Acs Income Based Repayment Form 2015

What is the Acs Income Based Repayment Form

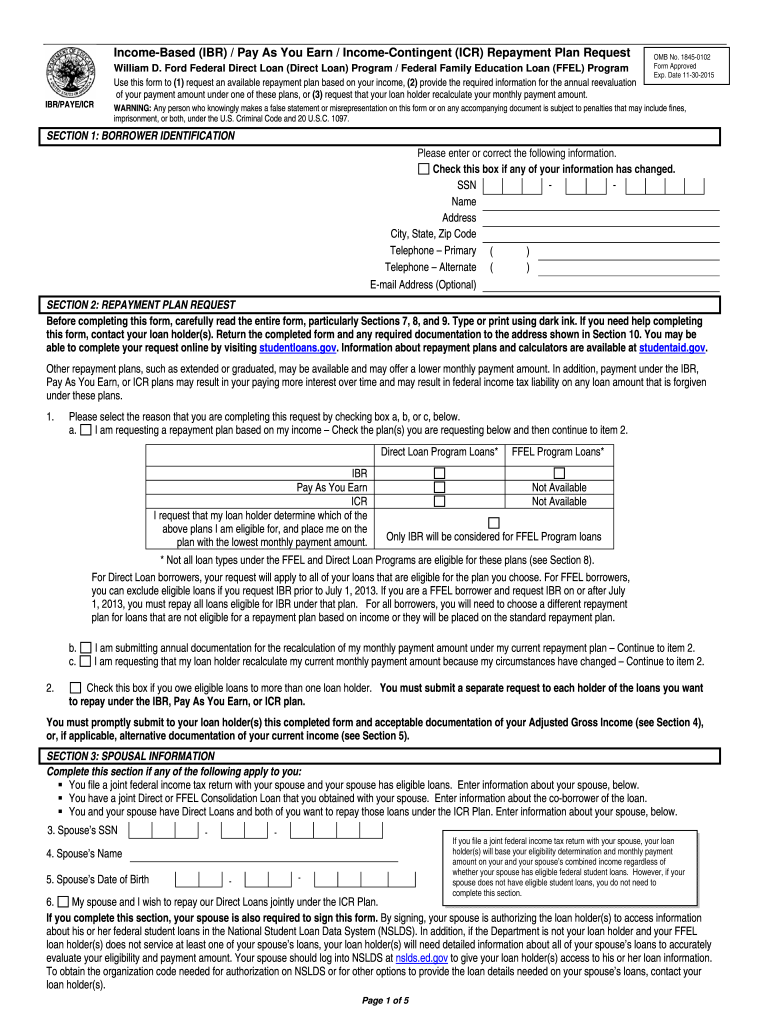

The Acs Income Based Repayment Form is a document designed for borrowers who wish to apply for income-driven repayment plans for their federal student loans. This form allows individuals to report their income and family size to determine their monthly payment amount based on their financial situation. By using this form, borrowers can potentially lower their monthly payments and make their student loan obligations more manageable.

Steps to complete the Acs Income Based Repayment Form

Completing the Acs Income Based Repayment Form involves several important steps to ensure accuracy and compliance:

- Gather necessary financial documents, including pay stubs, tax returns, and any other income verification.

- Fill out personal information, including your name, address, and Social Security number.

- Provide details about your income, including any additional sources such as bonuses or part-time work.

- Indicate your family size, as this will impact the calculation of your repayment amount.

- Review the completed form for accuracy before submission.

How to obtain the Acs Income Based Repayment Form

The Acs Income Based Repayment Form can be obtained through the official Federal Student Aid website or directly from your loan servicer. It is essential to ensure you are using the most current version of the form to avoid any processing delays. Additionally, many loan servicers provide the form in a downloadable format, making it easy to access and complete online.

Legal use of the Acs Income Based Repayment Form

Using the Acs Income Based Repayment Form legally requires adherence to federal regulations governing student loans. The form must be filled out truthfully and accurately, as providing false information can lead to penalties, including loan denial or other legal consequences. It is important to understand that submitting this form is a formal request for a change in repayment terms, and compliance with all instructions is necessary for it to be considered valid.

Eligibility Criteria

To qualify for the income-driven repayment plans associated with the Acs Income Based Repayment Form, borrowers must meet specific eligibility criteria. These typically include:

- Having federal student loans, as private loans are not eligible.

- Demonstrating a partial financial hardship, which is assessed based on income and family size.

- Completing the form annually or when there is a change in income or family size to maintain eligibility.

Form Submission Methods

The Acs Income Based Repayment Form can be submitted through various methods, ensuring flexibility for borrowers. These methods include:

- Online submission through your loan servicer's website, which is often the fastest option.

- Mailing a physical copy of the form to your loan servicer's designated address.

- In-person submission at your loan servicer's office, if available.

Quick guide on how to complete acs income based repayment form

A simple method to acquire and endorse Acs Income Based Repayment Form

Across the scope of an entire organization, ineffective procedures related to document approval can take up a signNow amount of work hours. Signing documents like Acs Income Based Repayment Form is an inherent aspect of operations in any enterprise, which is why the effectiveness of every agreement's lifecycle is crucial to the overall productivity of the organization. With airSlate SignNow, endorsing your Acs Income Based Repayment Form is as straightforward and quick as it can be. You will discover with this platform the most recent version of nearly any document. Even better, you can sign it instantly without the need to install external applications on your computer or printing materials as hard copies.

Steps to obtain and endorse your Acs Income Based Repayment Form

- Explore our catalog by category or utilize the search bar to locate the document you require.

- Examine the document preview by clicking on Learn more to confirm it's the correct one.

- Click Get form to start editing immediately.

- Fill out your document and include any essential information using the toolbar.

- When finished, click the Sign tool to endorse your Acs Income Based Repayment Form.

- Select the signing option that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and proceed to document-sharing options if necessary.

With airSlate SignNow, you possess everything required to handle your documents proficiently. You can search for, complete, edit, and even send your Acs Income Based Repayment Form in a single tab with minimal effort. Enhance your workflows by adopting a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct acs income based repayment form

FAQs

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How should one fill out Form 1120 for a company with no activity and no income and that has not issued shares?

You put all zeros in for revenue and expenses. Even though the corporation has not formally issued shares, someone or several individuals or entities own the common stock of the corporation and you need to report anyone who owns more than 20% of the corporation.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

Create this form in 5 minutes!

How to create an eSignature for the acs income based repayment form

How to make an eSignature for the Acs Income Based Repayment Form in the online mode

How to generate an electronic signature for the Acs Income Based Repayment Form in Google Chrome

How to make an eSignature for putting it on the Acs Income Based Repayment Form in Gmail

How to create an eSignature for the Acs Income Based Repayment Form straight from your smart phone

How to create an eSignature for the Acs Income Based Repayment Form on iOS

How to make an eSignature for the Acs Income Based Repayment Form on Android devices

People also ask

-

What is the Acs Income Based Repayment Form?

The Acs Income Based Repayment Form is a document that allows borrowers to apply for income-driven repayment plans for federal student loans. This form helps determine monthly payment amounts based on your income. Easily accessible through airSlate SignNow, the form streamlines the application process, ensuring you can manage your student loans effectively.

-

How can I complete the Acs Income Based Repayment Form using airSlate SignNow?

To complete the Acs Income Based Repayment Form using airSlate SignNow, simply upload the form to our platform, fill it out electronically, and add your signature. Our user-friendly interface makes it straightforward to complete the form quickly and efficiently. Once filled, you can send it directly to your loan servicer for processing.

-

Is there a cost associated with using airSlate SignNow for the Acs Income Based Repayment Form?

airSlate SignNow offers a variety of pricing plans to cater to different user needs, including options for individuals and businesses. You can use our platform to complete the Acs Income Based Repayment Form at an affordable price, which includes access to all essential features. Check our website for detailed pricing information and choose the plan that works best for you.

-

What features does airSlate SignNow offer for the Acs Income Based Repayment Form?

airSlate SignNow provides several features to enhance your experience with the Acs Income Based Repayment Form, including eSignature capabilities, document tracking, and secure cloud storage. Our platform ensures that your forms are completed accurately and securely, helping you manage your student loans with confidence. Additionally, you can easily collaborate with others on the form if needed.

-

Can I integrate airSlate SignNow with other tools for managing the Acs Income Based Repayment Form?

Yes, airSlate SignNow integrates with various applications, making it easy to manage the Acs Income Based Repayment Form alongside your other tools. Whether you use CRM systems, document management software, or cloud storage solutions, our integrations enhance your workflow. Explore our integration options to streamline your document processes effectively.

-

What are the benefits of using airSlate SignNow for the Acs Income Based Repayment Form?

Using airSlate SignNow for the Acs Income Based Repayment Form offers numerous benefits, including time savings, ease of use, and enhanced security. Our platform allows you to fill out and submit your form quickly, reducing the hassle of paperwork. Additionally, with secure storage and tracking features, you can rest assured that your sensitive information is protected.

-

How secure is my information when using airSlate SignNow for the Acs Income Based Repayment Form?

airSlate SignNow prioritizes the security of your information, especially when handling sensitive documents like the Acs Income Based Repayment Form. Our platform uses advanced encryption and security protocols to ensure that your data remains confidential and safe. You can complete your forms with peace of mind knowing that your information is protected.

Get more for Acs Income Based Repayment Form

Find out other Acs Income Based Repayment Form

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation