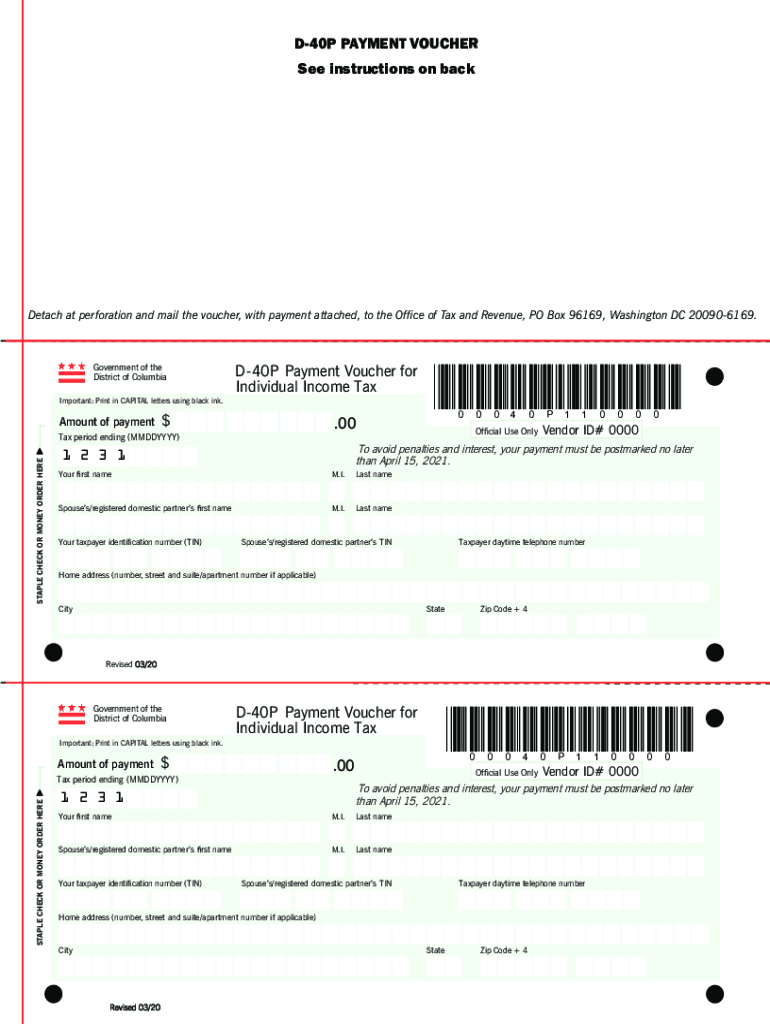

District of Columbia D 40P Income Tax Payment Voucher Form

What is the District Of Columbia D 40P Income Tax Payment Voucher

The District of Columbia D 40P income tax payment voucher is a form used by residents to submit their estimated tax payments to the District of Columbia's Office of Tax and Revenue. This voucher is essential for individuals who expect to owe tax at the end of the year and want to avoid penalties by making timely payments. It is specifically designed for taxpayers who are self-employed, have income not subject to withholding, or anticipate a tax liability that exceeds a certain threshold.

How to use the District Of Columbia D 40P Income Tax Payment Voucher

Using the D 40P payment voucher involves several straightforward steps. First, taxpayers need to accurately estimate their tax liability for the year. The voucher requires specific details, including the taxpayer's name, address, and Social Security number. Once completed, the voucher should be submitted along with the payment to the appropriate tax authority. It is important to keep a copy of the voucher for personal records and to ensure that the payment is processed correctly.

Steps to complete the District Of Columbia D 40P Income Tax Payment Voucher

Completing the D 40P payment voucher involves the following steps:

- Gather necessary information, including your income details and previous tax returns.

- Estimate your tax liability for the current year.

- Fill out the D 40P voucher with your personal information and estimated payment amount.

- Review the form for accuracy to avoid any delays or issues.

- Submit the voucher along with your payment, either online or by mail.

Legal use of the District Of Columbia D 40P Income Tax Payment Voucher

The D 40P payment voucher is legally recognized as a valid method for making estimated tax payments in the District of Columbia. To ensure its legal standing, taxpayers must comply with the relevant tax laws and regulations. This includes submitting the voucher by the specified deadlines and maintaining accurate records of all payments made. Failure to adhere to these requirements may result in penalties or interest charges.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the D 40P payment voucher. Typically, estimated tax payments are due quarterly, with specific dates set by the District of Columbia's Office of Tax and Revenue. Missing these deadlines can lead to penalties and interest on unpaid taxes. Taxpayers should mark their calendars for these important dates to ensure compliance and avoid additional costs.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the D 40P payment voucher. They can choose to submit the form online through the District of Columbia's tax portal, which offers a convenient and efficient way to make payments. Alternatively, taxpayers may opt to mail the completed voucher along with their payment to the designated tax office. In-person submissions are also accepted at local tax offices, providing flexibility for those who prefer direct interaction.

Quick guide on how to complete district of columbia d 40p income tax payment voucher

Complete District Of Columbia D 40P Income Tax Payment Voucher effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly and without delays. Manage District Of Columbia D 40P Income Tax Payment Voucher on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign District Of Columbia D 40P Income Tax Payment Voucher with ease

- Obtain District Of Columbia D 40P Income Tax Payment Voucher and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign District Of Columbia D 40P Income Tax Payment Voucher while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the district of columbia d 40p income tax payment voucher

The best way to generate an e-signature for your PDF in the online mode

The best way to generate an e-signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to create an e-signature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

How to create an e-signature for a PDF document on Android OS

People also ask

-

What is a d 40p payment voucher?

A d 40p payment voucher is a financial document used to authorize payments while ensuring compliance with accounting practices. It simplifies transaction processes by providing a clear reference for both the payer and the recipient. With airSlate SignNow, you can seamlessly create and manage your d 40p payment vouchers online.

-

How can airSlate SignNow help with d 40p payment vouchers?

airSlate SignNow allows businesses to create, send, and eSign d 40p payment vouchers efficiently. This digital solution enhances workflow by eliminating paperwork and reducing the time spent on transactions. Users can also track the status of their payment vouchers in real-time, ensuring nothing is lost in the process.

-

Are there any costs associated with using d 40p payment vouchers on airSlate SignNow?

Using the d 40p payment voucher feature on airSlate SignNow comes with a cost-effective pricing model. Subscription plans are available that cater to different business needs, from startups to large enterprises. These plans offer access to extensive features that streamline the management of d 40p payment vouchers and other documents.

-

What features does airSlate SignNow offer for managing d 40p payment vouchers?

airSlate SignNow provides essential features for managing d 40p payment vouchers, including customizable templates, eSignature capabilities, and document automation. Additionally, users benefit from user-friendly dashboards that facilitate easy tracking and organization of their payment vouchers. These tools greatly enhance productivity and accuracy.

-

Can d 40p payment vouchers be integrated with other software?

Yes, airSlate SignNow supports integrations with many popular software applications, allowing you to incorporate d 40p payment vouchers into your existing workflows. This connectivity enables smoother operations, as it allows for seamless data transfer between systems. Integrating your tools can help streamline the overall payment process.

-

What are the benefits of using airSlate SignNow for d 40p payment vouchers?

Using airSlate SignNow for d 40p payment vouchers offers several benefits, such as time savings, enhanced security, and improved compliance with financial regulations. The platform's intuitive interface makes it easy to create and manage payment vouchers, while eSignatures ensure that transactions are legally binding. This efficiency translates into signNow cost savings for businesses.

-

Is support available for users of d 40p payment vouchers on airSlate SignNow?

Absolutely, airSlate SignNow provides excellent customer support for all users, including those handling d 40p payment vouchers. Users can access educational resources, including tutorials and FAQs, and signNow out for assistance via chat or email. This support ensures that you can effectively utilize the platform for your payment voucher needs.

Get more for District Of Columbia D 40P Income Tax Payment Voucher

- Bill of sale for automobile or vehicle including odometer statement and promissory note alabama form

- Promissory note in connection with sale of vehicle or automobile alabama form

- Bill of sale for watercraft or boat alabama form

- Bill of sale of automobile and odometer statement for as is sale alabama form

- Cost plus construction contract template form

- Painting contract for contractor alabama form

- Trim carpenter contract for contractor alabama form

- Fencing contract 497295298 form

Find out other District Of Columbia D 40P Income Tax Payment Voucher

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter