Sws 12 Form

What is the Sws 12?

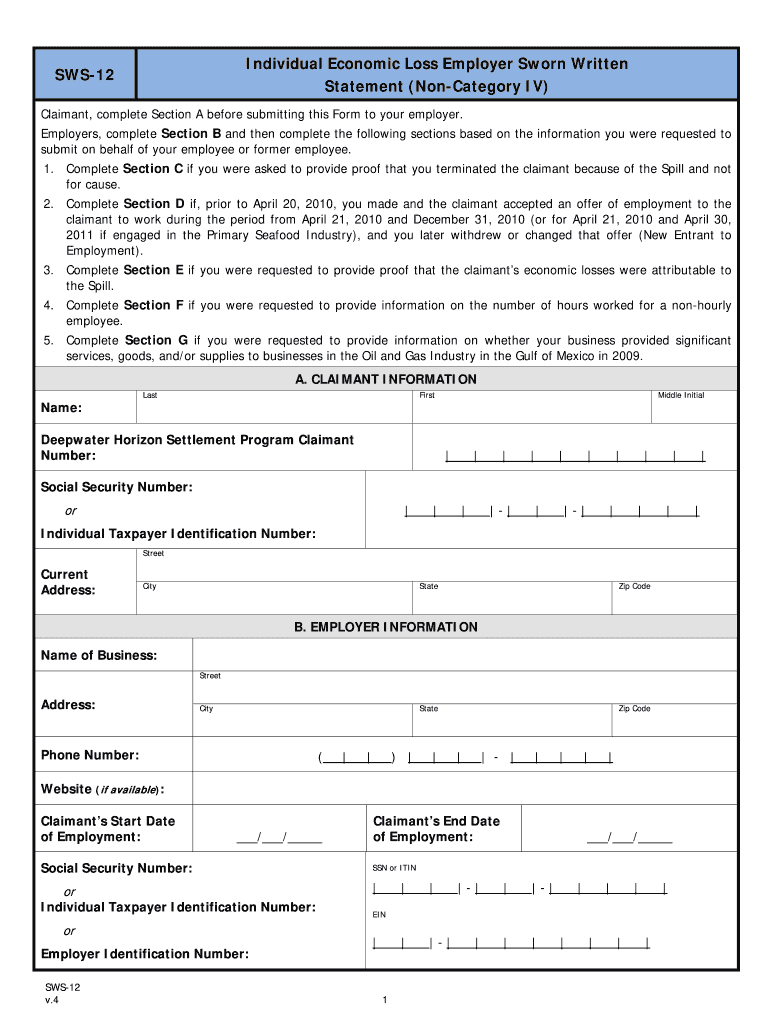

The Sworn Statement 12, commonly referred to as the SWS 12, is a legal document used primarily by employers to provide a sworn declaration regarding an employee's status and eligibility for benefits. This form is often required in situations involving unemployment claims, where the employer must verify employment details and other relevant information. The SWS 12 ensures that the information provided is accurate and truthful, serving as a protective measure for both the employer and the employee.

Steps to Complete the Sws 12

Completing the SWS 12 involves several key steps to ensure accuracy and compliance with legal requirements. First, gather all necessary information about the employee, including their employment dates, job title, and reason for separation if applicable. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once the form is filled out, review it for any errors or omissions. Finally, sign the document, which may require an eSignature for digital submissions, ensuring that it is legally binding.

Legal Use of the Sws 12

The SWS 12 must be used in accordance with specific legal guidelines to maintain its validity. This includes adherence to eSignature regulations such as the ESIGN Act and UETA, which govern electronic signatures in the United States. Additionally, the form should be submitted in a timely manner to avoid penalties or complications in the claims process. Understanding the legal framework surrounding the SWS 12 is crucial for both employers and employees to ensure that their rights and obligations are upheld.

Required Documents

When filling out the SWS 12, certain documents may be required to support the information provided. These can include the employee's identification, payroll records, and any relevant termination letters or notices. Having these documents on hand will facilitate the completion of the form and help ensure that all information is accurate. It is advisable to keep copies of all submitted documents for record-keeping purposes.

Form Submission Methods

The SWS 12 can be submitted through various methods, depending on the specific requirements of the agency or organization requesting it. Common submission methods include online electronic submission, mailing a hard copy to the designated office, or delivering it in person. Each method may have different processing times and requirements, so it is important to choose the one that best suits the situation while ensuring compliance with any deadlines.

Key Elements of the Sws 12

The SWS 12 contains several key elements that must be included for it to be considered complete and valid. These elements typically include the employer's contact information, the employee's details, a declaration of the information's accuracy, and the employer's signature. Additionally, any relevant dates, such as the employee's start and end dates, should be clearly indicated. Ensuring that all these elements are present will help prevent delays or issues with the form's acceptance.

Quick guide on how to complete income tax sws 12 form

Learn how to effortlessly navigate the Sws 12 execution with this straightforward guide

Filing electronically and completing paperwork online is becoming increasingly favored and is the preferred option for a diverse range of clients. It offers numerous advantages over conventional printed paperwork, such as ease, time savings, enhanced accuracy, and security.

With platforms like airSlate SignNow, you can locate, edit, sign, and enhance and forward your Sws 12 without being hindered by endless printing and scanning. Follow this brief guide to get going and finalize your document.

Follow these steps to obtain and complete Sws 12

- Begin by clicking on the Get Form button to access your form in our editor.

- Pay attention to the green label on the left indicating required fields so you do not miss any.

- Utilize our advanced features to annotate, alter, sign, protect, and enhance your form.

- Secure your document or convert it into a fillable format using the available tab tools.

- Review the form for mistakes or inconsistencies.

- Select DONE to complete the editing process.

- Rename your document or keep it as is.

- Choose the storage option you wish to use for saving your form, send it via USPS, or click the Download Now button to acquire your file.

If Sws 12 is not what you needed, you can explore our extensive collection of pre-designed templates that you can fill out effortlessly. Visit our platform now!

Create this form in 5 minutes or less

FAQs

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

Which income tax form should be filled out by a beautician?

As a beautician, since you are self-employed, your income would come under the source- income from business or profession. So you could either file your ITR using ITR3 (if you wish to file normally) or you can use ITR4 (if you wish to file on presumptive basis).Hope you find my answer helpfulFeel free to contact me at abhinandansethia90@gmail.com for any assistanceRegardsAbhinandan

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

Create this form in 5 minutes!

How to create an eSignature for the income tax sws 12 form

How to generate an eSignature for the Income Tax Sws 12 Form online

How to generate an eSignature for your Income Tax Sws 12 Form in Google Chrome

How to generate an electronic signature for signing the Income Tax Sws 12 Form in Gmail

How to make an eSignature for the Income Tax Sws 12 Form from your smartphone

How to generate an electronic signature for the Income Tax Sws 12 Form on iOS

How to make an eSignature for the Income Tax Sws 12 Form on Android

People also ask

-

What is an employer sworn statement and how is it used?

An employer sworn statement is a legal document affirming the employment status and information of an employee. It is often required for various purposes, such as loan applications or legal proceedings, to verify someone’s employment. By utilizing airSlate SignNow, businesses can create, send, and eSign employer sworn statements quickly and efficiently.

-

How does airSlate SignNow streamline the signing process for employer sworn statements?

airSlate SignNow simplifies the signing process for employer sworn statements by enabling businesses to easily send documents for eSignature. Our platform offers a user-friendly interface, reducing the time and effort needed to manage documents. This ensures that employer sworn statements are signed promptly, helping to speed up important transactions.

-

What pricing options are available for airSlate SignNow when creating employer sworn statements?

airSlate SignNow offers a variety of pricing plans tailored to meet the needs of different businesses. Each plan includes features that facilitate the creation and management of employer sworn statements, allowing you to choose the option that best fits your budget and requirements. Visit our pricing page for detailed information on our cost-effective solutions.

-

Can I customize an employer sworn statement using airSlate SignNow?

Yes, airSlate SignNow allows users to customize employer sworn statements to suit their specific needs. You can easily add fields, logos, and specific language relevant to your organization. This customization ensures that your employer sworn statements meet legal requirements and reflect your brand.

-

What are the benefits of using airSlate SignNow for employer sworn statements?

Using airSlate SignNow for employer sworn statements offers numerous benefits, including enhanced efficiency and reduced paperwork. It allows for faster processing times and improved accuracy by minimizing manual entry errors. Additionally, the secure platform ensures that your documents are protected while being easily accessible.

-

Does airSlate SignNow integrate with other software for employer sworn statements?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, including CRM and HR software, making it easier to manage employer sworn statements along with other documents. These integrations streamline your workflow, eliminating the need for duplicate data entry and enhancing overall productivity.

-

Is airSlate SignNow secure for handling sensitive employer sworn statements?

Yes, airSlate SignNow prioritizes the security of your documents, including employer sworn statements. Our platform employs advanced encryption and compliance with legal standards to ensure that sensitive information is protected. You can confidently send and sign documents knowing they are secure.

Get more for Sws 12

Find out other Sws 12

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors