Cube Tax Service 2020

What is the tax service letter?

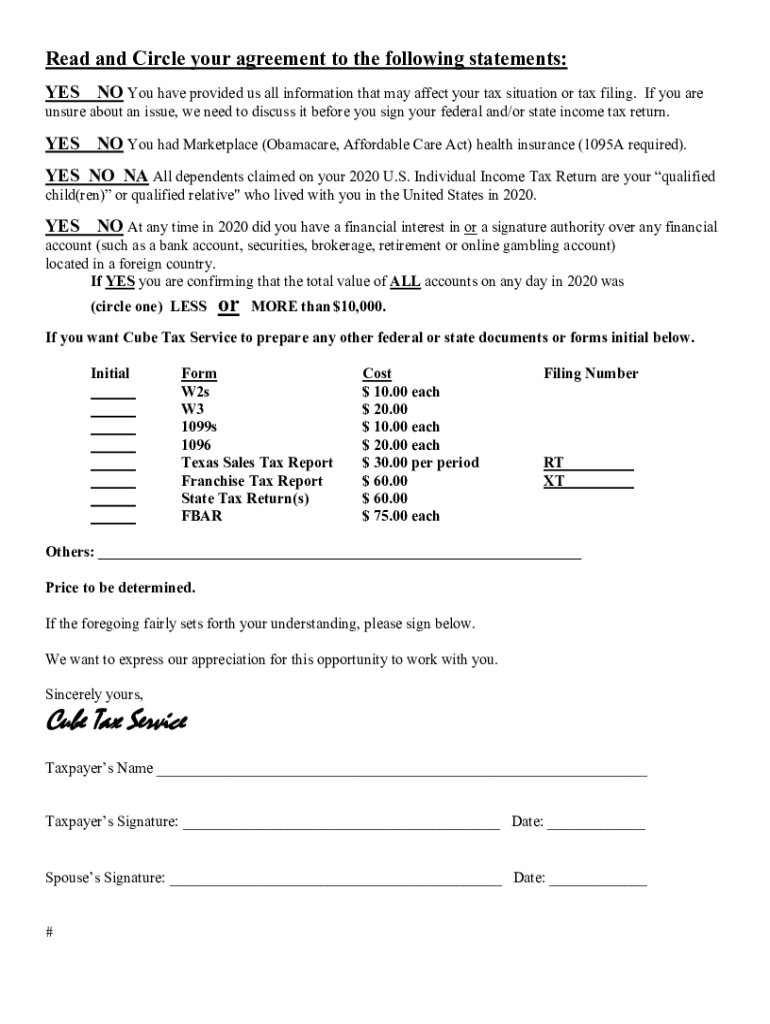

A tax service letter is a formal document used by tax professionals to outline the terms of their engagement with clients regarding tax preparation services. This letter serves as a mutual agreement that specifies the scope of work, responsibilities, and expectations between the tax preparer and the client. It often includes details such as the services provided, fees, deadlines, and confidentiality agreements. By establishing clear communication, both parties can ensure a smoother and more efficient tax preparation process.

Key elements of the tax service letter

When drafting a tax service letter, several key elements should be included to ensure clarity and legal compliance:

- Scope of services: Clearly define the specific tax services to be provided, such as preparation of federal and state tax returns, tax planning, and consulting.

- Fees and payment terms: Outline the fee structure, including any retainer fees, hourly rates, or flat fees for specific services, as well as payment due dates.

- Client responsibilities: Specify what information and documentation the client must provide to facilitate the tax preparation process.

- Confidentiality clause: Include a statement regarding the confidentiality of the client's financial information and how it will be protected.

- Termination conditions: Describe the conditions under which either party may terminate the agreement.

Steps to complete the tax service letter

Completing a tax service letter involves several important steps to ensure that both the tax professional and the client are on the same page:

- Gather necessary information: Collect all relevant details about the client, including personal information, previous tax returns, and any specific concerns they may have.

- Draft the letter: Use a clear and professional tone to outline the key elements discussed, ensuring that all terms are easy to understand.

- Review with the client: Present the draft to the client for feedback and make any necessary adjustments based on their input.

- Obtain signatures: Both parties should sign the final version of the letter to formalize the agreement.

Legal use of the tax service letter

The tax service letter is not only a professional courtesy but also serves a legal purpose. It helps protect both the tax preparer and the client by clearly defining the terms of the engagement. To ensure legal validity, the letter should comply with relevant laws and regulations, including those set forth by the IRS and state tax authorities. Additionally, maintaining a signed copy of the letter can provide legal protection in case of disputes or misunderstandings regarding the services provided.

Examples of using the tax service letter

Tax service letters can be utilized in various scenarios, including:

- Individual tax preparation: A tax preparer may issue a tax service letter to an individual client detailing the services to be provided for their personal tax return.

- Business tax consulting: A business may receive a tax service letter outlining the consulting services provided for tax planning and compliance.

- Non-profit organizations: Tax professionals may draft a tax service letter for non-profits, specifying services related to maintaining tax-exempt status and compliance with IRS regulations.

Required documents for the tax service letter

To effectively complete a tax service letter, certain documents may be required from the client, including:

- Previous tax returns: Copies of prior year returns to understand the client's tax history.

- Income statements: W-2s, 1099s, or other income documentation to accurately report earnings.

- Expense records: Receipts or statements that detail deductible expenses.

- Identification: A copy of the client's identification to verify their identity.

Quick guide on how to complete cube tax service

Complete Cube Tax Service effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Manage Cube Tax Service on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign Cube Tax Service without hassle

- Find Cube Tax Service and click on Get Form to begin.

- Use the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Cube Tax Service and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cube tax service

Create this form in 5 minutes!

How to create an eSignature for the cube tax service

The way to generate an e-signature for your PDF file online

The way to generate an e-signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

The best way to generate an e-signature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The best way to generate an e-signature for a PDF document on Android devices

People also ask

-

What is a tax service letter?

A tax service letter is a document that provides confirmation of services related to tax preparations. It outlines the terms under which your tax information is handled and ensures clarity between you and your tax service provider.

-

How can airSlate SignNow help with tax service letters?

airSlate SignNow allows you to create, send, and eSign tax service letters seamlessly. With its user-friendly platform, you can draft personalized tax service letters quickly, ensuring that you have the documentation you need for business and compliance purposes.

-

Are there any costs associated with using airSlate SignNow for tax service letters?

airSlate SignNow offers competitive pricing plans that can accommodate businesses of any size. You can choose a plan that best fits your needs, allowing you to manage your tax service letters efficiently without breaking the bank.

-

What features does airSlate SignNow provide for managing tax service letters?

With airSlate SignNow, you benefit from features like customizable templates, electronic signatures, and document tracking. These features make managing your tax service letters straightforward and efficient, saving you time and reducing the risk of errors.

-

Can I integrate airSlate SignNow with other software for tax management?

Yes, airSlate SignNow offers multiple integrations with popular accounting and tax software. This makes it simple to streamline your workflows and manage your tax service letters alongside other essential financial documents.

-

What are the benefits of using airSlate SignNow for my tax service letters?

Using airSlate SignNow for your tax service letters enhances your productivity and security. The platform allows you to send and receive documents promptly, reduces paperwork, and ensures that all signatures are legally binding for your peace of mind.

-

Is my data secure when using airSlate SignNow for tax service letters?

Absolutely! airSlate SignNow prioritizes data security by employing advanced encryption and compliance with industry standards. This ensures that your tax service letters and sensitive information are protected throughout the signing process.

Get more for Cube Tax Service

- Warning notice due to complaint from neighbors alabama form

- Lease subordination agreement alabama form

- Apartment rules and regulations alabama form

- Alabama cancellation 497295855 form

- Alabama separation form

- Amendment of residential lease alabama form

- Complaint for divorce with children alabama form

- Agreement for payment of unpaid rent alabama form

Find out other Cube Tax Service

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple