Illinois Attorney General Estate Tax Downloadable Forms 2022-2026

What are the Illinois Attorney General Estate Tax Downloadable Forms?

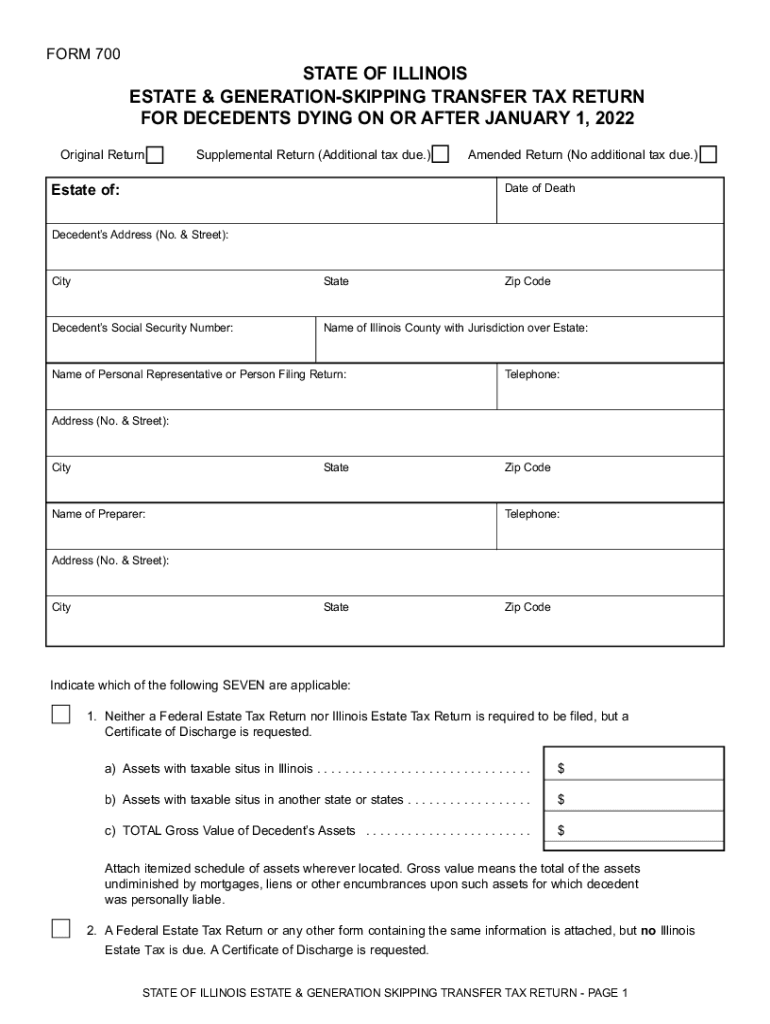

The Illinois Attorney General provides a range of downloadable forms related to estate tax matters. These forms are essential for individuals handling estate taxes in Illinois, ensuring compliance with state regulations. The forms typically include the Illinois Form 700, which is used for reporting estate tax liabilities, and other related documents necessary for the estate settlement process. Accessing these forms online allows users to print and complete them at their convenience, making the process more efficient.

Steps to complete the Illinois Attorney General Estate Tax Downloadable Forms

Completing the Illinois estate tax forms involves several key steps. First, gather all necessary information regarding the deceased's estate, including asset valuations and debts. Next, download the appropriate forms from the Illinois Attorney General's website. Carefully read the instructions provided with each form to ensure accurate completion. Fill out the forms with the required details, and double-check for any errors or omissions. Finally, submit the completed forms to the appropriate state office by the specified deadline to ensure compliance.

Filing Deadlines / Important Dates

Understanding the filing deadlines for estate tax forms in Illinois is crucial for compliance. Generally, the Illinois Form 700 must be filed within nine months of the date of death of the decedent. However, extensions may be available under certain circumstances. It is important to stay informed about any changes in deadlines or additional requirements that may arise, as these can impact the timely processing of the estate tax return.

Required Documents

When completing the Illinois estate tax forms, several documents are typically required to support the information provided. These may include the decedent's death certificate, a list of assets and liabilities, appraisals for real estate and other significant assets, and any prior tax returns that may be relevant. Gathering these documents in advance can streamline the completion process and ensure that all necessary information is included in the submission.

Legal use of the Illinois Attorney General Estate Tax Downloadable Forms

The Illinois estate tax forms are legally binding documents that must be completed accurately to comply with state laws. Proper use of these forms ensures that the estate is settled according to Illinois regulations, preventing potential legal issues or penalties. It is important to understand the legal implications of the information provided on these forms, as inaccuracies can lead to audits or disputes with the state tax authorities.

Who Issues the Form

The Illinois Form 700 and other estate tax forms are issued by the Illinois Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance with estate tax regulations. Individuals seeking guidance on completing these forms can contact the department for assistance or clarification on specific requirements.

Quick guide on how to complete illinois attorney general estate tax downloadable forms

Effortlessly Prepare Illinois Attorney General Estate Tax Downloadable Forms on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Illinois Attorney General Estate Tax Downloadable Forms on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

Easily Edit and eSign Illinois Attorney General Estate Tax Downloadable Forms

- Find Illinois Attorney General Estate Tax Downloadable Forms and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Illinois Attorney General Estate Tax Downloadable Forms and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct illinois attorney general estate tax downloadable forms

Create this form in 5 minutes!

People also ask

-

What are the key features of airSlate SignNow regarding Illinois Form 700 instructions?

airSlate SignNow offers a user-friendly interface that simplifies the process of completing Illinois Form 700 instructions. Users can easily upload, eSign, and share their documents securely, streamlining compliance and enhancing productivity for businesses.

-

How can airSlate SignNow assist me with Illinois Form 700 instructions?

By using airSlate SignNow, you can efficiently navigate and complete Illinois Form 700 instructions. The platform provides templates and step-by-step guides to ensure you understand every detail, making the process seamless and straightforward.

-

What is the pricing structure for airSlate SignNow for handling Illinois Form 700 instructions?

airSlate SignNow offers several pricing plans tailored for different business needs, including a plan suitable for handling Illinois Form 700 instructions. Each plan provides access to eSigning features and document management tools at competitive rates.

-

Is airSlate SignNow compliant with Illinois regulations for form submission?

Yes, airSlate SignNow adheres to all relevant regulations, ensuring that users comply with Illinois Form 700 instructions. Our platform guarantees that signatures are legally binding and documents are securely stored in accordance with local laws.

-

Can I integrate airSlate SignNow with other tools for managing Illinois Form 700 instructions?

Absolutely! airSlate SignNow integrates smoothly with various software tools, enhancing your workflow for Illinois Form 700 instructions. You can connect with CRMs, cloud storage, and other applications to create a streamlined document management system.

-

What benefits does airSlate SignNow offer for small businesses submitting Illinois Form 700?

AirSlate SignNow provides small businesses with cost-effective solutions to manage Illinois Form 700 instructions efficiently. Users benefit from reduced paperwork, improved turnaround times, and enhanced collaboration among team members.

-

Are there any tutorials available for using Illinois Form 700 instructions on airSlate SignNow?

Yes, airSlate SignNow offers comprehensive tutorials and resources specifically designed to guide users through Illinois Form 700 instructions. These resources ensure you are well-equipped to utilize all features of the platform effectively.

Get more for Illinois Attorney General Estate Tax Downloadable Forms

- Bill of sale for automobile or vehicle including odometer statement and promissory note nevada form

- Promissory note in connection with sale of vehicle or automobile nevada form

- Bill of sale for watercraft or boat nevada form

- Nevada as is form

- Construction contract cost plus or fixed fee nevada form

- Painting contract for contractor nevada form

- Trim carpenter contract for contractor nevada form

- Fencing contract for contractor nevada form

Find out other Illinois Attorney General Estate Tax Downloadable Forms

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe