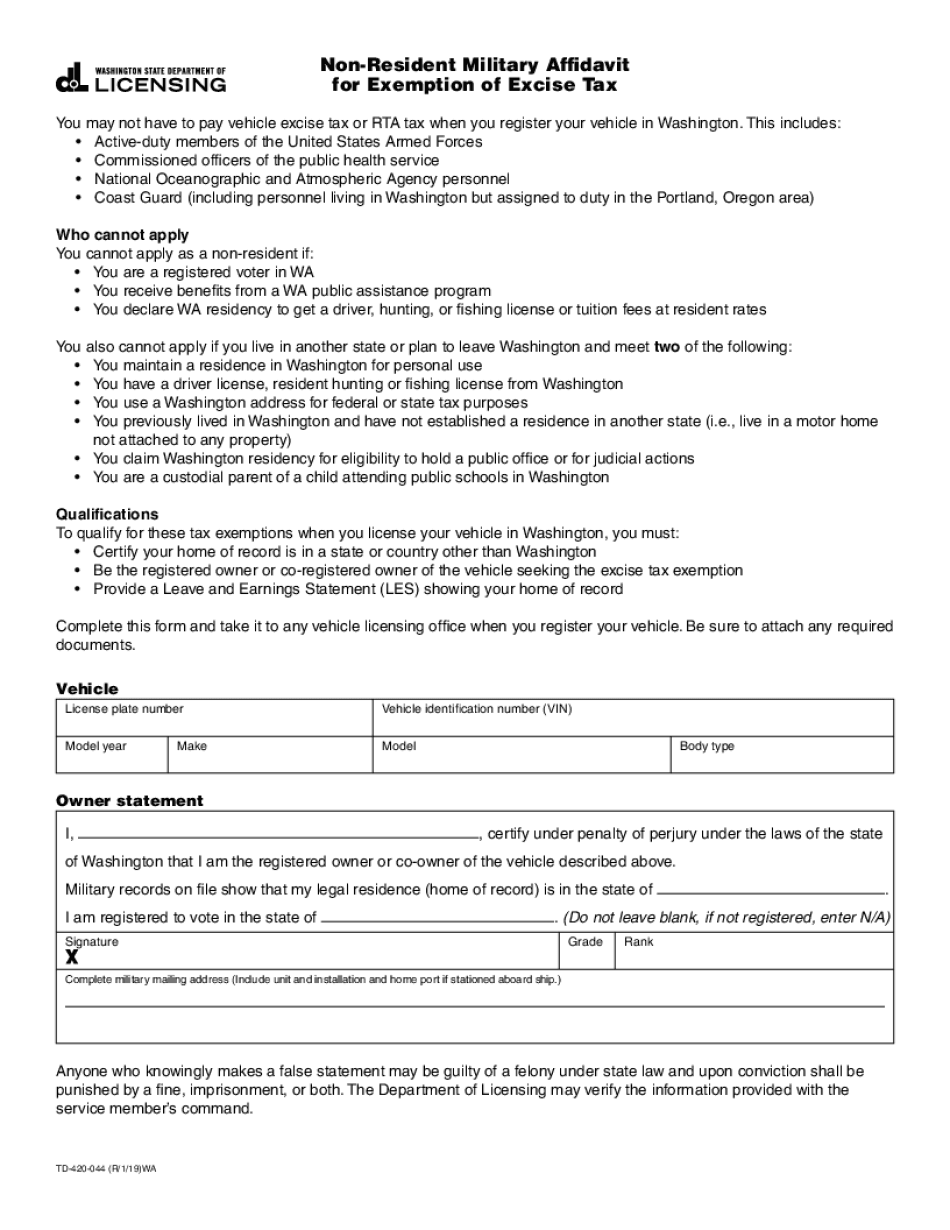

You May Not Have to Pay Vehicle Excise Tax or RTA Tax When You Register Your Vehicle in Washington Form

Understanding the RTA Excise Tax in Washington

The RTA excise tax is a fee imposed on vehicle registrations in specific regions of Washington State, particularly in areas served by the Regional Transit Authority. This tax is intended to fund public transportation projects and services. It is essential for vehicle owners to understand this tax, as it can significantly impact the total cost of vehicle ownership. The rate of the RTA excise tax may vary based on the location and the type of vehicle being registered.

Eligibility for Exemptions from the RTA Excise Tax

Certain individuals and vehicles may qualify for exemptions from the RTA excise tax. For instance, vehicles that are owned by non-profit organizations, government entities, or are used for specific purposes may be exempt. Additionally, some low-income individuals may also qualify for tax relief. Understanding the eligibility criteria is crucial for those looking to reduce their financial burden when registering a vehicle.

Steps to Calculate Your RTA Excise Tax

Calculating the RTA excise tax can be straightforward if you follow these steps:

- Determine the vehicle's value based on its current market price.

- Identify the applicable RTA excise tax rate for your area.

- Multiply the vehicle's value by the tax rate to find the total excise tax owed.

- Consider any exemptions or deductions that may apply to your situation.

Using an RTA tax calculator can simplify this process, ensuring accuracy and efficiency.

Filing Requirements for the RTA Excise Tax

When registering a vehicle and paying the RTA excise tax, certain documents are required. These typically include:

- Proof of vehicle ownership, such as a title or bill of sale.

- Identification, such as a driver's license or state ID.

- Completed registration forms, which may vary by county.

Ensuring that all necessary documents are prepared can help facilitate a smooth registration process.

Common Questions About the RTA Excise Tax

Many vehicle owners have questions regarding the RTA excise tax. Common inquiries include:

- What is the purpose of the RTA excise tax?

- How can I find out if I qualify for an exemption?

- Why is my RTA excise tax amount higher than expected?

Addressing these questions can help demystify the tax process and assist vehicle owners in making informed decisions.

Consequences of Non-Compliance with RTA Excise Tax Regulations

Failure to comply with RTA excise tax regulations can lead to penalties, including fines and interest on unpaid taxes. Additionally, vehicle registration may be delayed or denied until the tax obligations are met. Understanding these consequences is essential for vehicle owners to avoid potential legal and financial issues.

Quick guide on how to complete you may not have to pay vehicle excise tax or rta tax when you register your vehicle in washington

Complete You May Not Have To Pay Vehicle Excise Tax Or RTA Tax When You Register Your Vehicle In Washington with ease on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Manage You May Not Have To Pay Vehicle Excise Tax Or RTA Tax When You Register Your Vehicle In Washington on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign You May Not Have To Pay Vehicle Excise Tax Or RTA Tax When You Register Your Vehicle In Washington effortlessly

- Find You May Not Have To Pay Vehicle Excise Tax Or RTA Tax When You Register Your Vehicle In Washington and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign You May Not Have To Pay Vehicle Excise Tax Or RTA Tax When You Register Your Vehicle In Washington and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the you may not have to pay vehicle excise tax or rta tax when you register your vehicle in washington

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

The best way to create an e-signature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The best way to create an e-signature for a PDF file on Android

People also ask

-

What is an RTA tax calculator?

An RTA tax calculator is a tool designed to help individuals and businesses calculate their tax obligations associated with vehicle ownership. By entering specific details about the vehicle and its use, the RTA tax calculator provides accurate estimates, streamlining the tax preparation process.

-

How can the RTA tax calculator benefit my business?

Using the RTA tax calculator can signNowly simplify your tax calculations, ensuring compliance while saving time. It allows you to quickly assess your tax liabilities, helping in better financial planning and management for your business.

-

Is there a cost associated with using the RTA tax calculator?

Many online RTA tax calculators are free to use; however, premium features may require a subscription or a one-time fee. Ensuring you choose the right tool that fits your budget while offering the features you need is crucial for effective tax management.

-

What features should I look for in an RTA tax calculator?

When choosing an RTA tax calculator, look for features such as user-friendly interfaces, accuracy in tax calculations, and comprehensive data entry fields. It may also be beneficial to find a calculator that integrates with other financial tools to streamline your tax processes.

-

Can I integrate the RTA tax calculator with other software?

Many RTA tax calculators allow for integration with accounting and financial software, enhancing your overall tax management capabilities. This seamless connection ensures your tax calculations are consistent and up-to-date with your financial data.

-

How accurate is the RTA tax calculator?

The accuracy of an RTA tax calculator depends on its data sources and algorithms used for calculations. Reputable calculators update their tax information regularly to provide reliable estimates, ensuring you make informed financial decisions.

-

What types of vehicles can I calculate taxes for using the RTA tax calculator?

The RTA tax calculator is typically designed for a variety of vehicle types, including cars, trucks, and motorcycles. Ensure the calculator you choose accommodates the specific vehicle types relevant to your needs for accurate tax calculations.

Get more for You May Not Have To Pay Vehicle Excise Tax Or RTA Tax When You Register Your Vehicle In Washington

- In the matter of the estate of larry michael form

- State of wyoming and being described as follows form

- Wy inc cr form

- Incorporators shareholders and the board of directors of a wyoming form

- Forms ampampamp publications wyoming secretary of state

- Minnesota notarial certificates form

- Of business in this state form

- Govsitesproductionfiles201402documentsleadinyourhomebrochurelandbw508easyprint0 form

Find out other You May Not Have To Pay Vehicle Excise Tax Or RTA Tax When You Register Your Vehicle In Washington

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free