Claim for Homeowners Property Tax Exemption Connecticut Form 2013

What is the Claim For Homeowners Property Tax Exemption Connecticut Form

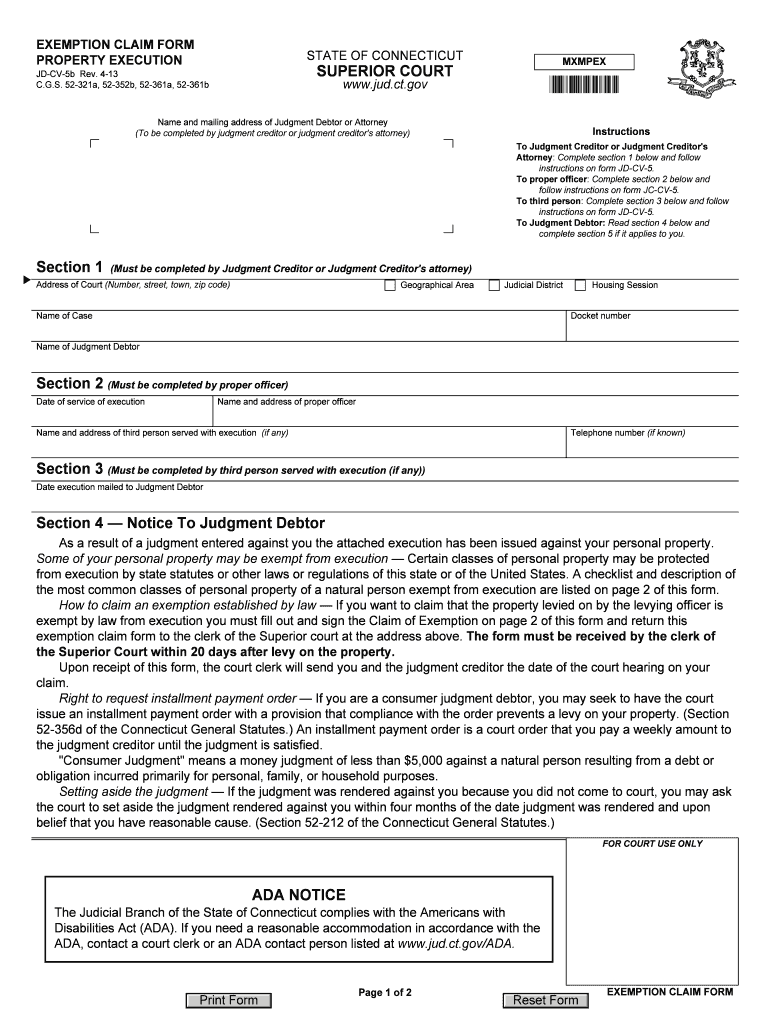

The Claim For Homeowners Property Tax Exemption Connecticut Form is a crucial document that allows eligible homeowners in Connecticut to apply for a property tax exemption. This exemption can significantly reduce the amount of property tax owed, providing financial relief to qualifying individuals. The form is specifically designed for those who meet certain criteria, including residency requirements and ownership status. Understanding the purpose and significance of this form is essential for homeowners looking to take advantage of available tax benefits.

Eligibility Criteria

To qualify for the Claim For Homeowners Property Tax Exemption Connecticut Form, applicants must meet specific eligibility criteria. Generally, homeowners must be permanent residents of Connecticut and occupy the property as their primary residence. Additional requirements may include age limitations, income thresholds, and ownership status. It is important for applicants to review these criteria carefully to ensure they meet all necessary conditions before submitting the form.

Steps to Complete the Claim For Homeowners Property Tax Exemption Connecticut Form

Filling out the Claim For Homeowners Property Tax Exemption Connecticut Form involves several key steps. First, gather all required information, including personal identification details, property information, and any supporting documentation that verifies eligibility. Next, accurately complete each section of the form, ensuring that all information is correct and up to date. Finally, review the completed form for any errors or omissions before submitting it to the appropriate local tax authority.

How to Obtain the Claim For Homeowners Property Tax Exemption Connecticut Form

The Claim For Homeowners Property Tax Exemption Connecticut Form can be obtained through various channels. Homeowners may visit their local tax assessor's office to request a physical copy of the form. Additionally, many municipalities provide downloadable versions of the form on their official websites. It is advisable to check with the local tax authority for any specific instructions or additional requirements related to obtaining the form.

Form Submission Methods

Once the Claim For Homeowners Property Tax Exemption Connecticut Form is completed, homeowners have several options for submission. The form can typically be submitted in person at the local tax assessor's office, mailed directly to the appropriate office, or, in some cases, submitted electronically if the municipality allows for online filing. Homeowners should confirm the preferred submission method with their local tax authority to ensure compliance with all regulations.

Legal Use of the Claim For Homeowners Property Tax Exemption Connecticut Form

The legal use of the Claim For Homeowners Property Tax Exemption Connecticut Form is governed by state laws and regulations. To ensure that the form is legally binding, it must be completed accurately and submitted within the designated deadlines. Additionally, homeowners should retain copies of the submitted form and any supporting documents for their records. Understanding the legal implications of the form can help prevent issues related to tax assessments and eligibility disputes.

Quick guide on how to complete claim for homeowners property tax exemption connecticut form

Complete Claim For Homeowners Property Tax Exemption Connecticut Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly option to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Claim For Homeowners Property Tax Exemption Connecticut Form on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Claim For Homeowners Property Tax Exemption Connecticut Form effortlessly

- Locate Claim For Homeowners Property Tax Exemption Connecticut Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device. Edit and eSign Claim For Homeowners Property Tax Exemption Connecticut Form and ensure smooth communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct claim for homeowners property tax exemption connecticut form

Create this form in 5 minutes!

How to create an eSignature for the claim for homeowners property tax exemption connecticut form

The best way to create an electronic signature for a PDF online

The best way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What is the ct state property tax exempt form fillable?

The ct state property tax exempt form fillable is a digital version of the tax exemption form used in Connecticut. It allows property owners to apply for tax exemptions easily and efficiently. With a fillable format, users can enter their information directly into the form and submit it online.

-

How can I access the ct state property tax exempt form fillable?

You can access the ct state property tax exempt form fillable through the airSlate SignNow application. Simply visit our website, create an account, and navigate to the forms section to find and fill out your form. Our platform makes it accessible and easy to manage.

-

Is there a cost associated with using the ct state property tax exempt form fillable?

Using the ct state property tax exempt form fillable through airSlate SignNow is part of our cost-effective service. We offer several pricing plans to fit the needs of various users, including individual and business packages. Review our pricing options on our website for more details.

-

What are the benefits of using the ct state property tax exempt form fillable?

The ct state property tax exempt form fillable simplifies the process of applying for property tax exemptions. It saves you time by allowing for easy data entry and quick submissions. Additionally, it helps ensure accuracy and compliance with state regulations.

-

Can I save and edit the ct state property tax exempt form fillable later?

Yes, the airSlate SignNow platform allows you to save your ct state property tax exempt form fillable and edit it later. You can work on your application at your own pace and return to it whenever you need to. This flexibility makes it easier to gather the necessary information for submission.

-

Does the ct state property tax exempt form fillable integrate with other tools?

Absolutely! The ct state property tax exempt form fillable can integrate with various tools and software to streamline your workflow. With airSlate SignNow, you can connect your forms with platforms like Google Drive and Dropbox for better document management.

-

Is there customer support available for the ct state property tax exempt form fillable?

Yes, airSlate SignNow offers customer support for any issues you may encounter while using the ct state property tax exempt form fillable. Our support team is available to assist you with questions, technical issues, or guidance on completing your form.

Get more for Claim For Homeowners Property Tax Exemption Connecticut Form

Find out other Claim For Homeowners Property Tax Exemption Connecticut Form

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement