Application for Residence Homestead Exemption Brazoria Form

What is the Application for Residence Homestead Exemption Brazoria?

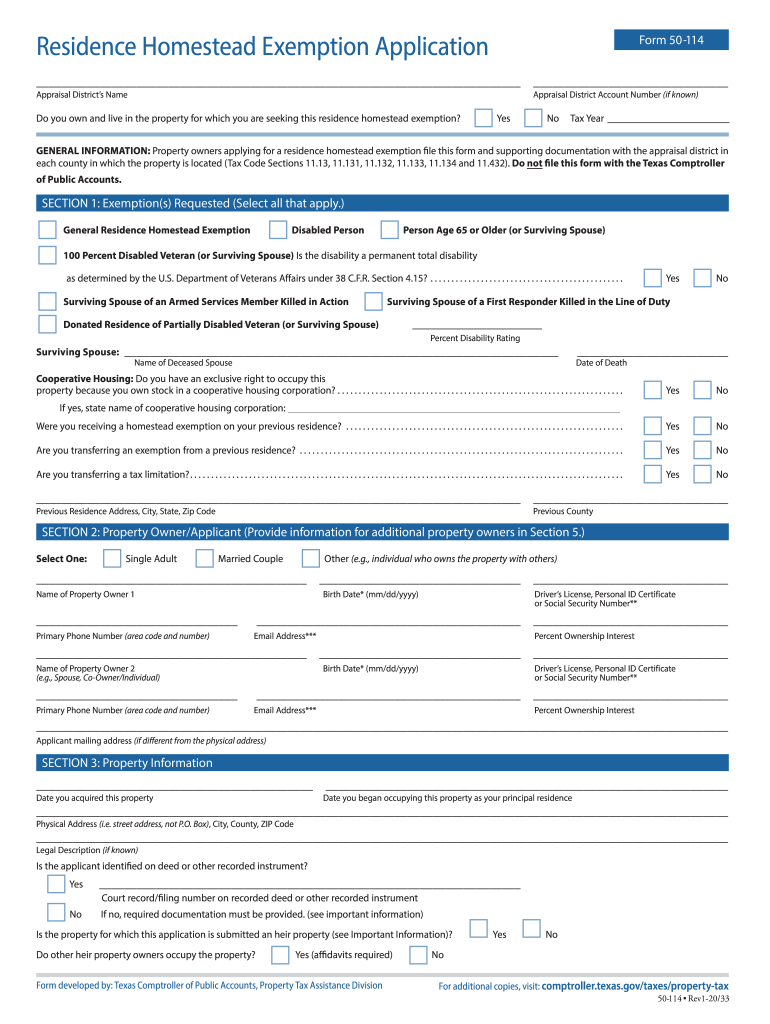

The Application for Residence Homestead Exemption in Brazoria County is a crucial document for homeowners seeking to reduce their property tax burden. This exemption is designed for individuals who occupy their home as their primary residence. By filing this application, homeowners can qualify for a reduction in the assessed value of their property, which directly impacts the amount of property tax owed. The exemption can provide significant financial relief, making homeownership more affordable.

Eligibility Criteria for the Brazoria County Homestead Exemption

To qualify for the Brazoria County homestead exemption, applicants must meet specific criteria. Generally, the homeowner must:

- Own the property and occupy it as their principal residence.

- Be a resident of Texas.

- Not claim a homestead exemption on any other property.

Additional requirements may apply, such as age restrictions or disability status, which can further influence the type of exemption available.

Steps to Complete the Application for Residence Homestead Exemption Brazoria

Completing the Application for Residence Homestead Exemption involves several steps:

- Obtain the application form, typically available online or at the local appraisal district office.

- Fill out the necessary information, including property details and ownership status.

- Gather required documentation, such as proof of residency and identification.

- Submit the completed application by the specified deadline, either online, by mail, or in person.

It is essential to ensure all information is accurate and complete to avoid delays in processing.

How to Obtain the Application for Residence Homestead Exemption Brazoria

The application form can be easily obtained through various channels. Homeowners can visit the Brazoria County Appraisal District's official website to download the form. Alternatively, physical copies of the application are available at the appraisal district office. For convenience, many residents choose to fill out the form digitally, which can streamline the submission process.

Form Submission Methods for the Brazoria County Homestead Exemption

Homeowners have several options for submitting the Application for Residence Homestead Exemption. The methods include:

- Online Submission: Many appraisal districts offer an online portal for easy submission.

- Mail: Completed forms can be mailed to the appropriate appraisal district office.

- In-Person: Homeowners can also submit their applications directly at the appraisal district office.

Choosing the right submission method can enhance the efficiency of the application process.

Key Elements of the Application for Residence Homestead Exemption Brazoria

The application form contains essential elements that need to be completed accurately. Key sections typically include:

- Property identification, including the address and legal description.

- Owner information, such as name, contact details, and social security number.

- Verification of residency status and any applicable exemptions.

Ensuring that all sections are filled out correctly is vital for successful approval.

Quick guide on how to complete application for residence homestead exemption brazoria

Complete Application For Residence Homestead Exemption Brazoria with ease on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage Application For Residence Homestead Exemption Brazoria on any device with airSlate SignNow Android or iOS applications and improve any document-driven process today.

How to modify and electronically sign Application For Residence Homestead Exemption Brazoria effortlessly

- Locate Application For Residence Homestead Exemption Brazoria and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that function.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or mislaid files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Modify and eSign Application For Residence Homestead Exemption Brazoria and guarantee superb communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for residence homestead exemption brazoria

The best way to make an e-signature for your PDF in the online mode

The best way to make an e-signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the Brazoria County homestead exemption?

The Brazoria County homestead exemption is a tax benefit that allows homeowners to reduce the amount of property taxes they owe on their primary residence. By qualifying for this exemption, homeowners can exempt a portion of their home’s value from taxation, leading to signNow savings. It is crucial to understand how this exemption applies to increase savings on your property taxes.

-

Who qualifies for the Brazoria County homestead exemption?

To qualify for the Brazoria County homestead exemption, you must own and occupy the home as your principal residence on January 1st of the tax year. Additionally, you must meet certain age and income criteria, especially for the over-65 or disabled exemptions. Providing the proper documentation ensures your eligibility.

-

How do I apply for the Brazoria County homestead exemption?

Applying for the Brazoria County homestead exemption requires you to fill out an application form provided by the local appraisal district. You will need to include relevant documentation, such as proof of identity and ownership. It's essential to submit your application by the deadlines set by the county to ensure you receive the exemption.

-

What are the benefits of the Brazoria County homestead exemption?

The primary benefit of the Brazoria County homestead exemption is the reduction in property taxes, which can result in substantial annual savings. Additionally, this exemption can provide protection against creditors in the event of bankruptcy, ensuring homeownership security. It also enhances the overall equity of your home.

-

Is there a cost associated with applying for the Brazoria County homestead exemption?

There are no fees associated with applying for the Brazoria County homestead exemption. Homeowners can complete the application process at no cost, making it an accessible option for reducing tax liabilities. It’s important to adhere to the application guidelines to ensure a smooth process.

-

Can I still receive the Brazoria County homestead exemption if I rent out part of my home?

To qualify for the Brazoria County homestead exemption, you must occupy the home as your principal residence without renting out more than 10% of the total area of the house. If you are using the property primarily as a rental, you may not be eligible. It is crucial to assess your living arrangements before applying.

-

How does the Brazoria County homestead exemption affect property resale?

The Brazoria County homestead exemption does not directly impact the resale value of your property; however, it can make your home more attractive to potential buyers due to the lower tax burden. Buyers often see the homestead exemption as a financial advantage. It is advisable to disclose any applicable exemptions when listing your property for sale.

Get more for Application For Residence Homestead Exemption Brazoria

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children alabama form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure alabama form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497295646 form

- Alabama failure form

- Alabama codes form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497295655 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497295657 form

- Al letter landlord 497295659 form

Find out other Application For Residence Homestead Exemption Brazoria

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document