Idr Income Driven Repayment Request 2018-2026

What is the IDR Income Driven Repayment Request?

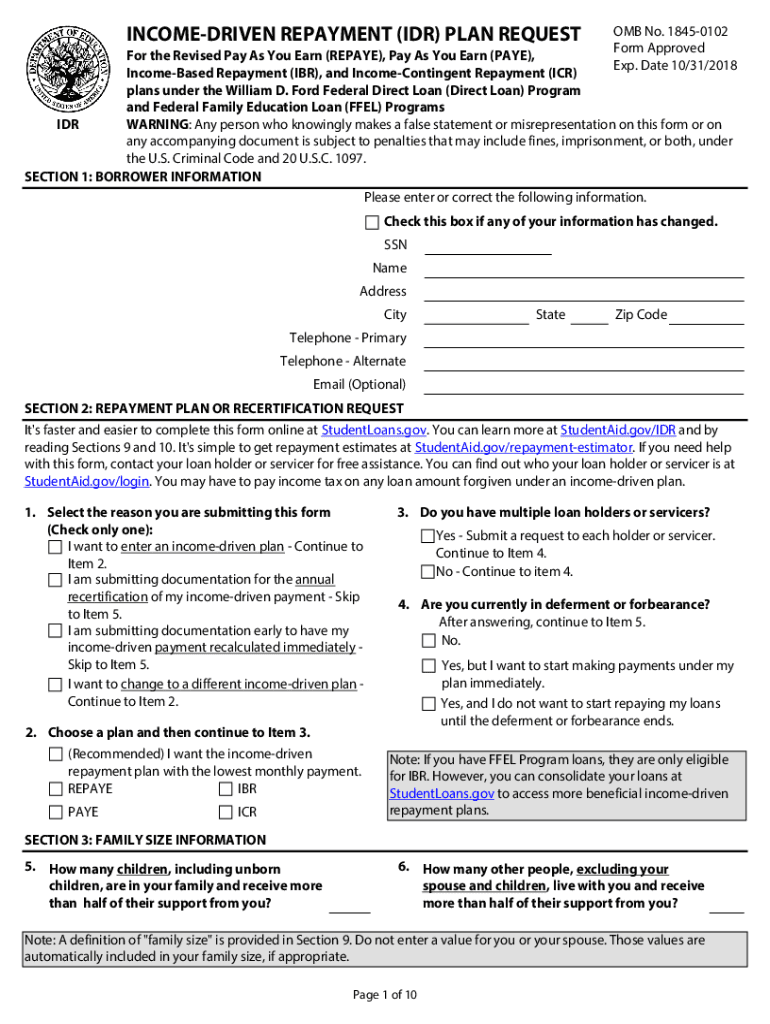

The IDR Income Driven Repayment Request is a formal document used by borrowers to apply for a repayment plan based on their income. This request allows individuals with federal student loans to adjust their monthly payments according to their financial situation. The goal is to make loan repayment more manageable, especially for those experiencing financial hardship. By submitting this form, borrowers can potentially lower their monthly payments and extend the repayment period, making it easier to keep up with their obligations.

Steps to Complete the IDR Income Driven Repayment Request

Completing the IDR Income Driven Repayment Request involves several key steps:

- Gather necessary financial information, including your income, family size, and any other relevant financial details.

- Obtain the IDR Income Driven Repayment Plan form, which can typically be found on the official student loan servicer's website.

- Fill out the form accurately, ensuring all sections are completed, including income details and family size.

- Review the form for accuracy and completeness before submission.

- Submit the form either electronically or via mail, depending on your preference and the options provided by your loan servicer.

Eligibility Criteria for the IDR Income Driven Repayment Request

To qualify for the IDR Income Driven Repayment Request, borrowers must meet specific eligibility criteria. These generally include:

- Having federal student loans, as private loans do not qualify for this repayment plan.

- Demonstrating a financial need based on income and family size.

- Being in good standing with your loan payments, meaning you are not currently in default.

It is essential for borrowers to review these criteria carefully to ensure they can successfully apply for the income-driven repayment plan.

Required Documents for the IDR Income Driven Repayment Request

When submitting the IDR Income Driven Repayment Request, borrowers need to provide certain documents to support their application. These typically include:

- Proof of income, such as pay stubs, tax returns, or a recent income statement.

- Documentation of family size, which may include birth certificates or other legal documents.

- Any additional information requested by the loan servicer to verify your financial situation.

Having these documents ready can facilitate a smoother application process and help ensure that your request is processed quickly.

Form Submission Methods for the IDR Income Driven Repayment Request

Borrowers have various options for submitting the IDR Income Driven Repayment Request. The methods generally include:

- Online submission through the loan servicer's website, which is often the quickest method.

- Mailing a physical copy of the completed form to the appropriate address provided by the loan servicer.

- In-person submission at designated loan servicer locations, if available.

Choosing the right submission method can depend on personal preference and the urgency of the request.

Legal Use of the IDR Income Driven Repayment Request

The IDR Income Driven Repayment Request is legally binding once submitted. Borrowers must ensure that all information provided is accurate and truthful, as providing false information can lead to penalties, including loan denial or legal consequences. The form adheres to federal regulations governing student loans and repayment plans, ensuring that borrowers receive fair treatment under the law.

Quick guide on how to complete acs income based repayment 2018 2019 form

The optimal approach to acquire and authorize Idr Income Driven Repayment Request

On a company-wide scale, ineffective workflows related to document authorization can deplete numerous working hours. Signing papers like Idr Income Driven Repayment Request is an inherent aspect of operations in any establishment, which is why the efficacy of each contract’s lifecycle signNowly impacts the organization’s overall performance. With airSlate SignNow, signing your Idr Income Driven Repayment Request is as simple and rapid as it can be. This platform provides you with the latest version of nearly any document. Even better, you can sign it instantly without needing to install external applications on your PC or printing physical copies.

Steps to acquire and authorize your Idr Income Driven Repayment Request

- Explore our library by category or utilize the search box to locate the document you require.

- Check the document preview by clicking Learn more to confirm it is the correct one.

- Hit Get form to start editing immediately.

- Fill out your document and include any required information using the toolbar.

- Once finished, click the Sign tool to authorize your Idr Income Driven Repayment Request.

- Choose the signature option that suits you best: Draw, Create initials, or upload a picture of your handwritten signature.

- Click Done to complete editing and move on to document-sharing options as needed.

With airSlate SignNow, you possess everything necessary to handle your documents effectively. You can discover, complete, modify, and even send your Idr Income Driven Repayment Request in a single tab without complications. Enhance your workflows by utilizing a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct acs income based repayment 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Which ITR form should an NRI fill out for AY 2018–2019 if there are two rental incomes in India other than that from interests?

Choosing Correct Income Tax form is the important aspect of filling Income tax return.Lets us discuss it one by one.ITR -1 —— Mainly used for salary income , other source income, one house property income ( upto Rs. 50 Lakhs ) for Individual Resident Assessees only.ITR-2 —- For Salary Income , Other source income ( exceeding Rs. 50 lakhs) house property income from more than one house and Capital Gains / Loss Income for Individual Resident or Non- Resident Assessees and HUF Assessees only.ITR 3— Income from Business or profession Together with any other income such as Salary Income, Other sources, Capital Gains , House property ( Business/ Profession income is must for filling this form) . For individual and HUF Assessees OnlySo in case NRI Assessees having rental income from two house property , then ITR need to be filed in Form ITR 2.For Detail understanding please refer to my video link.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

Create this form in 5 minutes!

How to create an eSignature for the acs income based repayment 2018 2019 form

How to make an electronic signature for your Acs Income Based Repayment 2018 2019 Form online

How to make an electronic signature for your Acs Income Based Repayment 2018 2019 Form in Google Chrome

How to create an electronic signature for putting it on the Acs Income Based Repayment 2018 2019 Form in Gmail

How to make an eSignature for the Acs Income Based Repayment 2018 2019 Form straight from your smartphone

How to create an electronic signature for the Acs Income Based Repayment 2018 2019 Form on iOS devices

How to create an eSignature for the Acs Income Based Repayment 2018 2019 Form on Android

People also ask

-

What is an income driven repayment form?

An income driven repayment form is a document that allows borrowers to apply for a repayment plan based on their income and family size. This form is crucial for those seeking lower monthly payments on their federal student loans. By submitting this form, you can ensure that your repayment plan aligns with your financial circumstances.

-

How can airSlate SignNow help with the income driven repayment form?

airSlate SignNow simplifies the process of filling out and submitting your income driven repayment form. Our platform allows you to eSign documents securely and efficiently, ensuring that your application is processed quickly. With our user-friendly interface, you can manage and track your forms with ease.

-

What are the benefits of using airSlate SignNow for the income driven repayment form?

Using airSlate SignNow for your income driven repayment form offers several benefits, including faster processing times and enhanced security. Our solution helps reduce the paperwork hassle and allows you to focus on what matters most—managing your loans effectively. Plus, with electronic signatures, you can complete documents from anywhere.

-

Is there a cost associated with using airSlate SignNow for the income driven repayment form?

Yes, airSlate SignNow offers cost-effective solutions for businesses needing to manage documents like the income driven repayment form. Our pricing plans are flexible, catering to various needs and budgets. You can choose a plan that best fits your usage requirements and enjoy the benefits of our eSigning services.

-

Can I integrate airSlate SignNow with other software for my income driven repayment form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, including CRMs and document management systems. This allows you to streamline the workflow for the income driven repayment form and other related documents. Our integrations enhance efficiency and ensure a smooth document handling experience.

-

Is the income driven repayment form easy to fill out with airSlate SignNow?

Yes, filling out the income driven repayment form with airSlate SignNow is user-friendly and intuitive. Our platform provides guided steps to ensure that all necessary information is accurately captured. You'll find features that allow you to save time and reduce errors during the form completion process.

-

What security features does airSlate SignNow offer for the income driven repayment form?

airSlate SignNow takes the security of your documents seriously, especially with sensitive information like the income driven repayment form. We employ advanced encryption and secure cloud storage to protect your data from unauthorized access. You can trust that your information is in safe hands.

Get more for Idr Income Driven Repayment Request

- Ymca basketball score sheet ymcaspokane form

- Eagle reference cover letter san francisco bay area council sfbac form

- De 1545te edd form

- Appdirector user guide docme ru form

- Aims practice worksheet expanded notation third grade expanded notation test practice grade 3 form

- Spotlight vet centers ecu form

- Bl garza middle school bbrandempowermentbbcomb form

- Tv show contract template form

Find out other Idr Income Driven Repayment Request

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure