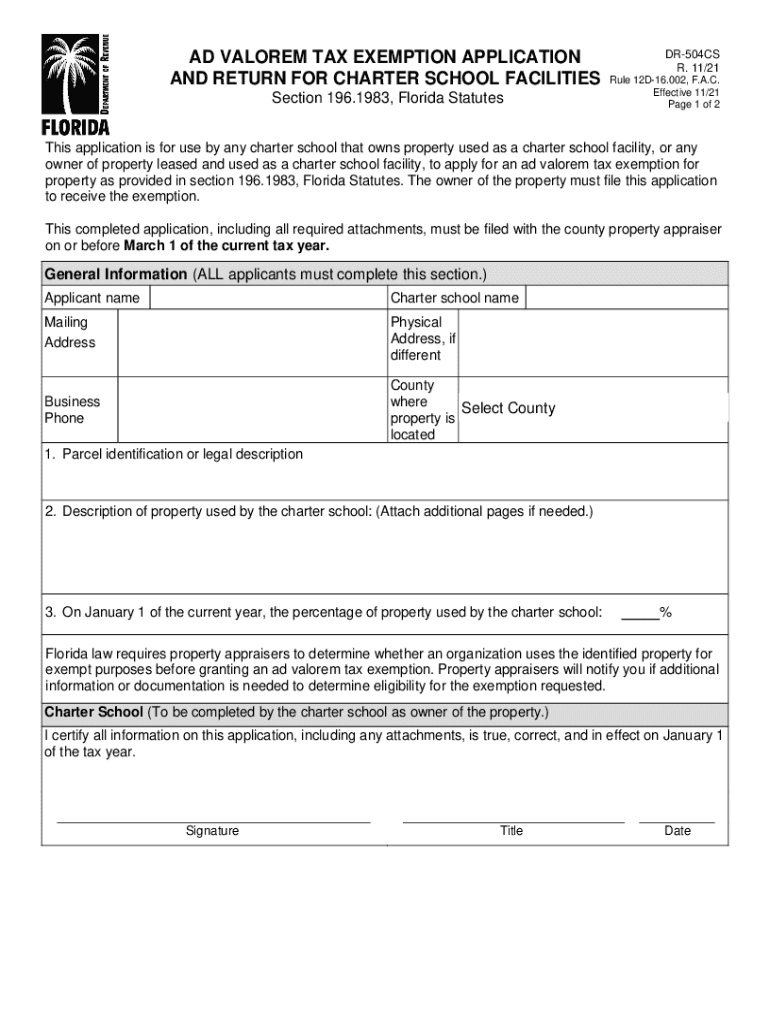

AD VALOREM TAX EXEMPTION APPLICATION, CHARTER SCHOOL FACILITY Form

What is the revenue dr 504cs tax exemption application?

The revenue dr 504cs tax exemption application is a form used in Florida to apply for an ad valorem tax exemption. This exemption is often sought by charter schools and other qualifying entities to alleviate their tax burden. By completing this form, applicants can demonstrate their eligibility for tax relief based on specific criteria set forth by the state. Understanding the purpose of this application is crucial for organizations looking to benefit from potential savings on property taxes.

Steps to complete the revenue dr 504cs tax exemption application

Completing the revenue dr 504cs tax exemption application involves several key steps:

- Gather necessary documentation, including proof of eligibility and supporting financial information.

- Fill out the application form accurately, ensuring all required fields are completed.

- Review the application for any errors or omissions to prevent delays in processing.

- Submit the application by the designated deadline, either online or via mail, as specified by local regulations.

Following these steps carefully can help streamline the application process and improve the chances of approval.

Eligibility criteria for the revenue dr 504cs tax exemption application

To qualify for the revenue dr 504cs tax exemption, applicants must meet specific eligibility criteria. Generally, this includes being a charter school or a similar educational institution that serves a public purpose. Additionally, the property for which the exemption is sought must be used exclusively for educational purposes. It is essential for applicants to review the detailed requirements outlined by the Florida Department of Revenue to ensure compliance and eligibility.

Required documents for the revenue dr 504cs tax exemption application

When applying for the revenue dr 504cs tax exemption, certain documents are typically required to support the application. These may include:

- Proof of the entity's status as a charter school or eligible organization.

- Financial statements demonstrating the use of funds for educational purposes.

- Documentation of property ownership or lease agreements.

- Any additional forms or affidavits as specified by local authorities.

Ensuring that all required documents are included can help facilitate a smoother review process.

Form submission methods for the revenue dr 504cs tax exemption application

Applicants have several options for submitting the revenue dr 504cs tax exemption application. The most common methods include:

- Online submission through the Florida Department of Revenue's designated portal.

- Mailing the completed application to the appropriate local tax authority.

- In-person submission at designated offices, if available.

Choosing the right submission method can depend on the applicant's preferences and the urgency of the application.

Key elements of the revenue dr 504cs tax exemption application

The revenue dr 504cs tax exemption application includes several key elements that must be addressed for a successful submission. These elements typically consist of:

- Identification of the applicant, including contact information and organizational details.

- A detailed description of the property for which the exemption is being requested.

- Clear justification for the exemption, outlining how the property is used for educational purposes.

- Signature of the authorized representative, affirming the accuracy of the information provided.

Attention to these elements can significantly impact the outcome of the application process.

Quick guide on how to complete ad valorem tax exemption application charter school facility

Effortlessly Prepare AD VALOREM TAX EXEMPTION APPLICATION, CHARTER SCHOOL FACILITY on Any Device

The management of documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without complications. Manage AD VALOREM TAX EXEMPTION APPLICATION, CHARTER SCHOOL FACILITY on any device using airSlate SignNow's Android or iOS applications and streamline any document-centered task today.

How to Edit and Electronically Sign AD VALOREM TAX EXEMPTION APPLICATION, CHARTER SCHOOL FACILITY with Ease

- Locate AD VALOREM TAX EXEMPTION APPLICATION, CHARTER SCHOOL FACILITY and select Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure confidential information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you'd like to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tiresome form hunting, or errors that necessitate printing new copies of documents. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign AD VALOREM TAX EXEMPTION APPLICATION, CHARTER SCHOOL FACILITY and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ad valorem tax exemption application charter school facility

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The best way to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

The best way to create an e-signature for a PDF on Android

People also ask

-

What is revenue dr 504cs?

Revenue dr 504cs is a tax form utilized by businesses to report revenue to the IRS. This form is crucial for ensuring compliance and accurate reporting of income for tax purposes. Utilizing tools like airSlate SignNow can simplify the process of submitting this documentation by enabling electronic signatures.

-

How can airSlate SignNow help with revenue dr 504cs submissions?

AirSlate SignNow facilitates the electronic signing of important documents such as revenue dr 504cs, making the submission process faster and more efficient. Its user-friendly interface allows businesses to easily prepare, send, and track documents. This solution streamlines the entire workflow, leading to quicker turnaround times.

-

What features does airSlate SignNow offer for revenue dr 504cs documentation?

AirSlate SignNow provides a range of features specifically designed for managing revenue dr 504cs documentation. These include customizable templates, secure storage, and automated reminders for signatories. Such features enhance productivity and ensure that essential documents are completed promptly.

-

Is airSlate SignNow cost-effective for handling revenue dr 504cs?

Yes, airSlate SignNow is a cost-effective solution for handling revenue dr 504cs and other essential documents. Its pricing plans are designed to accommodate various business sizes, allowing companies to select an option that fits their budget. This affordability, combined with its robust features, makes it a valuable investment for businesses.

-

Can I integrate airSlate SignNow with other software for revenue dr 504cs management?

AirSlate SignNow offers seamless integrations with various software programs to enhance revenue dr 504cs management. This includes accounting software, customer relationship management tools, and document storage solutions. Such integrations allow for improved efficiency and a smoother workflow.

-

What benefits does using airSlate SignNow for revenue dr 504cs provide?

Using airSlate SignNow for revenue dr 504cs provides numerous benefits including enhanced efficiency, reduced errors, and faster processing times. Automated workflows ensure that documents move through the approval chain without unnecessary delays. This ultimately contributes to better compliance and risk management.

-

How secure is airSlate SignNow when signing revenue dr 504cs?

AirSlate SignNow prioritizes security, ensuring that all documents, including revenue dr 504cs, are securely signed and stored. The platform employs industry-standard encryption and complies with legal regulations to protect sensitive information. This enhances trust, making it a suitable option for handling critical business documents.

Get more for AD VALOREM TAX EXEMPTION APPLICATION, CHARTER SCHOOL FACILITY

Find out other AD VALOREM TAX EXEMPTION APPLICATION, CHARTER SCHOOL FACILITY

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free