PDF Indemnity of the Canada RSP Beneficiary Form and Guidelines 2020-2026

What is the PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines

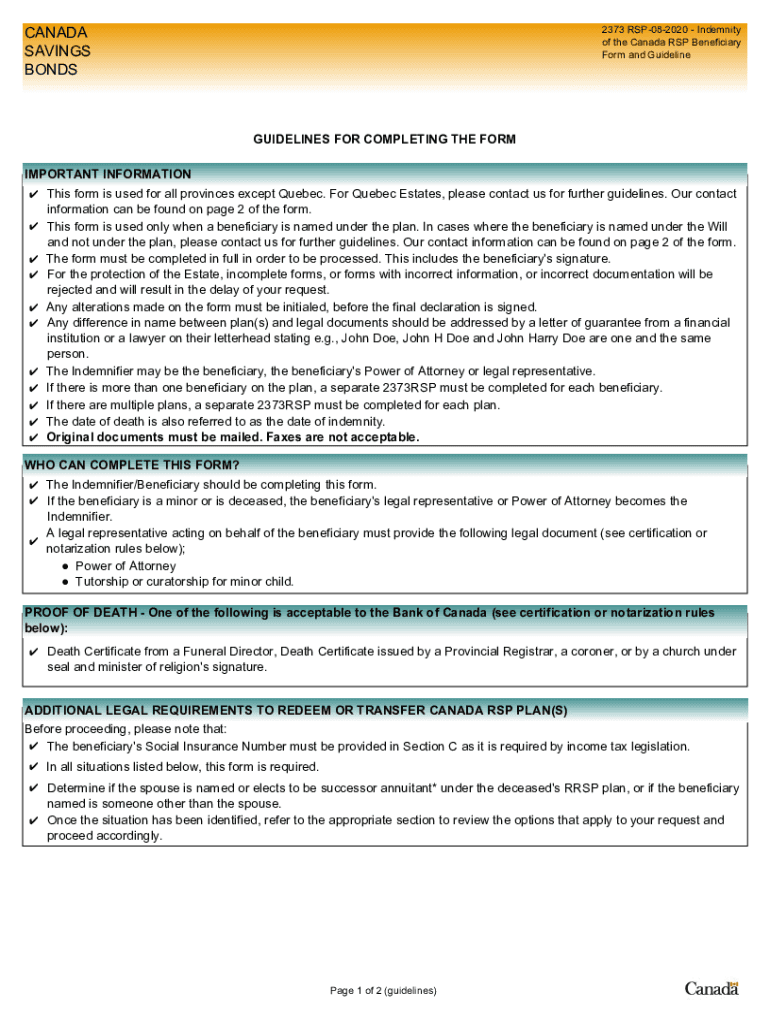

The PDF Indemnity of the Canada RSP Beneficiary Form and Guidelines is a crucial document used to designate beneficiaries for Registered Savings Plans (RSPs) in Canada. This form provides a legal framework for ensuring that the assets within the RSP are transferred to the designated beneficiaries upon the account holder's passing. Understanding the guidelines associated with this form is essential for both the account holder and the beneficiaries, as it outlines the rights and responsibilities of all parties involved.

Steps to complete the PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines

Completing the PDF Indemnity of the Canada RSP Beneficiary Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal details of the account holder and the intended beneficiaries. Next, carefully fill out the form, ensuring that all fields are completed accurately. It is important to review the guidelines to understand any specific requirements, such as witness signatures or notarization. Finally, submit the completed form to the appropriate financial institution managing the RSP.

Legal use of the PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines

The legal use of the PDF Indemnity of the Canada RSP Beneficiary Form is governed by specific regulations that ensure its validity. For the form to be legally binding, it must be completed in accordance with the guidelines provided, including proper signatures and any necessary witness requirements. Additionally, compliance with electronic signature laws is essential if the form is submitted digitally. Adhering to these legal standards protects the interests of both the account holder and the beneficiaries.

How to obtain the PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines

Obtaining the PDF Indemnity of the Canada RSP Beneficiary Form is a straightforward process. The form can typically be accessed through the financial institution that manages the RSP. Many institutions provide downloadable versions of the form on their websites, allowing users to fill it out electronically. Alternatively, individuals may request a physical copy from their financial advisor or institution. It is advisable to ensure that the most current version of the form is used to avoid any compliance issues.

Key elements of the PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines

Several key elements are essential to the PDF Indemnity of the Canada RSP Beneficiary Form. These include the account holder's personal information, the names and details of the designated beneficiaries, and any specific instructions regarding the distribution of assets. Additionally, the form may require signatures from witnesses or notaries to validate the document. Understanding these elements is crucial for ensuring that the form is completed correctly and meets all legal requirements.

Form Submission Methods (Online / Mail / In-Person)

The submission methods for the PDF Indemnity of the Canada RSP Beneficiary Form vary based on the policies of the financial institution. Typically, the form can be submitted online through the institution's secure portal, allowing for quick processing. Alternatively, individuals may choose to mail the completed form or deliver it in person to ensure that it is received promptly. It is important to verify the submission method preferred by the institution to avoid delays in processing.

Quick guide on how to complete pdf indemnity of the canada rsp beneficiary form and guidelines

Effortlessly Prepare PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines on Any Device

Digital document management has become widely embraced by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents quickly without delays. Manage PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Modify and eSign PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines with Ease

- Find PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to submit your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines and maintain effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf indemnity of the canada rsp beneficiary form and guidelines

Create this form in 5 minutes!

How to create an eSignature for the pdf indemnity of the canada rsp beneficiary form and guidelines

The best way to generate an electronic signature for a PDF file online

The best way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to make an e-signature straight from your mobile device

The way to make an e-signature for a PDF file on iOS

How to make an e-signature for a PDF document on Android devices

People also ask

-

What is the PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines?

The PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines is a crucial document that outlines the procedures for naming beneficiaries for Registered Retirement Savings Plans (RSPs) in Canada. This form helps ensure that your assets are passed on according to your wishes after your passing, making it essential for financial planning.

-

How can airSlate SignNow help with the PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines?

airSlate SignNow allows you to easily create, send, and eSign the PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines. Our user-friendly platform streamlines the process, ensuring that your documents are securely signed and legally binding, thus simplifying your estate planning.

-

What are the pricing options for using airSlate SignNow to manage the PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines?

airSlate SignNow offers various pricing plans, including a free trial to test features for free. For businesses, pricing is competitive and tailored to meet different needs, allowing users to efficiently manage forms like the PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines without breaking the bank.

-

What features does airSlate SignNow offer for handling the PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines?

With airSlate SignNow, you'll benefit from features like document templates, advanced eSignature options, and secure cloud storage. These features allow you to easily organize, edit, and sign the PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines, ensuring a seamless experience.

-

Are there integrations available for using the PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines through airSlate SignNow?

Yes, airSlate SignNow supports numerous integrations with popular business applications, making it easier to manage the PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines within your existing workflow. This integration capability enhances productivity and ensures that all your documents are easily accessible.

-

Is the PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines legally binding when signed through airSlate SignNow?

Absolutely! The PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines signed through airSlate SignNow is legally binding and compliant with international eSignature laws. Our platform adheres to strict security protocols to ensure the legality and integrity of your signed documents.

-

Can I track the status of my PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines during the signing process?

Yes, airSlate SignNow provides real-time tracking for all sent documents, including the PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines. You'll be notified when recipients view and sign your documents, giving you peace of mind throughout the process.

Get more for PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines

- Power of attorney low cost lawyers and law firms pro form

- New mexico corporation guide start a corporation in new form

- Nm pc om form

- New mexico public regulation commission p o box 1269 1120 form

- 20 fee limited liability company form

- This instrument was acknowledged before me on date by 490201900 form

- County clerk of county new mexico on date the following form

- The undersigned is the present holder of the above described mortgage form

Find out other PDF Indemnity Of The Canada RSP Beneficiary Form And Guidelines

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast