Business Form Finder All Forms on File for Kansas 2021-2026

What is the Kansas business entity search?

The Kansas business entity search is a tool provided by the Kansas Secretary of State that allows individuals and organizations to look up information about registered businesses in the state. This search can reveal details such as the business's name, status, type, and the names of its officers or directors. It is essential for anyone looking to verify the legitimacy of a business, whether for potential partnerships, investments, or compliance purposes.

How to use the Kansas business entity search

Utilizing the Kansas business entity search is straightforward. Users can access the search feature on the Kansas Secretary of State's official website. By entering the business name or the entity ID, users can retrieve relevant information. The search results typically include the business's registration date, status (active or inactive), and any filed documents. This process helps ensure that you have accurate and up-to-date information about any business entity in Kansas.

Key elements of the Kansas business entity search

Several key elements are crucial when conducting a Kansas business entity search:

- Business Name: The name under which the business is registered.

- Entity Type: The classification of the business, such as LLC, corporation, or partnership.

- Status: Indicates whether the business is active, inactive, or dissolved.

- Filing History: A record of important documents and filings submitted to the Secretary of State.

- Registered Agent: The individual or entity designated to receive legal documents on behalf of the business.

Steps to complete the Kansas business entity search

To complete a Kansas business entity search, follow these steps:

- Visit the Kansas Secretary of State's website.

- Locate the business entity search tool on the homepage.

- Enter the business name or entity ID into the search field.

- Review the search results for relevant information about the business.

- If necessary, click on the business name for more detailed information and documents.

Legal use of the Kansas business entity search

The Kansas business entity search serves various legal purposes. It is commonly used by potential investors, creditors, and business partners to verify the legitimacy of a business. Additionally, it can assist in ensuring compliance with state regulations and help in making informed decisions regarding business transactions. The information obtained through this search can also be crucial in legal proceedings where business identity verification is necessary.

Form submission methods for Kansas business entity documents

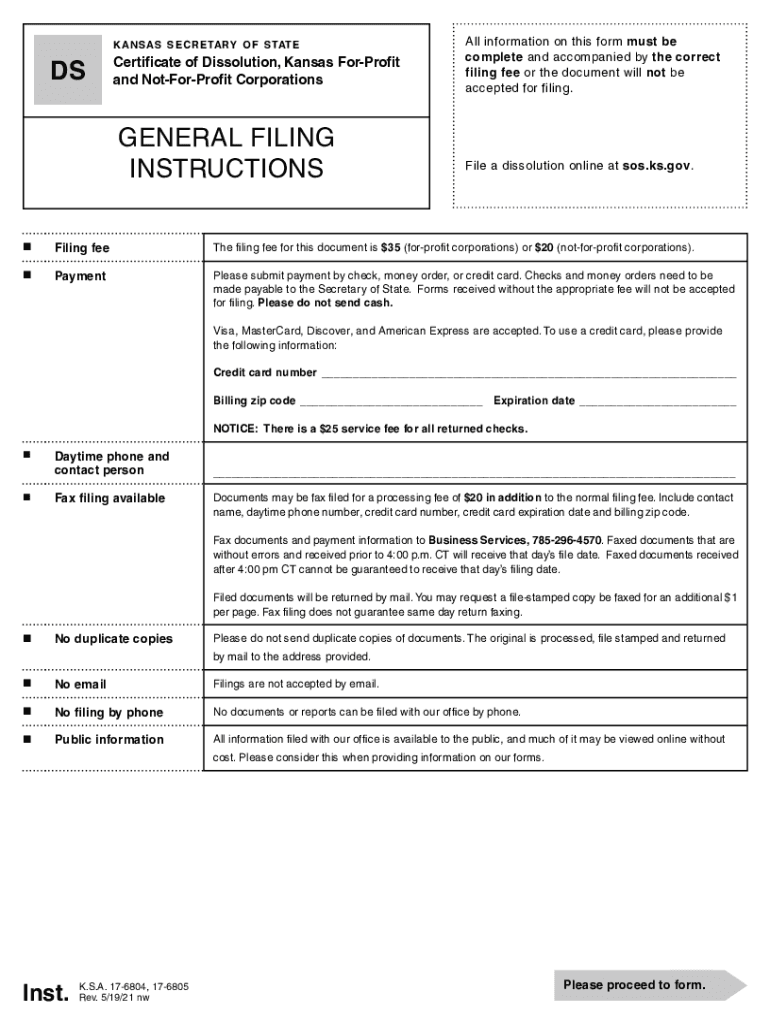

When submitting business entity documents in Kansas, there are several methods available:

- Online: Many forms can be completed and submitted electronically through the Kansas Secretary of State's website.

- Mail: Forms can be printed, filled out, and sent via postal service to the appropriate office.

- In-Person: Individuals may also visit the Secretary of State's office to submit forms directly.

Quick guide on how to complete business form finder all forms on file for kansas

Accomplish Business Form Finder All Forms On File For Kansas smoothly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Business Form Finder All Forms On File For Kansas on any system with airSlate SignNow apps for Android or iOS and enhance any document-related procedure today.

The simplest way to modify and eSign Business Form Finder All Forms On File For Kansas effortlessly

- Find Business Form Finder All Forms On File For Kansas and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and select the Done button to save your alterations.

- Choose your preferred delivery method for your form, be it email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Modify and eSign Business Form Finder All Forms On File For Kansas and ensure effective communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business form finder all forms on file for kansas

Create this form in 5 minutes!

How to create an eSignature for the business form finder all forms on file for kansas

The way to make an e-signature for a PDF online

The way to make an e-signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

The way to make an e-signature straight from your smartphone

The way to make an e-signature for a PDF on iOS

The way to make an e-signature for a PDF document on Android

People also ask

-

What is a Kansas business entity search?

A Kansas business entity search is a process that allows individuals and organizations to look up registered business entities in the state of Kansas. This search can reveal important details such as business status, registration date, and ownership information. It's an essential tool for verifying business legitimacy and compliance within Kansas.

-

How can airSlate SignNow assist with a Kansas business entity search?

While airSlate SignNow primarily focuses on eSigning and document management, it can facilitate the process of managing and documenting your Kansas business entity search. You can create, share, and eSign essential documents related to your entity registration and compliance seamlessly. This ensures that all necessary paperwork is organized and accessible.

-

What features does airSlate SignNow offer for document management related to Kansas businesses?

airSlate SignNow offers robust features such as electronic signatures, templates, and real-time collaboration tools, all tailored for Kansas businesses. You can generate documents easily, track their status, and ensure timely execution. These features streamline workflows and enhance productivity when managing Kansas business entity searches and related documentation.

-

Is airSlate SignNow cost-effective for small Kansas businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small Kansas businesses. With flexible pricing plans and the ability to reduce paper-related costs, it helps your business save money while efficiently managing documents. This makes it an ideal choice for those conducting Kansas business entity searches and needing streamlined document handling.

-

Can airSlate SignNow integrate with other software used for Kansas business registrations?

Absolutely! airSlate SignNow supports various integrations with popular software that Kansas businesses might use for managing registrations and compliance. This includes accounting software and project management tools, allowing for a seamless workflow when conducting a Kansas business entity search and handling related documents.

-

What are the benefits of using airSlate SignNow for managing Kansas business documents?

Using airSlate SignNow for managing Kansas business documents offers numerous benefits, including increased efficiency, cost savings, and enhanced security. The platform allows you to perform a Kansas business entity search quickly and efficiently, digitizing and automating document workflows. This not only saves time but also ensures compliance with Kansas regulations.

-

How secure is the document management system of airSlate SignNow for Kansas businesses?

airSlate SignNow employs industry-leading security measures to protect the documents of Kansas businesses. This includes encryption, advanced user authentication, and compliance with applicable data protection laws. As you conduct a Kansas business entity search or manage sensitive documents, you can trust that your data remains secure.

Get more for Business Form Finder All Forms On File For Kansas

- Claimants name please print form

- Section 32 waiver agreement claimant release workers form

- Claim for compensation in a death case c 62 8 09 nycosh form

- Section 30037 case file creation and indexing of claims that form

- Notice of treatment issues disputed bill issues forms

- Notice of treatment issuesdisputed bill issues workers form

- Justia notice to chair of carriers action on claim for benefits form

- Nys workers compensation board an albany new york form

Find out other Business Form Finder All Forms On File For Kansas

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer