WSHFCAMCTax Credit Compliance Procedures Manual Form

Understanding the WSHFCAMCTax Credit Compliance Procedures Manual

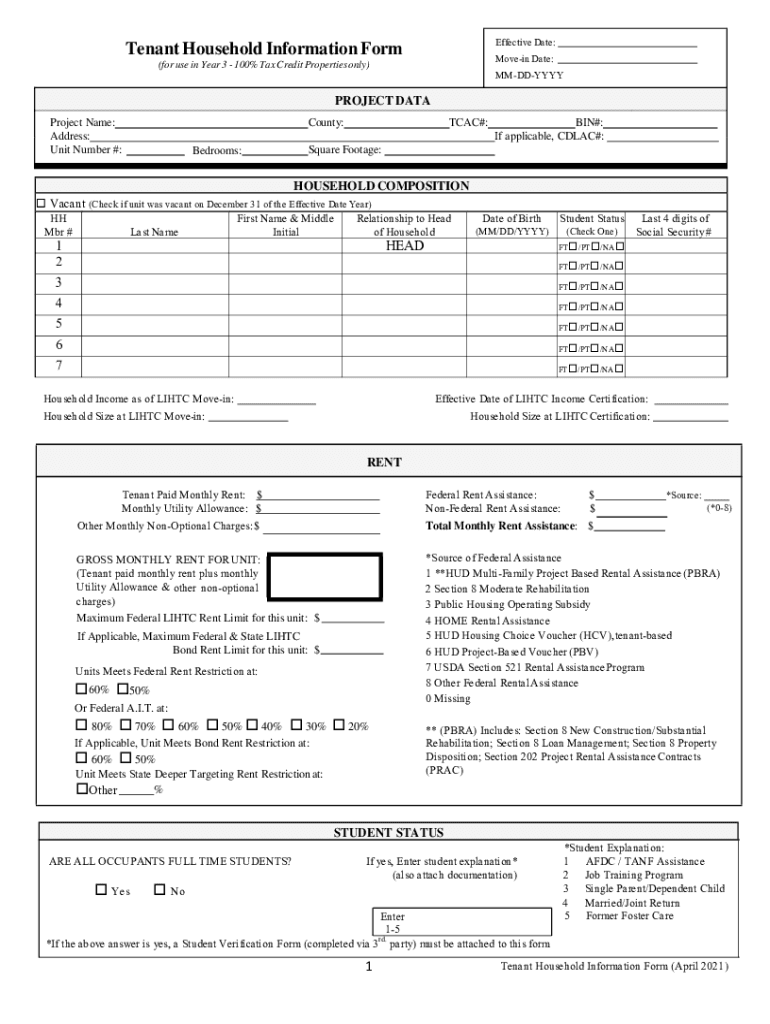

The WSHFCAMCTax Credit Compliance Procedures Manual is a vital resource for understanding the requirements and processes related to tax credit compliance. This manual outlines the necessary steps and guidelines for ensuring that credit tenant households meet the compliance standards set forth by the Washington State Housing Finance Commission. It serves as a comprehensive guide for property owners, managers, and tenants involved in tax credit programs.

Steps to Complete the WSHFCAMCTax Credit Compliance Procedures Manual

Completing the WSHFCAMCTax Credit Compliance Procedures Manual involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation related to tenant household information. Next, carefully follow the outlined procedures to fill out the required forms accurately. Ensure that each section is completed thoroughly, as incomplete forms may lead to compliance issues. After completing the manual, review all entries for accuracy before submission.

Eligibility Criteria for Credit Tenant Households

Eligibility for credit tenant households is determined by specific criteria outlined in the WSHFCAMCTax Credit Compliance Procedures Manual. Generally, households must meet income limits, which are adjusted based on family size and local area median income. Additionally, tenants must provide documentation to verify their income and household composition. Understanding these criteria is essential for both tenants and property managers to ensure compliance with tax credit regulations.

Required Documents for Compliance

To comply with the WSHFCAMCTax Credit Compliance Procedures Manual, several documents are typically required. These may include:

- Income verification documents, such as pay stubs or tax returns

- Identification for all household members

- Proof of residency

- Completed tenant household forms

Having these documents ready will facilitate a smoother compliance process and help avoid delays.

Form Submission Methods

Submitting the WSHFCAMCTax Credit Compliance Procedures Manual can be done through various methods, depending on the specific requirements of the program. Generally, forms can be submitted online, via mail, or in person at designated offices. Each method has its own set of guidelines, so it is important to follow the instructions provided in the manual to ensure that submissions are processed correctly.

Penalties for Non-Compliance

Failure to comply with the WSHFCAMCTax Credit Compliance Procedures Manual can result in significant penalties. These may include loss of tax credits, fines, or legal action against property owners or managers. It is crucial for all parties involved to understand the implications of non-compliance and to take proactive steps to adhere to the guidelines set forth in the manual.

Quick guide on how to complete wshfcamctax credit compliance procedures manual

Complete WSHFCAMCTax Credit Compliance Procedures Manual effortlessly on any device

Online document management has become favored by businesses and individuals alike. It offers an ideal environmentally friendly option to traditional printed and signed documents, as you can easily access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage WSHFCAMCTax Credit Compliance Procedures Manual on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest method to modify and electronically sign WSHFCAMCTax Credit Compliance Procedures Manual with ease

- Obtain WSHFCAMCTax Credit Compliance Procedures Manual and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to preserve your changes.

- Select your preferred method to send your form, be it via email, SMS, or an invitation link, or download it to your computer.

Leave behind worries over lost or misplaced documents, time-consuming form searches, or mistakes that require printing new copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device you choose. Alter and electronically sign WSHFCAMCTax Credit Compliance Procedures Manual and maintain excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wshfcamctax credit compliance procedures manual

The best way to generate an e-signature for a PDF file in the online mode

The best way to generate an e-signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to create an e-signature from your smartphone

How to create an e-signature for a PDF file on iOS devices

The best way to create an e-signature for a PDF file on Android

People also ask

-

What is the California credit tenant form?

The California credit tenant form is a document used by landlords to evaluate the financial stability of potential tenants. It helps landlords assess creditworthiness to ensure they choose reliable renters. Utilizing this form can streamline the tenant screening process and minimize financial risk.

-

How does airSlate SignNow simplify the California credit tenant form process?

airSlate SignNow simplifies the California credit tenant form process by allowing users to easily create, send, and eSign documents online. Our platform offers an intuitive interface that makes it easy for landlords to manage tenant applications efficiently. You can gather signatures from multiple parties without the hassle of printing or mailing.

-

Is there a cost associated with using airSlate SignNow for the California credit tenant form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. While the exact cost may vary based on features and number of users, our plans are competitive and designed to provide cost-effective solutions, particularly for high-volume document handling like the California credit tenant form.

-

What are the benefits of using airSlate SignNow for the California credit tenant form?

Using airSlate SignNow for the California credit tenant form offers numerous benefits, including faster processing times and enhanced security. The electronic signature feature ensures that documents are signed quickly and efficiently. Moreover, you can store and access all tenant documents in one convenient location.

-

Can I customize the California credit tenant form in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize the California credit tenant form to fit your specific requirements. You can add your branding, modify fields, and adjust text to create a tailored experience for both landlords and tenants. This flexibility enhances the tenant screening process.

-

Does airSlate SignNow integrate with other applications for managing the California credit tenant form?

Yes, airSlate SignNow offers integrations with various applications that can enhance your workflow when managing the California credit tenant form. Our platform connects with CRM systems, property management tools, and more to create a seamless document management experience. This integration helps streamline operations and save time.

-

How secure is the airSlate SignNow platform for handling the California credit tenant form?

The airSlate SignNow platform is designed with security in mind, offering robust encryption and compliance measures. Your data is protected while managing the California credit tenant form, ensuring that sensitive information remains confidential. Our commitment to security gives you peace of mind when handling tenant applications.

Get more for WSHFCAMCTax Credit Compliance Procedures Manual

- Llc buyout agreement template everything you need to know form

- In the supreme court of the state of nevada no 74071 filed form

- Control number nv 00inc2 form

- Organized pursuant to the laws of the state of nevada hereinafter quotcorporationquot form

- Of nevada relating to corporations form

- Fillable online pursuant to nrs 88 fax email print form

- Instructions for nonprofit form

- Company articles of organization form

Find out other WSHFCAMCTax Credit Compliance Procedures Manual

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now