AD VALOREM TAX EXEMPTION APPLICATION, PROPRIETARY CONTINUING CARE FACILITY Form

Understanding the ad valorem tax exemption application for proprietary continuing care facilities

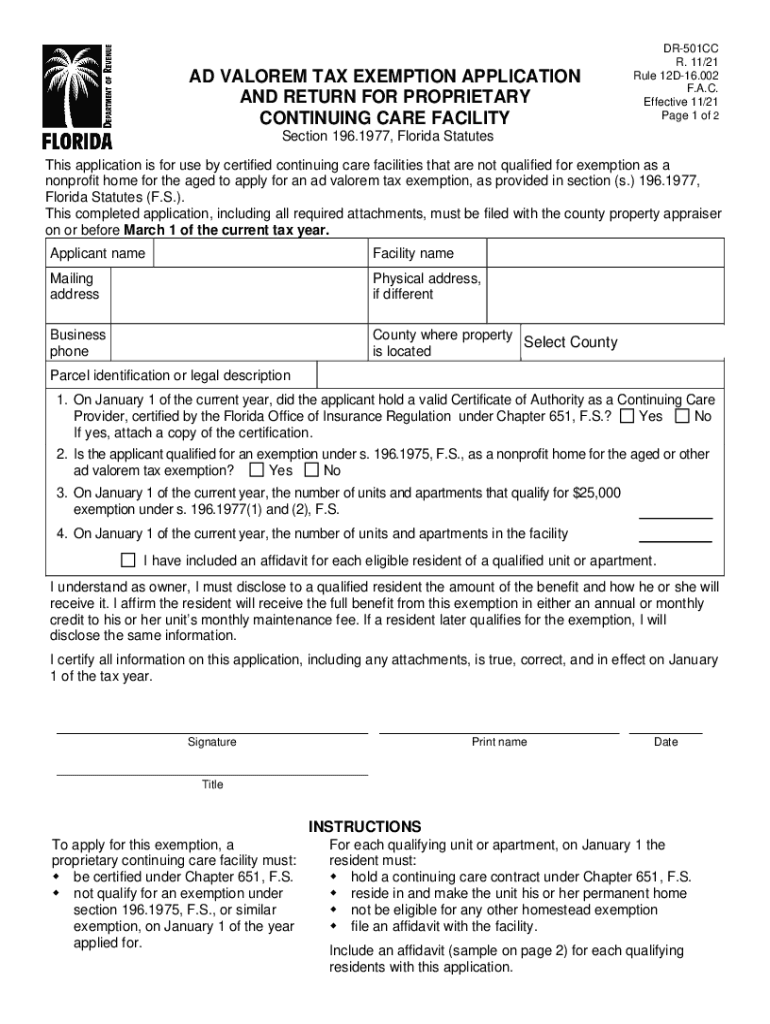

The ad valorem tax exemption application for proprietary continuing care facilities is a crucial document that allows qualifying facilities to seek relief from property taxes. This exemption is typically available to facilities that provide necessary services to elderly residents, ensuring they can maintain their quality of life. The application process involves demonstrating that the facility meets specific criteria set by state laws, which can vary significantly across different jurisdictions.

Steps to complete the ad valorem tax exemption application

Completing the ad valorem tax exemption application involves several key steps:

- Gather necessary documentation, including proof of the facility's services and financial statements.

- Fill out the application form accurately, ensuring all required fields are completed.

- Provide supporting evidence that illustrates how the facility meets the eligibility criteria for the exemption.

- Review the application for accuracy and completeness before submission.

- Submit the application through the designated method, whether online, by mail, or in person.

Eligibility criteria for the ad valorem tax exemption application

To qualify for the ad valorem tax exemption, proprietary continuing care facilities must meet specific eligibility criteria. These often include:

- Providing a continuum of care that includes independent living, assisted living, and skilled nursing services.

- Demonstrating that the facility serves a significant number of low-income residents.

- Complying with state regulations governing the operation of continuing care facilities.

Required documents for the ad valorem tax exemption application

When applying for the ad valorem tax exemption, certain documents are typically required to support the application. These may include:

- Financial statements that reflect the facility's operational costs and revenues.

- Proof of services provided to residents, such as contracts or service agreements.

- Tax identification numbers and other relevant business information.

Form submission methods for the ad valorem tax exemption application

The ad valorem tax exemption application can usually be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission via the state’s tax department website.

- Mailing the completed application to the appropriate tax authority.

- In-person submission at designated government offices.

Legal use of the ad valorem tax exemption application

Using the ad valorem tax exemption application legally requires adherence to state laws and regulations. Facilities must ensure that they are compliant with all legal requirements to avoid penalties or denial of the exemption. This includes maintaining accurate records and providing truthful information throughout the application process.

Quick guide on how to complete ad valorem tax exemption application proprietary continuing care facility

Complete AD VALOREM TAX EXEMPTION APPLICATION, PROPRIETARY CONTINUING CARE FACILITY seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed paperwork, as you can locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without interruptions. Manage AD VALOREM TAX EXEMPTION APPLICATION, PROPRIETARY CONTINUING CARE FACILITY on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to adjust and eSign AD VALOREM TAX EXEMPTION APPLICATION, PROPRIETARY CONTINUING CARE FACILITY effortlessly

- Obtain AD VALOREM TAX EXEMPTION APPLICATION, PROPRIETARY CONTINUING CARE FACILITY and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Adjust and eSign AD VALOREM TAX EXEMPTION APPLICATION, PROPRIETARY CONTINUING CARE FACILITY and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ad valorem tax exemption application proprietary continuing care facility

How to create an e-signature for your PDF online

How to create an e-signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an e-signature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The best way to generate an e-signature for a PDF on Android

People also ask

-

What is ad valorem taxation?

Ad valorem taxation refers to a tax based on the value of an item, such as real estate or personal property. In the context of airSlate SignNow, understanding ad valorem taxation can help businesses navigate compliance and reporting when eSigning documents related to property transactions. With our solution, you can easily manage such documents while ensuring accuracy and efficiency.

-

How can airSlate SignNow help with ad valorem taxation processes?

airSlate SignNow simplifies the management of documents associated with ad valorem taxation. Our platform allows businesses to eSign required forms quickly and securely, ensuring that all necessary documentation is completed on time. This helps streamline the taxation process, saving you both time and effort.

-

Are there any features in airSlate SignNow specifically for ad valorem taxation?

Yes, airSlate SignNow offers features designed to assist with ad valorem taxation, such as customizable templates and document storage. These features help organizations maintain compliance by organizing and securely storing relevant tax documents. Additionally, with our easy-to-use interface, you can eSign and send these documents without hassle.

-

What pricing plans does airSlate SignNow offer for handling ad valorem taxation?

airSlate SignNow provides flexible pricing plans that cater to businesses of all sizes, making it an affordable option for managing ad valorem taxation documents. You can choose a plan that fits your budget while still accessing essential features for efficient document handling. Our pricing is transparent and designed to meet diverse organizational needs.

-

Is airSlate SignNow easy to integrate with existing systems for ad valorem taxation?

Absolutely! airSlate SignNow integrates seamlessly with various software systems commonly used in handling ad valorem taxation. This ensures that you can enhance your existing workflows without disruption, making it easy to incorporate eSigning into your current processes for better efficiency and compliance.

-

Can I track the status of documents related to ad valorem taxation in airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of all documents related to ad valorem taxation in real time. You will receive notifications when documents are viewed, signed, or completed, ensuring you stay informed about critical processes. This feature helps you manage deadlines and improves overall compliance.

-

What benefits does airSlate SignNow offer for businesses dealing with ad valorem taxation?

By using airSlate SignNow, businesses can benefit from increased efficiency, reduced paperwork, and improved compliance when handling ad valorem taxation processes. Our platform allows for quick eSigning and secure document management, which saves time and reduces errors. Ultimately, this enables companies to focus on their core business activities.

Get more for AD VALOREM TAX EXEMPTION APPLICATION, PROPRIETARY CONTINUING CARE FACILITY

- Kansas commercial rental lease application questionnaire form

- Kansas residential rental lease agreement form

- Kansas revocation of living trust form

- Lead paint disclosure 481379614 form

- Kansas satisfaction release or cancellation of mortgage by corporation form

- Partial release mortgage template form

- Kentucky agreement form

- Bylaws 481379626 form

Find out other AD VALOREM TAX EXEMPTION APPLICATION, PROPRIETARY CONTINUING CARE FACILITY

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement