Specification for Employer Substitute Forms P60 GOV UK

What is the Specification for Employer Substitute Forms P60

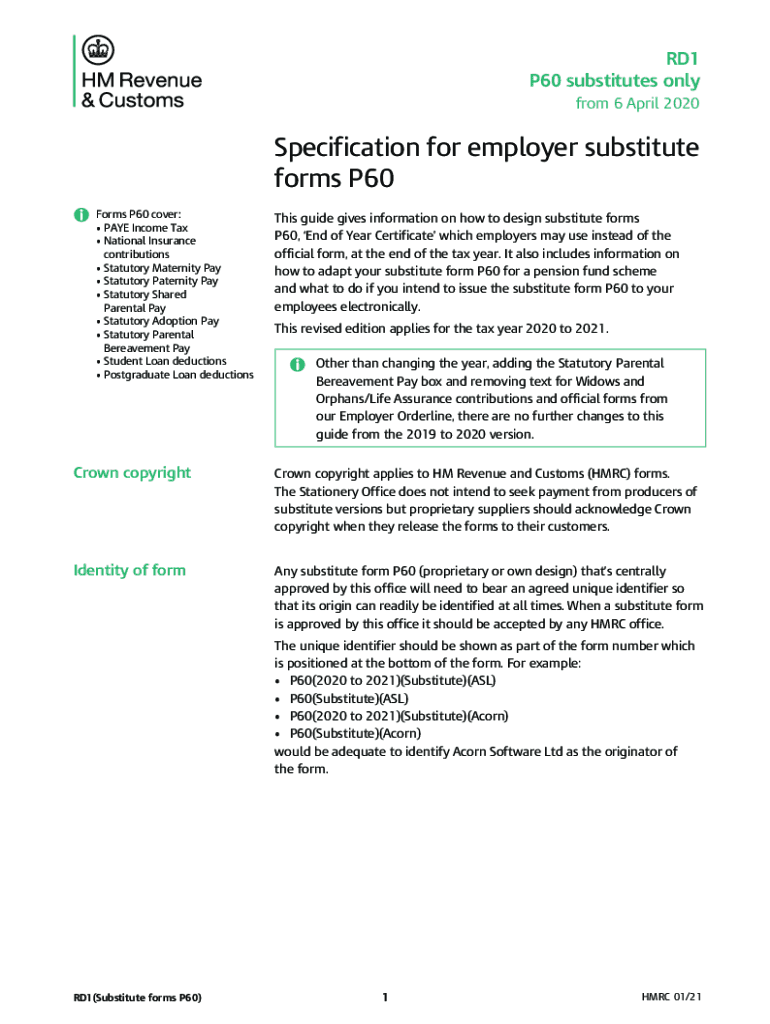

The Specification for Employer Substitute Forms P60 outlines the essential requirements for employers who need to provide a substitute version of the P60 form. This document serves as a summary of an employee's pay and deductions for a tax year, and it is crucial for accurate reporting to both employees and tax authorities. The specification ensures that all necessary information is included, such as the employee's name, National Insurance number, total earnings, and tax deducted. Employers must adhere to these guidelines to ensure compliance with tax regulations.

Key Elements of the Specification for Employer Substitute Forms P60

Understanding the key elements of the Specification for Employer Substitute Forms P60 is vital for employers. The main components include:

- Employee Information: Full name, address, and National Insurance number.

- Employer Details: Name and PAYE reference number.

- Income Details: Total earnings for the tax year, including bonuses and other payments.

- Tax Information: Total amount of tax deducted during the year.

- Year-End Summary: A clear summary of the financial information for the employee.

These elements must be presented clearly and accurately to ensure that the form is valid and useful for tax purposes.

Steps to Complete the Specification for Employer Substitute Forms P60

Completing the Specification for Employer Substitute Forms P60 involves several steps to ensure accuracy and compliance:

- Gather Employee Information: Collect all necessary details about the employee, including their full name and National Insurance number.

- Compile Earnings Data: Calculate total earnings, including any bonuses or additional payments made throughout the tax year.

- Calculate Tax Deductions: Determine the total tax deducted from the employee's earnings during the year.

- Fill Out the Form: Enter all collected information into the substitute P60 form, ensuring clarity and correctness.

- Review for Accuracy: Double-check all entries for mistakes or omissions before finalizing the document.

Following these steps helps ensure that the substitute P60 form is completed correctly, minimizing the risk of errors that could lead to complications with tax authorities.

Legal Use of the Specification for Employer Substitute Forms P60

The legal use of the Specification for Employer Substitute Forms P60 is essential for compliance with tax regulations. Employers are required to provide accurate and timely P60 forms to their employees, which serve as proof of income and tax deductions. Failure to comply with these specifications can result in penalties, including fines or legal action from tax authorities. It is important for employers to understand that the substitute form must meet the same legal standards as the official P60 to be considered valid.

How to Obtain the Specification for Employer Substitute Forms P60

Employers can obtain the Specification for Employer Substitute Forms P60 through official government resources. Typically, this information is available on the HMRC website or through employer tax guides. It is advisable to regularly check for updates or changes to the specifications to ensure compliance. Additionally, consulting with a tax professional can provide further guidance on obtaining and using the specification correctly.

Digital vs. Paper Version of the Specification for Employer Substitute Forms P60

Employers have the option to use either a digital or paper version of the Specification for Employer Substitute Forms P60. The digital version allows for easier storage, sharing, and completion, while the paper version may be preferred for traditional record-keeping. Both formats must adhere to the same specifications to ensure they are legally valid. Employers should consider their operational needs and preferences when deciding which format to use.

Quick guide on how to complete specification for employer substitute forms p60 govuk

Complete Specification For Employer Substitute Forms P60 GOV UK effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the resources you need to create, edit, and eSign your documents rapidly without any hold-ups. Manage Specification For Employer Substitute Forms P60 GOV UK on any platform with airSlate SignNow Android or iOS applications and enhance your document-centric processes today.

The easiest way to modify and eSign Specification For Employer Substitute Forms P60 GOV UK seamlessly

- Find Specification For Employer Substitute Forms P60 GOV UK and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow efficiently manages your document administration needs in just a few clicks from any device of your choice. Modify and eSign Specification For Employer Substitute Forms P60 GOV UK and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the specification for employer substitute forms p60 govuk

How to make an e-signature for a PDF file online

How to make an e-signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to create an e-signature straight from your mobile device

The best way to make an e-signature for a PDF file on iOS

The way to create an e-signature for a PDF document on Android devices

People also ask

-

What is a P60 HMRC template?

A P60 HMRC template is a government document that summarizes an employee's total pay and deductions for a tax year. It’s crucial for both businesses and employees for tax calculations. airSlate SignNow offers a user-friendly P60 HMRC template that streamlines this process.

-

How can I create a P60 HMRC template using airSlate SignNow?

Creating a P60 HMRC template in airSlate SignNow is straightforward. Simply upload your existing document or use our customizable template features to design one that fits your needs. Then, you can easily send it for electronic signatures.

-

Is there a cost associated with using the P60 HMRC template feature?

airSlate SignNow provides a cost-effective solution for creating and managing P60 HMRC templates. We offer various pricing plans depending on your business size and needs, ensuring that you only pay for features you utilize.

-

What are the key benefits of using airSlate SignNow for P60 HMRC templates?

Using airSlate SignNow for your P60 HMRC template offers numerous advantages, such as improved efficiency, easy document tracking, and enhanced compliance with HMRC regulations. It also simplifies the eSigning process, allowing quick turnaround times for your documents.

-

Can I integrate airSlate SignNow with other software for P60 HMRC templates?

Yes, airSlate SignNow supports various integrations with popular software applications, facilitating seamless data transfer for your P60 HMRC templates. This ensures that your payroll and document management systems work efficiently together.

-

How secure is the airSlate SignNow platform for handling P60 HMRC templates?

airSlate SignNow employs advanced security measures to ensure the safety of your P60 HMRC templates and sensitive information. Our platform is compliant with industry standards, providing peace of mind when dealing with critical documents.

-

What support options are available for P60 HMRC template users?

airSlate SignNow offers robust customer support for users of our P60 HMRC templates. Our dedicated team is available through various channels, including live chat and email, to assist you with any inquiries or challenges you may encounter.

Get more for Specification For Employer Substitute Forms P60 GOV UK

- Sample certification from company to consumer reporting agency form

- Sample ampquotbeforeampquot adverse action letter form

- Sample letter for employee leaving the company form

- Document title form

- Notice to employees who havent produced identity and form

- Employment eligibility verification form morehead state

- Job offer letter guide with free templates included payfactors form

- Job offer letter non exempt position form

Find out other Specification For Employer Substitute Forms P60 GOV UK

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template