Assam Schedule Lix Part Iv Form No 29

What is the Assam Schedule Lix Part IV Form No 29

The Assam Schedule Lix Part IV Form No 29 is a specific document used within the context of tax compliance in Assam, India. This form is essential for individuals and businesses to report certain financial information as mandated by local tax regulations. It serves as a formal declaration of income and deductions, ensuring that the relevant authorities have accurate data for tax assessment purposes. Understanding the purpose and requirements of this form is crucial for maintaining compliance and avoiding penalties.

How to use the Assam Schedule Lix Part IV Form No 29

Using the Assam Schedule Lix Part IV Form No 29 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as income statements and receipts for deductions. Next, fill out the form carefully, ensuring that all information is accurate and complete. It is advisable to double-check entries for any errors before submission. Once completed, the form can be submitted electronically or through traditional mail, depending on the specific requirements set by the tax authority.

Steps to complete the Assam Schedule Lix Part IV Form No 29

Completing the Assam Schedule Lix Part IV Form No 29 requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including income records and expense receipts.

- Begin filling out the form with personal information, such as name, address, and identification number.

- Report income from various sources, ensuring to categorize them correctly.

- List any eligible deductions, providing necessary documentation to support each claim.

- Review the completed form for accuracy, checking all calculations and entries.

- Submit the form through the designated method, ensuring that it is sent before the filing deadline.

Legal use of the Assam Schedule Lix Part IV Form No 29

The Assam Schedule Lix Part IV Form No 29 holds legal significance as it is a formal declaration required by tax regulations. Filing this form accurately and on time is essential to avoid legal repercussions, including fines or penalties. It is important to understand the legal implications of the information provided within the form, as any discrepancies can lead to audits or further investigations by tax authorities.

Key elements of the Assam Schedule Lix Part IV Form No 29

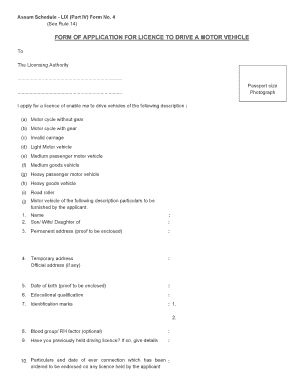

Several key elements must be included in the Assam Schedule Lix Part IV Form No 29 for it to be considered complete and valid. These elements include:

- Personal Information: Name, address, and identification details of the filer.

- Income Reporting: A detailed account of all income sources, including salaries, business income, and investments.

- Deductions: A list of allowable deductions, supported by appropriate documentation.

- Signature: The form must be signed by the individual or authorized representative to validate the submission.

Form Submission Methods

The Assam Schedule Lix Part IV Form No 29 can be submitted through various methods, depending on the preferences of the filer and the requirements of the tax authority. Common submission methods include:

- Online Submission: Many jurisdictions allow for electronic filing through official tax websites.

- Mail: The form can be printed and sent via postal service to the appropriate tax office.

- In-Person Submission: Some individuals may choose to deliver the form directly to a local tax office for immediate processing.

Quick guide on how to complete assam schedule lix part iv form no 29

Prepare Assam Schedule Lix Part Iv Form No 29 easily on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides all the essential tools to create, modify, and eSign your documents quickly without delays. Manage Assam Schedule Lix Part Iv Form No 29 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to adjust and eSign Assam Schedule Lix Part Iv Form No 29 with ease

- Locate Assam Schedule Lix Part Iv Form No 29 and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically available through airSlate SignNow for that task.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to send your form, whether it be by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements with just a few clicks from any device you choose. Edit and eSign Assam Schedule Lix Part Iv Form No 29 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the assam schedule lix part iv form no 29

How to generate an electronic signature for a PDF document in the online mode

How to generate an electronic signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

How to make an e-signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the 'assam schedule lix part iv' and how does it relate to airSlate SignNow?

The 'assam schedule lix part iv' refers to a specific document format pertinent to businesses in Assam. airSlate SignNow facilitates the eSigning of such documents, ensuring compliance and efficiency. By utilizing our services, users can streamline their workflows while adhering to the requirements of the 'assam schedule lix part iv.'

-

How does airSlate SignNow help with compliance regarding the 'assam schedule lix part iv'?

airSlate SignNow offers features designed to meet the compliance needs of documents like the 'assam schedule lix part iv.' With built-in security measures and audit trails, businesses can trust that their signed documents conform to legal standards. This ensures that every eSigned document carries the necessary weight in legal scenarios.

-

What pricing plans are available for airSlate SignNow users focusing on 'assam schedule lix part iv'?

airSlate SignNow provides flexible pricing plans tailored to meet various business needs. Users interested in handling documents like the 'assam schedule lix part iv' can choose from monthly or yearly subscriptions, ensuring cost-effectiveness. Our plans are scalable, allowing businesses to upgrade as they grow.

-

What features does airSlate SignNow offer for managing the 'assam schedule lix part iv'?

airSlate SignNow includes features such as customizable templates, automated workflows, and bulk sending, all designed to enhance the management of the 'assam schedule lix part iv.' Users can easily create, edit, and send these documents for eSigning within minutes. Additionally, the platform provides real-time status tracking.

-

Can airSlate SignNow integrate with other software for handling 'assam schedule lix part iv'?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, enhancing the eSigning process for documents like the 'assam schedule lix part iv.' Users can connect with popular CRMs, cloud storage solutions, and productivity tools. This interoperability makes it easier to manage documents alongside existing workflows.

-

What are the benefits of using airSlate SignNow for the 'assam schedule lix part iv'?

The benefits of using airSlate SignNow for managing the 'assam schedule lix part iv' include increased efficiency, reduced turnaround times, and enhanced document security. Businesses can accelerate their signing processes, saving both time and resources. Moreover, the platform's user-friendly interface makes it accessible for teams of all sizes.

-

Is airSlate SignNow suitable for small businesses handling 'assam schedule lix part iv'?

Absolutely! airSlate SignNow is designed to cater to small businesses managing documents like the 'assam schedule lix part iv.' Our cost-effective solutions provide the necessary tools for efficient document management without overwhelming features. This user-friendly platform helps small enterprises maintain professionalism and compliance.

Get more for Assam Schedule Lix Part Iv Form No 29

- 12th biennial judge joe lee bankruptcy institute uknowledge form

- Form c 22 tngov

- Fillable online form c 28 fax email print pdffiller

- 1 introduction this incident guide will provide an explanation form

- Final medical report form

- Form c 35autilization review denial appeal tngov

- Sedgwick claims kit tennessee uscom form

- Purchase and sale agreement tennessee bar form

Find out other Assam Schedule Lix Part Iv Form No 29

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP