United States Estate and Generation IRS Tax Forms 2021

What is the United States Estate and Generation IRS Tax Forms

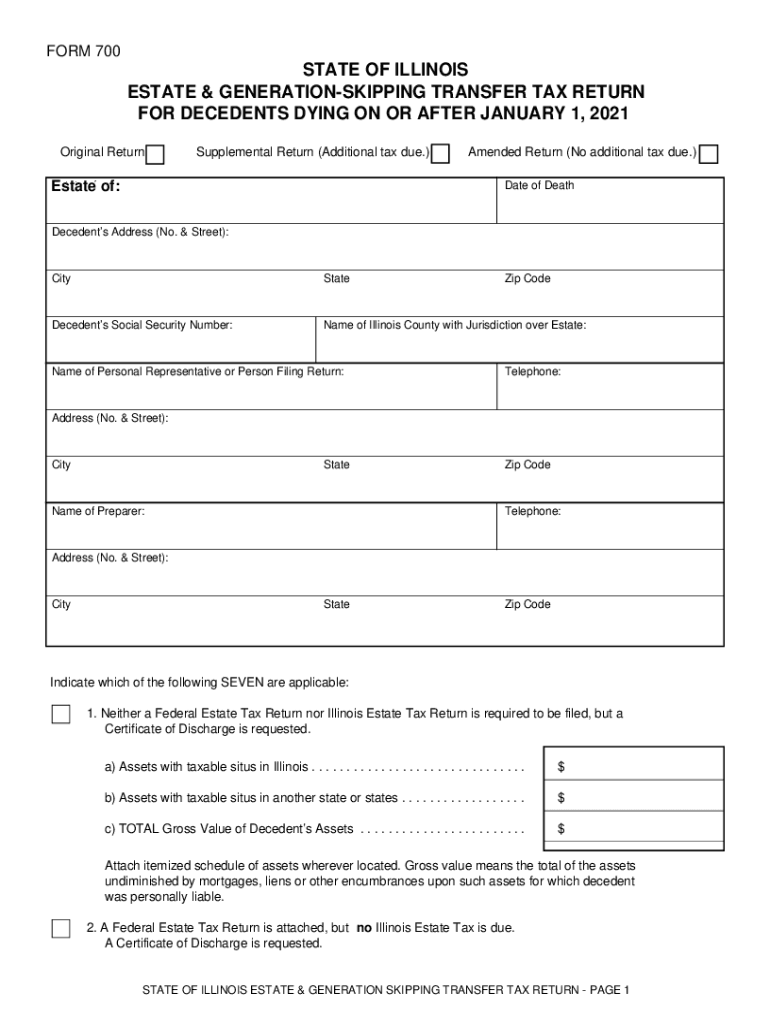

The United States Estate and Generation IRS Tax Forms are essential documents used to report the estate tax liability of a deceased individual and to calculate any generation-skipping transfer taxes. These forms are particularly relevant for estates that exceed specific value thresholds, as defined by the IRS. The primary form associated with this process is the IRS Form 706, which is used to compute the estate tax owed based on the value of the deceased's assets at the time of death. Additionally, the Illinois Form 700 may be required for state-level tax obligations, particularly for residents of Illinois.

Steps to complete the United States Estate and Generation IRS Tax Forms

Completing the United States Estate and Generation IRS Tax Forms involves several critical steps to ensure accuracy and compliance. First, gather all necessary documentation, including the deceased's financial records, property valuations, and any previous tax returns. Next, determine the gross estate value by adding all assets, such as real estate, bank accounts, and investments. After calculating the gross estate, subtract any allowable deductions, such as debts, funeral expenses, and charitable contributions, to arrive at the taxable estate amount. Finally, fill out IRS Form 706 and any applicable state forms, ensuring all information is accurate before submission.

Filing Deadlines / Important Dates

Filing deadlines for the United States Estate and Generation IRS Tax Forms are crucial to avoid penalties. Generally, Form 706 must be filed within nine months of the date of death. However, an extension may be requested using IRS Form 4768, which can provide an additional six months to file. It is important to note that any estate tax owed is also due at the time of filing. For state-specific forms, such as the Illinois Form 700, check local regulations for exact deadlines, as they may differ from federal requirements.

Legal use of the United States Estate and Generation IRS Tax Forms

The legal use of the United States Estate and Generation IRS Tax Forms is governed by federal and state tax laws. These forms must be completed accurately to ensure compliance with tax obligations. Failure to file or inaccuracies in the forms can lead to significant penalties, including interest on unpaid taxes and potential audits. Additionally, using electronic filing methods can enhance security and streamline the submission process, provided that the chosen platform complies with IRS regulations for eSignatures and document submissions.

Required Documents

To complete the United States Estate and Generation IRS Tax Forms, several documents are required. These include the decedent's death certificate, a detailed inventory of all assets, appraisals for real estate and other valuable items, and documentation of any debts or liabilities. Additionally, any previous gift tax returns may be needed to determine the total taxable gifts made during the decedent's lifetime. Collecting these documents ahead of time can facilitate a smoother filing process.

Who Issues the Form

The United States Estate and Generation IRS Tax Forms, including IRS Form 706, are issued by the Internal Revenue Service (IRS). This federal agency is responsible for tax collection and enforcement of tax laws in the United States. For state-specific forms, such as the Illinois Form 700, these are issued by the Illinois Department of Revenue. It is essential to ensure that the correct forms are obtained from the appropriate issuing authority to comply with both federal and state tax regulations.

Quick guide on how to complete united states estate and generation irs tax forms

Complete United States Estate and Generation IRS Tax Forms seamlessly on any gadget

Web-based document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the needed form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any holdups. Manage United States Estate and Generation IRS Tax Forms across any platform with airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

How to alter and electronically sign United States Estate and Generation IRS Tax Forms effortlessly

- Obtain United States Estate and Generation IRS Tax Forms and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your files or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to preserve your modifications.

- Choose how you wish to send your form, whether by email, SMS, or link invitation, or download it to your computer.

Set aside worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Alter and eSign United States Estate and Generation IRS Tax Forms and ensure outstanding communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct united states estate and generation irs tax forms

Create this form in 5 minutes!

How to create an eSignature for the united states estate and generation irs tax forms

The way to generate an electronic signature for a PDF file online

The way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to create an e-signature straight from your mobile device

The best way to make an e-signature for a PDF file on iOS

The best way to create an e-signature for a PDF document on Android devices

People also ask

-

What are tax forms 2021 and why are they important?

Tax forms 2021 are essential documents used to report income, deductions, and tax obligations to the IRS. They ensure compliance with tax laws and help individuals and businesses accurately calculate their tax liabilities. Proper handling of these forms can signNowly influence financial outcomes.

-

How can airSlate SignNow help with tax forms 2021?

airSlate SignNow simplifies the signing and sending process for tax forms 2021, making it easy to manage documents electronically. With our user-friendly interface, you can prepare and eSign your forms quickly, ensuring timely submissions and reducing paperwork hassle.

-

What features does airSlate SignNow offer for managing tax forms 2021?

Our platform includes features like customizable templates, secure eSigning, and document storage, all tailored to assist with tax forms 2021. These tools help streamline your workflow, minimize errors, and keep your tax documents organized and accessible.

-

Is airSlate SignNow a cost-effective solution for filing tax forms 2021?

Yes, airSlate SignNow provides a cost-effective solution for businesses and individuals needing to manage tax forms 2021. Our pricing plans cater to various budgets, ensuring everyone can access the essential tools they need without breaking the bank.

-

Can I integrate airSlate SignNow with my existing accounting software for tax forms 2021?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, allowing for easy management of tax forms 2021 alongside your other financial documents. This integration enhances efficiency and ensures all your data is synchronized.

-

What is the security level of airSlate SignNow for handling tax forms 2021?

Security is a top priority for airSlate SignNow. Our platform employs advanced encryption and compliance measures to protect your tax forms 2021 from unauthorized access and data bsignNowes, providing you with peace of mind while you manage sensitive information.

-

Is it easy to use airSlate SignNow for someone unfamiliar with eSigning tax forms 2021?

Yes, airSlate SignNow is designed for ease of use. Even if you are unfamiliar with eSigning, our intuitive interface and helpful resources will guide you through the process step by step, ensuring that anyone can manage their tax forms 2021 effortlessly.

Get more for United States Estate and Generation IRS Tax Forms

- Documents personnel form

- Essential legal documents for new parents alabama form

- Power of attorney for care and custody of children alabama form

- Small business accounting package alabama form

- Company employment policies and procedures package alabama form

- Alabama revocation form

- Newly divorced individuals package alabama form

- Contractors forms package alabama

Find out other United States Estate and Generation IRS Tax Forms

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation