Www Jud Ct GovwebformsformsEXEMPTION and MODIFICATION CLAIM FORM, WAGE EXECUTION 2021-2026

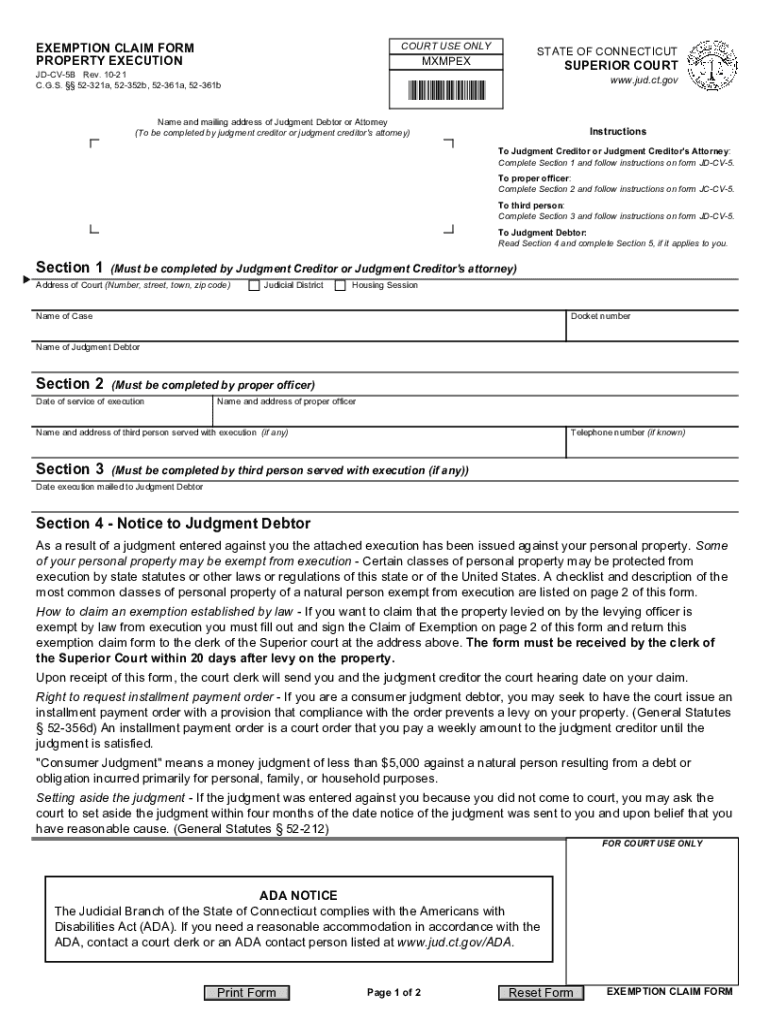

Understanding the Connecticut Exemption Property Form

The Connecticut exemption property form is a legal document used to claim exemptions on property taxes. This form is essential for homeowners seeking to reduce their tax liabilities based on specific criteria established by state law. It is important to understand the purpose and implications of this form to ensure compliance and maximize potential benefits.

Eligibility Criteria for the Connecticut Exemption Property Form

To qualify for the Connecticut exemption property, applicants must meet certain eligibility criteria. Typically, these criteria include:

- Ownership of the property in question.

- Residency in Connecticut.

- Meeting income limits, which may vary based on the type of exemption being claimed.

- Specific age or disability requirements for certain exemptions.

It is crucial for applicants to review these criteria carefully to determine their eligibility before submitting the form.

Steps to Complete the Connecticut Exemption Property Form

Filling out the Connecticut exemption property form involves several key steps to ensure accuracy and compliance:

- Gather necessary documentation, including proof of ownership and income verification.

- Obtain the correct version of the exemption property form from the appropriate state or local agency.

- Fill out the form completely, providing all required information such as personal details, property information, and income data.

- Review the completed form for accuracy and completeness before submission.

- Submit the form by the designated deadline, either online, by mail, or in person, depending on local regulations.

Legal Use of the Connecticut Exemption Property Form

The Connecticut exemption property form serves a legal purpose in the context of property tax exemptions. When completed and submitted correctly, it allows individuals to claim exemptions that can significantly reduce their tax burden. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or denial of the claim.

Required Documents for the Connecticut Exemption Property Form

When submitting the Connecticut exemption property form, applicants must include specific documents to support their claims. Commonly required documents include:

- Proof of property ownership, such as a deed or tax bill.

- Income documentation, which may include recent tax returns or pay stubs.

- Identification documents, such as a driver's license or state ID.

Having these documents ready can streamline the application process and help ensure a successful claim.

Form Submission Methods for the Connecticut Exemption Property Form

Applicants have several options for submitting the Connecticut exemption property form. These methods may include:

- Online submission through a designated state portal.

- Mailing the completed form to the appropriate local tax assessor's office.

- In-person submission at local government offices.

Each submission method may have different processing times and requirements, so it is advisable to choose the one that best fits individual circumstances.

Quick guide on how to complete wwwjudctgovwebformsformsexemption and modification claim form wage execution

Prepare Www jud ct govwebformsformsEXEMPTION AND MODIFICATION CLAIM FORM, WAGE EXECUTION effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without interruptions. Handle Www jud ct govwebformsformsEXEMPTION AND MODIFICATION CLAIM FORM, WAGE EXECUTION on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Www jud ct govwebformsformsEXEMPTION AND MODIFICATION CLAIM FORM, WAGE EXECUTION with ease

- Find Www jud ct govwebformsformsEXEMPTION AND MODIFICATION CLAIM FORM, WAGE EXECUTION and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing out new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your preference. Modify and electronically sign Www jud ct govwebformsformsEXEMPTION AND MODIFICATION CLAIM FORM, WAGE EXECUTION to ensure exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwjudctgovwebformsformsexemption and modification claim form wage execution

Create this form in 5 minutes!

How to create an eSignature for the wwwjudctgovwebformsformsexemption and modification claim form wage execution

How to make an e-signature for your PDF file online

How to make an e-signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is Connecticut exemption property?

Connecticut exemption property refers to specific assets or properties that are protected under state law from being seized to satisfy debts. Understanding these exemptions is crucial for property owners looking to safeguard their assets. By utilizing the benefits of Connecticut exemption property, you can alleviate financial stress while preserving your valuable holdings.

-

How can airSlate SignNow assist with Connecticut exemption property documentation?

airSlate SignNow streamlines the process of creating and signing documents related to Connecticut exemption property. Our platform makes it easy to manage legal forms, ensuring that all necessary documentation is completed accurately and efficiently. By leveraging digital signatures, you can save time and stay compliant with state requirements.

-

What features does airSlate SignNow offer for managing Connecticut exemption property forms?

Our platform includes features like customizable templates, secure cloud storage, and multi-party signing that are ideal for managing Connecticut exemption property forms. These tools help you efficiently handle necessary paperwork while maintaining compliance. Additionally, our user-friendly interface ensures that the process is straightforward and accessible to everyone.

-

Is airSlate SignNow cost-effective for handling Connecticut exemption property documentation?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to manage Connecticut exemption property documentation. With various pricing plans available, you can choose one that fits your needs and budget. Investing in our service can reduce paperwork costs and improve overall productivity in handling property-related matters.

-

Can airSlate SignNow integrate with other tools for managing Connecticut exemption property?

Absolutely! airSlate SignNow seamlessly integrates with various applications and tools, making it easier to manage Connecticut exemption property documents alongside your existing workflows. Whether you use CRM systems, cloud storage, or accounting software, our integration capabilities enhance functionality and collaboration across your business operations.

-

How secure is airSlate SignNow for Connecticut exemption property transactions?

Security is a top priority at airSlate SignNow. Our platform adheres to industry-leading security standards to ensure that all documents related to Connecticut exemption property transactions are protected. With features like encrypted data storage and secure access protocols, you can trust that sensitive information remains confidential and secure.

-

What are the benefits of using airSlate SignNow for Connecticut exemption property management?

Utilizing airSlate SignNow for Connecticut exemption property management simplifies the entire documentation process. You gain access to digital signatures, automated workflows, and easy tracking of document statuses. These benefits not only enhance efficiency but also contribute to a smoother and more organized management of your exemption property.

Get more for Www jud ct govwebformsformsEXEMPTION AND MODIFICATION CLAIM FORM, WAGE EXECUTION

- General instructions washingtonlawhelporg form

- Deborah jean dahl v james richard dahl 02 3 02768 6 form

- Service by certified mail or publication instructions and form

- Full text of ampquotthe history of phi gamma deltaampquot form

- Form fl all family 107 proof of service by mail washington

- Responding to a petition for modification of a child form

- I understand that by joining in the petition a decree or form

- Petition for a parenting plan residential schedule andor form

Find out other Www jud ct govwebformsformsEXEMPTION AND MODIFICATION CLAIM FORM, WAGE EXECUTION

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF