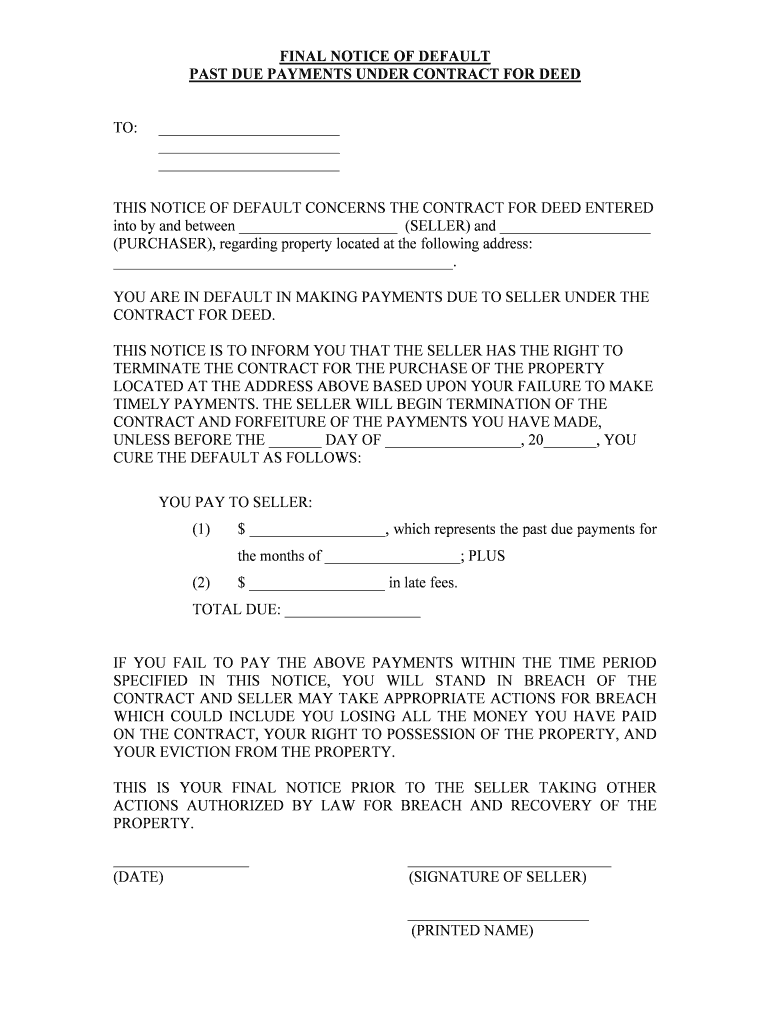

The $ In Late Fees form is a document used to calculate and report any late fees incurred by individuals or businesses. This form is essential for maintaining accurate financial records and ensuring compliance with relevant regulations. Late fees can arise from various situations, such as overdue payments on loans, credit cards, or other financial obligations. Understanding the specifics of this form helps users manage their financial responsibilities effectively.

How to use the $ In Late Fees

To use the $ In Late Fees form, individuals or businesses must first gather relevant financial information, including the amount due, the due date, and any applicable interest rates. Once this information is compiled, the form can be filled out accurately to reflect the late fees incurred. Users should ensure that all calculations are correct and that the completed form is submitted to the appropriate entity, such as a lender or financial institution, to avoid further penalties.

Steps to complete the $ In Late Fees

Completing the $ In Late Fees form involves several key steps:

- Gather necessary financial documents related to the late payment.

- Identify the total amount due and the date it was originally due.

- Calculate the late fees based on the terms outlined in the agreement.

- Fill out the form with accurate details, ensuring all calculations are correct.

- Review the completed form for accuracy and completeness.

- Submit the form to the designated recipient, either electronically or via mail.

Legal use of the $ In Late Fees

The legal use of the $ In Late Fees form is crucial for ensuring that late fees are documented and reported correctly. This form must comply with applicable laws and regulations governing financial transactions in the United States. Properly completing and submitting this form can help protect individuals and businesses from potential legal disputes regarding unpaid debts and associated fees.

Key elements of the $ In Late Fees

Key elements of the $ In Late Fees form include:

- The total amount of the original debt.

- The due date for the payment.

- The specific late fee percentage or amount.

- The date the payment was made, if applicable.

- Any relevant account or reference numbers.

Including these elements ensures that the form is complete and provides a clear record of the late fees incurred.

Examples of using the $ In Late Fees

Examples of using the $ In Late Fees form can include scenarios such as:

- A borrower who fails to make a mortgage payment on time and incurs a late fee.

- A business that pays its suppliers after the due date, resulting in additional charges.

- Individuals who miss credit card payment deadlines and face penalties.

These examples illustrate the importance of accurately documenting late fees to maintain financial integrity and accountability.

Quick guide on how to complete in late fees

Complete $ In Late Fees effortlessly on any gadget

Digital document management has become increasingly favored by enterprises and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly and without interruptions. Manage $ In Late Fees on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign $ In Late Fees with ease

- Obtain $ In Late Fees and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or conceal sensitive details using tools that airSlate SignNow offers specifically for this function.

- Generate your signature with the Sign feature, which takes only moments and carries the same legal validity as a standard wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Decide how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign $ In Late Fees and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

How can airSlate SignNow help me save on $ In Late Fees?

By streamlining the document signing process, airSlate SignNow reduces delays that often lead to late payments. With faster eSigning, you can avoid unnecessary $ in late fees caused by slow turnaround times. This efficiency not only saves you money but also improves your business relationships.

-

What are the key features of airSlate SignNow that help avoid $ in late fees?

Key features include automated reminders, template creation, and real-time tracking of document status. These tools ensure that your documents are signed promptly, minimizing the risk of incurring $ in late fees. Additionally, the app's user-friendly interface makes it easy for clients to sign without hassle.

-

Is airSlate SignNow affordable enough to prevent $ in late fees?

Yes, airSlate SignNow offers cost-effective pricing plans that can save you more money than traditional methods. By investing in this service, businesses can reduce the risk of lost revenue due to $ in late fees. The overall savings on late payments can outweigh the monthly subscription costs.

-

Can I integrate airSlate SignNow with other applications to further reduce $ in late fees?

Absolutely! airSlate SignNow integrates seamlessly with various applications like CRM systems and accounting software. These integrations allow for more efficient workflows, ensuring that documents are processed quickly and minimizing $ in late fees due to oversight or miscommunication.

-

What benefits does airSlate SignNow offer regarding $ in late fees?

The primary benefit is the reduction of time spent on document processing, leading to quicker payments. With airSlate SignNow, you can minimize distractions and ensure documents don't get lost or forgotten, which often results in $ in late fees. The result is smoother business operations and increased cash flow.

-

How does airSlate SignNow ensure compliance and avoid $ in late fees?

airSlate SignNow helps maintain compliance with legally binding signatures that protect your interests. By ensuring all documents are correctly and promptly signed, you can avoid potential disputes that lead to $ in late fees. This reduces legal risks and promotes a smoother transaction process.

-

What support does airSlate SignNow provide for customers worried about $ in late fees?

We offer dedicated customer support to assist users in navigating the platform and optimizing their processes. Our team can help you set up reminders and notifications specifically designed to prevent $ in late fees. Additionally, our extensive knowledge base provides tips for improving efficiency.

Get more for $ In Late Fees

- Or126 horseshoe creek siuslaw river section oregon gov oregon form

- Name and address of the new employer date employment commences and the reason for the change in employment health ri form

- Whodas 2 0 assessment form

- Content creation contract template form

- Software e development agency contract template form

- Software development outsourc contract template form

- Software implementation contract template form

- Software engineer contract template form

Find out other $ In Late Fees

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe