Kansas Office of the Secretary of State Sos Ks 2019

What is the Kansas Office of the Secretary of State (SOS)?

The Kansas Office of the Secretary of State (SOS) is a vital state agency responsible for overseeing various administrative functions, including business registrations, election management, and maintaining official state records. The office plays a crucial role in ensuring compliance with state laws and regulations, providing services to individuals and businesses alike. One of its key functions is managing the dissolution process for corporations, which involves formally terminating a business entity's existence in the state.

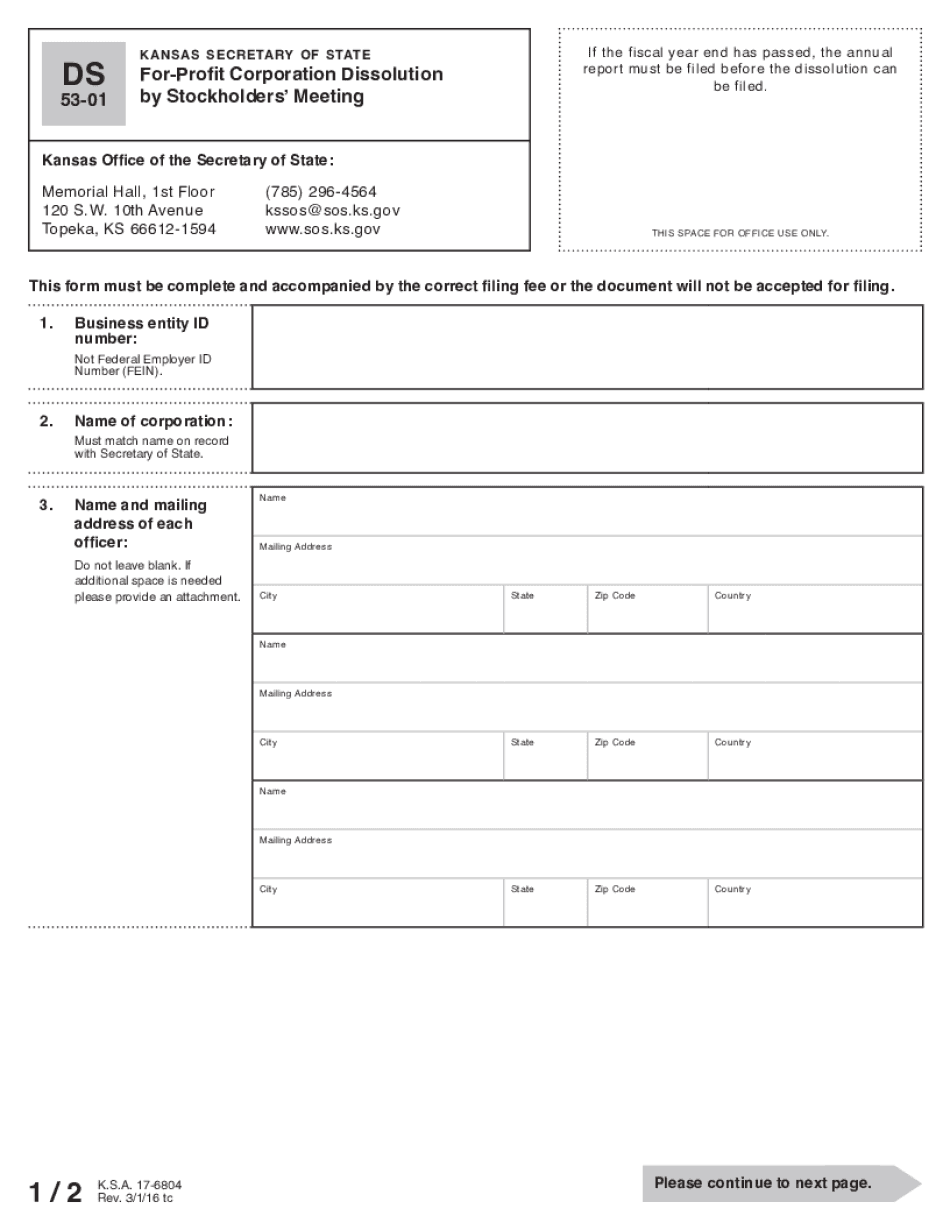

Steps to Complete the Kansas Office of the Secretary of State (SOS) Dissolution Process

Completing the dissolution process for a corporation in Kansas involves several important steps. First, ensure that the decision to dissolve is made in accordance with the corporation's bylaws and that any necessary approvals are obtained from shareholders or directors. Next, prepare the appropriate dissolution form, often referred to as the KS dissolution form, and gather any required documentation, such as meeting minutes or resolutions. Once the form is completed, it must be submitted to the Kansas SOS along with the necessary filing fee. Finally, ensure that all outstanding debts and obligations of the corporation are settled before the dissolution is finalized.

Required Documents for Kansas Corporation Dissolution

To successfully dissolve a corporation in Kansas, certain documents are typically required. These may include:

- The completed KS dissolution form.

- Meeting minutes or a resolution approving the dissolution.

- Any additional documentation that may be required based on the corporation's specific circumstances.

It is important to review the latest requirements from the Kansas SOS to ensure that all necessary documents are included with the submission.

Legal Use of the Kansas Office of the Secretary of State (SOS)

The Kansas SOS provides a legal framework for businesses to operate within the state. This includes the dissolution process, which must adhere to specific legal guidelines to be recognized as valid. The KS dissolution form must be filed in compliance with state laws, and the dissolution must be executed properly to avoid future liabilities. Ensuring that all legal requirements are met protects the interests of the corporation's shareholders and creditors.

Filing Deadlines for Kansas Corporation Dissolution

Understanding the filing deadlines for the KS dissolution process is essential to ensure compliance. Generally, there are no specific deadlines for filing a dissolution form, but it is advisable to complete the process in a timely manner to avoid accruing additional fees or penalties. Additionally, if the corporation has outstanding taxes or obligations, addressing these matters promptly is crucial to facilitate a smooth dissolution.

Penalties for Non-Compliance with Kansas Dissolution Requirements

Failure to comply with the dissolution requirements set forth by the Kansas SOS can result in various penalties. These may include fines, continued liability for outstanding debts, and potential legal action from creditors. To avoid these consequences, it is important for corporations to follow the proper procedures for dissolution and ensure that all obligations are settled before the process is finalized.

Quick guide on how to complete kansas office of the secretary of state sos ks

Complete Kansas Office Of The Secretary Of State Sos Ks seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct version and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Kansas Office Of The Secretary Of State Sos Ks on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to edit and electronically sign Kansas Office Of The Secretary Of State Sos Ks with ease

- Locate Kansas Office Of The Secretary Of State Sos Ks and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Kansas Office Of The Secretary Of State Sos Ks and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kansas office of the secretary of state sos ks

Create this form in 5 minutes!

How to create an eSignature for the kansas office of the secretary of state sos ks

The way to generate an eSignature for a PDF online

The way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What is ks dissolution and how can airSlate SignNow assist?

KS dissolution refers to the process of formally dissolving a business entity in Kansas. airSlate SignNow offers a user-friendly platform that allows businesses to manage and eSign the necessary dissolution documents efficiently, ensuring compliance with state regulations.

-

How much does it cost to use airSlate SignNow for ks dissolution?

airSlate SignNow provides flexible pricing plans to suit different business needs, starting at an affordable monthly rate. By utilizing our services for ks dissolution, businesses can save on legal fees and streamline the document signing process.

-

What features does airSlate SignNow offer for ks dissolution?

airSlate SignNow includes features such as document templates, secure eSigning, and automated workflows, all designed to simplify the ks dissolution process. These tools help ensure that your documents are completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other software for ks dissolution?

Yes, airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and CRM systems to facilitate the ks dissolution process. This integration allows users to access and manage documents from multiple platforms efficiently.

-

What are the benefits of using airSlate SignNow for ks dissolution?

Using airSlate SignNow for ks dissolution offers numerous benefits, including reduced paperwork, faster document turnaround times, and enhanced security for your important files. This solution streamlines the entire process, making it simple and stress-free.

-

Is airSlate SignNow compliant with state regulations for ks dissolution?

Yes, airSlate SignNow ensures that all documents processed through its platform comply with Kansas state regulations regarding ks dissolution. Our dedicated team continuously updates templates and processes to remain compliant with legal requirements.

-

How long does it take to complete ks dissolution using airSlate SignNow?

The timeline for completing ks dissolution with airSlate SignNow can vary based on the specific documents required and your readiness. However, our efficient platform allows users to prepare and eSign documents quickly, often shortening the total processing time signNowly.

Get more for Kansas Office Of The Secretary Of State Sos Ks

Find out other Kansas Office Of The Secretary Of State Sos Ks

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe