Indemnity of the Canada RSP Beneficiary Form and Guidelines 2373RSP 2019

What is the Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP

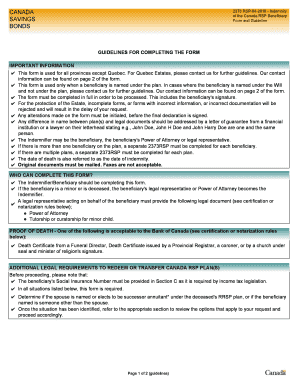

The Indemnity of the Canada RSP Beneficiary Form and Guidelines 2373RSP is a legal document designed to outline the rights and responsibilities of beneficiaries associated with a Registered Savings Plan (RSP) in Canada. This form is essential for ensuring that the designated beneficiaries receive the intended benefits upon the account holder's passing. It serves as a protective measure for both the account holder and the beneficiaries, providing clarity on the distribution of assets and any associated liabilities.

How to use the Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP

Using the Indemnity of the Canada RSP Beneficiary Form and Guidelines 2373RSP involves several steps to ensure proper completion and legal validity. First, gather all necessary information about the RSP account and the designated beneficiaries. Next, fill out the form accurately, ensuring that all required fields are completed. It's crucial to review the guidelines provided with the form to understand any specific instructions related to signatures and submission. Once completed, the form can be submitted electronically or via traditional mail, depending on the institution's requirements.

Steps to complete the Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP

Completing the Indemnity of the Canada RSP Beneficiary Form and Guidelines 2373RSP involves a systematic approach:

- Gather necessary documentation, including personal identification and RSP account details.

- Carefully read the guidelines accompanying the form to understand specific requirements.

- Fill out the form, ensuring all fields are accurately completed, including beneficiary information.

- Sign the form, adhering to any signature requirements outlined in the guidelines.

- Submit the completed form according to the preferred method of the financial institution.

Legal use of the Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP

The legal use of the Indemnity of the Canada RSP Beneficiary Form and Guidelines 2373RSP is governed by various regulations that ensure its validity. For the form to be legally binding, it must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws establish the legitimacy of electronic signatures and documents, ensuring that the form holds up in court if necessary. Proper execution of the form, including notarization or witness signatures if required, strengthens its legal standing.

Key elements of the Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP

Several key elements are essential to the Indemnity of the Canada RSP Beneficiary Form and Guidelines 2373RSP:

- Beneficiary Information: Accurate details of the beneficiaries, including names and contact information.

- Account Holder Information: The RSP account holder's details, ensuring proper identification.

- Signature Requirements: Clear instructions on how and where to sign the form.

- Submission Instructions: Guidelines on how to submit the form, either electronically or by mail.

- Legal Disclaimers: Any legal language that clarifies the responsibilities and liabilities of all parties involved.

Form Submission Methods (Online / Mail / In-Person)

The Indemnity of the Canada RSP Beneficiary Form and Guidelines 2373RSP can be submitted through various methods, depending on the financial institution's policies. Common submission methods include:

- Online Submission: Many institutions allow for electronic submission through secure portals, making it a convenient option.

- Mail: The form can be printed and sent via postal service, ensuring it reaches the appropriate department.

- In-Person: Some account holders may prefer to deliver the form in person at their financial institution, allowing for immediate confirmation of receipt.

Quick guide on how to complete indemnity of the canada rsp beneficiary form and guidelines 2373rsp

Complete Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, alter, and eSign your documents quickly without delays. Manage Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP with ease

- Find Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, either via email, text (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indemnity of the canada rsp beneficiary form and guidelines 2373rsp

Create this form in 5 minutes!

How to create an eSignature for the indemnity of the canada rsp beneficiary form and guidelines 2373rsp

The way to generate an electronic signature for a PDF file online

The way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What is the Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP?

The Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP is a crucial document that outlines the beneficiaries of a Registered Savings Plan (RSP) in Canada. This form ensures that the funds are distributed according to your wishes after your passing, providing peace of mind to you and your beneficiaries.

-

How can I obtain the Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP?

You can easily obtain the Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP through the airSlate SignNow platform. By signing up, you can access, fill out, and eSign this form conveniently without the need for physical paperwork.

-

What are the key features of the Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP?

Key features of the Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP include customizable templates, secure eSigning capabilities, and compliance with Canadian financial regulations. These features simplify the process of managing your RSP beneficiary designations effectively.

-

Is there a cost associated with using the Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP?

Yes, there may be a subscription or usage fee associated with accessing the Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP via airSlate SignNow. However, this cost is typically outweighed by the convenience and security provided by the platform.

-

What are the benefits of using airSlate SignNow for the Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP?

Using airSlate SignNow for the Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP allows for streamlined document management, enhanced security, and easy accessibility from anywhere. You'll benefit from reduced paperwork and faster turnaround times.

-

Can I integrate the Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP with other software?

Yes, airSlate SignNow offers integrations with various software platforms, allowing you to streamline your workflow while managing the Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP. This capability enhances productivity and reduces time spent on administrative tasks.

-

How does airSlate SignNow ensure the security of the Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP?

airSlate SignNow employs top-tier security measures, including encryption and secure access protocols, to protect the Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP. You can trust that your sensitive information will remain confidential and secure.

Get more for Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP

- Fhu 4 form

- Unusual enrollment history form homepage gadsden state gadsdenstate

- Inspection ladder form

- Northern virginia community college transcript request form

- Parenting class registration form fairfax county public schools fcps

- Level iv referral form fairfax county public schools fcps 45046359

- Payroll remittance form v001 mak financial and tax consultants

- Commercial questionnaire form

Find out other Indemnity Of The Canada RSP Beneficiary Form And Guidelines 2373RSP

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament