Rusa Form

What is the Rusa Form

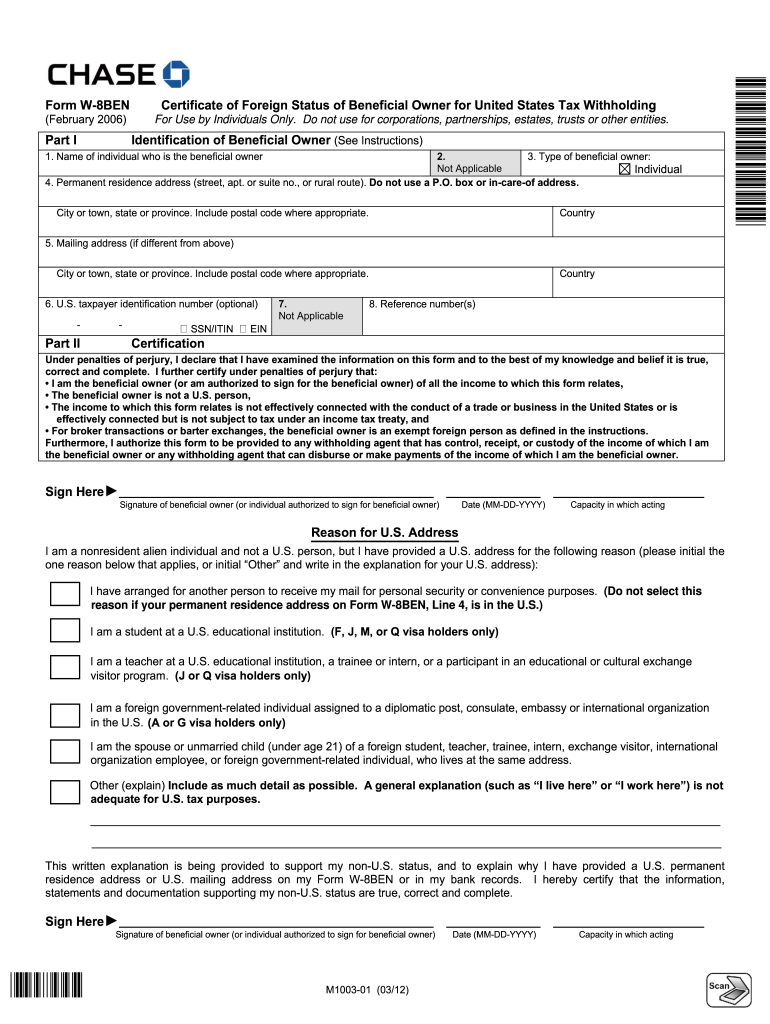

The Rusa form is a document used primarily for tax purposes, specifically designed to collect information from individuals or entities that may be subject to U.S. tax withholding. It serves as a declaration of the individual's or entity's foreign status, ensuring compliance with U.S. tax laws. This form is essential for non-resident aliens and foreign entities to certify their status and claim any applicable tax treaty benefits.

How to Use the Rusa Form

To effectively use the Rusa form, individuals or entities must first gather the necessary information required for completion. This includes personal identification details, such as name, address, and taxpayer identification number. Once the form is filled out accurately, it should be submitted to the relevant financial institution or withholding agent. It is crucial to ensure that all information is correct to avoid any issues with tax withholding.

Steps to Complete the Rusa Form

Completing the Rusa form involves several key steps:

- Gather required information, including personal identification and tax-related details.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the completed form to the relevant party, such as a bank or employer.

Taking these steps carefully will help ensure compliance with U.S. tax regulations.

Legal Use of the Rusa Form

The Rusa form is legally recognized under U.S. tax law, provided it is completed and submitted correctly. It is essential for non-resident aliens and foreign entities to use this form to declare their status and avoid unnecessary tax withholding. Compliance with the form's requirements helps protect individuals and entities from legal penalties associated with tax non-compliance.

Required Documents

When completing the Rusa form, certain documents may be required to support the information provided. These documents typically include:

- Proof of identity, such as a passport or government-issued ID.

- Taxpayer identification number, if applicable.

- Any relevant tax treaty documentation that may apply to the individual or entity.

Having these documents ready can streamline the completion process and ensure accuracy.

Form Submission Methods

The Rusa form can be submitted through various methods, depending on the requirements of the receiving institution. Common submission methods include:

- Online submission through secure portals provided by financial institutions.

- Mailing a physical copy of the completed form to the appropriate address.

- In-person submission at designated locations, such as bank branches or tax offices.

Choosing the appropriate submission method can help ensure timely processing of the form.

Penalties for Non-Compliance

Failure to complete and submit the Rusa form as required can result in significant penalties. These may include:

- Increased tax withholding on payments received.

- Potential fines or legal action for failure to comply with U.S. tax laws.

- Loss of eligibility for tax treaty benefits, leading to higher tax liabilities.

Understanding these penalties underscores the importance of timely and accurate form submission.

Quick guide on how to complete w8 chase form

Complete Rusa Form seamlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent environmentally-friendly substitute to traditional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Rusa Form on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Rusa Form effortlessly

- Obtain Rusa Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Rusa Form and guarantee excellent communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Do I need US EIN taxpayer ID to properly fill out a W8-BEN form?

Since I have asked this question, I believe that I should share the knowledge I have managed to collect in its regard.So, it appears that you should file a SS-4 form to apply for the Employer Identification Number (EIN). To this successfully you will need to have a contract signed with customer in the USA. You will have to show given contract to the US IRA.The downside of this method is that:It requires for you to sign contract with US party prior to the acquiring the EINYou will have to mail originals of your Passport/Natinal ID and contract to the IRA.Instead of going that way, I have decided to register my own "Disregarded entity"-type LLC.If you are also considering going that way, please note that the most popular state for registering such companies (namely, Delaware) is not necessary best for your particular case.AFAICK, tax-wise, there are two top states:Delaware (DE): Sales Tax = 0%, Income Tax = 6.95%Nevada (NV): Sales tax = 7.93%, Income Tax = 0%You will need to find registered agent to register your LLC properly.

-

How to fill the apple U.S tax form (W8BEN iTunes Connect) for indie developers?

This article was most helpful: Itunes Connect Tax Information

-

For the new 2016 W8-BEN-E form to be filled out by companies doing business as a seller on the Amazon USA website, do I fill out a U.S. TIN, a GIIN, or a foreign TIN?

You will need to obtain an EIN for the BC corporation; however, I would imagine a W8-BEN is not appropriate for you, if you are selling through Amazon FBA. The FBA program generally makes Amazon your agent in the US, which means any of your US source income, ie anything sold to a US customer is taxable in the US. W8-BEN is asserting that you either have no US sourced income or that income is exempt under the US/Canadian tax treaty. Based on the limited knowledge I have of your situation, but if you are selling through the FBA program, I would say you don’t qualify to file a W8-BEN, but rather should be completing a W8-ECI and your BC corporation should be filing an 1120F to report your US effectively connected income.

-

How do I fill the W8-BEN-E form for engaging as a service provider for a US based company?

Which specific question do you have an issue with ? I’ve done it in the past and can guide you on any specific issue you have …

-

Some large USA institutions want me to fill a W8 Form. I am a Canadian. What tax implications does this have for me? Would it affect me in the future? What happens after I fill it out?

That is dependent upon if you are working as an employee for that company(/ies). It’s similar to a W-4 form, which most American’s are more familiar with but designed for non-US Citizens who are working in the US or a nation that has a tax treaty with the US.This is a more indepth link from the IRS. Who needs to fill out IRS tax form W-8?

-

How should a W8-BEN form be filled without having an ITIN or EIN?

It is a form for deciding the contracting state in which a particular income would be taxed as per the Double Taxation Avoidance treaty entered into between the countries. You can fill the said form even without having ITIN/EIN as it does not require ITIN/EIN as a compulsory thing to file.My above answer is subject to the limited information provided by you, we can give you a perfect answer only after having the complete data.For more information you can visit autusconsultants - autusconsultants

-

Being in a sole proprietorship business in the Philippines, do I need to fill out any W8/W9 forms in order to be paid by a company that was recently bought by a US corporation?

NOT a W-9 as that is for domestic vendors.You do not even have to fill out a W-8BEN (probably the actual correct form) if you wish to have US taxes taken out of your payments and paid to the IRS. It is only required if you wish to have no US taxes withheld on your payment.

Create this form in 5 minutes!

How to create an eSignature for the w8 chase form

How to create an eSignature for the W8 Chase Form in the online mode

How to create an electronic signature for the W8 Chase Form in Google Chrome

How to generate an eSignature for signing the W8 Chase Form in Gmail

How to create an eSignature for the W8 Chase Form right from your mobile device

How to make an eSignature for the W8 Chase Form on iOS devices

How to generate an electronic signature for the W8 Chase Form on Android

People also ask

-

What is Rusa Form and how does it work?

Rusa Form is an innovative feature within airSlate SignNow that allows users to create customizable forms for collecting information seamlessly. With Rusa Form, you can easily design forms tailored to your needs, integrate them into your workflow, and gather data efficiently. This tool is designed to streamline your document management process and improve overall productivity.

-

How much does Rusa Form cost with airSlate SignNow?

The pricing for Rusa Form is included in the various subscription plans offered by airSlate SignNow, which cater to different business needs. Depending on the plan you choose, you'll gain access to a range of features, including the Rusa Form functionality. For detailed pricing information, visit our pricing page or contact our sales team for a personalized quote.

-

What are the key features of Rusa Form?

Rusa Form boasts several key features, including drag-and-drop form creation, customizable templates, and advanced data collection options. Additionally, users can integrate Rusa Form with other airSlate SignNow tools for a more comprehensive document management solution. These features ensure that creating and managing forms is efficient and user-friendly.

-

Can Rusa Form be integrated with other applications?

Yes, Rusa Form can be easily integrated with various applications and services through airSlate SignNow’s API and pre-built integrations. This allows you to connect Rusa Form with your favorite CRM, project management, or productivity tools, enhancing your workflow and making data collection more efficient. Explore our integrations section for a complete list of compatible applications.

-

What benefits does Rusa Form provide for businesses?

Rusa Form provides numerous benefits for businesses, including improved efficiency in data collection, reduced paperwork, and enhanced collaboration among team members. By using Rusa Form within airSlate SignNow, organizations can streamline their document processes and ensure that information is gathered and stored securely. This ultimately leads to better decision-making and increased productivity.

-

Is Rusa Form user-friendly for non-technical users?

Absolutely! Rusa Form is designed with user-friendliness in mind, allowing even non-technical users to create and manage forms effortlessly. The intuitive drag-and-drop interface and customizable templates make it easy for anyone to design forms without needing coding skills or extensive training. This accessibility ensures that all team members can contribute to the data collection process.

-

How secure is the data collected through Rusa Form?

Data security is a top priority for airSlate SignNow, and Rusa Form adheres to strict security protocols to protect your information. All data collected through Rusa Form is encrypted and stored in compliant data centers, ensuring that sensitive information remains safe. Additionally, users can set access controls to further safeguard their forms and collected data.

Get more for Rusa Form

Find out other Rusa Form

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast