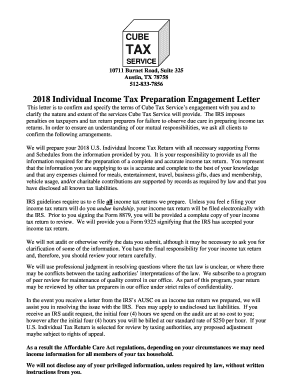

Tax Engagement Letter 2018

What is the Tax Engagement Letter

A tax engagement letter is a formal document that outlines the responsibilities and expectations between a tax preparer and their client. This letter serves as a contract that defines the scope of services, fees, and the obligations of both parties during the tax preparation process. It is essential for ensuring clarity and mutual understanding, helping to prevent disputes or misunderstandings regarding the services provided.

Key Elements of the Tax Engagement Letter

Several critical components should be included in a tax engagement letter to ensure its effectiveness:

- Scope of Services: Clearly define what services will be provided, such as tax preparation, consultation, or representation before the IRS.

- Fees and Payment Terms: Outline the fees for services, payment methods, and any additional costs that may arise.

- Responsibilities: Specify the responsibilities of both the tax preparer and the client, including the provision of necessary documents and information.

- Confidentiality: Include a statement regarding the confidentiality of the information shared between the parties.

- Signature Requirement: Indicate that both parties must sign the letter to acknowledge their agreement to the terms.

Steps to Complete the Tax Engagement Letter

Completing a tax engagement letter involves several straightforward steps:

- Gather Information: Collect all necessary information about the client and the services to be provided.

- Draft the Letter: Create a draft that includes all key elements, ensuring clarity and completeness.

- Review with the Client: Discuss the draft with the client to ensure they understand the terms and address any questions.

- Make Revisions: Adjust the letter based on feedback from the client, if necessary.

- Obtain Signatures: Have both parties sign the finalized letter to formalize the agreement.

Legal Use of the Tax Engagement Letter

The tax engagement letter is a legally binding document that protects both the tax preparer and the client. It establishes a formal relationship and clarifies the expectations, which can be crucial in case of disputes. The letter should comply with relevant laws and regulations to ensure its enforceability. It is advisable for tax preparers to keep a copy of the signed letter for their records.

IRS Guidelines

The IRS provides guidelines on the use of engagement letters in tax preparation. While not mandatory, having a well-drafted engagement letter can enhance the professional relationship between the tax preparer and the client. It can also serve as evidence of the agreed-upon terms should the IRS question the validity of the tax return or the services provided. Tax preparers are encouraged to follow best practices as outlined by the IRS to maintain compliance and professionalism.

Digital vs. Paper Version

In today’s digital age, tax engagement letters can be completed and signed electronically. This method offers several advantages, including convenience, speed, and reduced paper waste. Digital engagement letters are legally valid and can be stored securely in cloud-based systems, making them easily accessible for both tax preparers and clients. However, it is essential to ensure that the electronic signatures used comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act.

Quick guide on how to complete cube tax service 10711 burnet rd austin tx tax consultants

Your assistance manual on how to prepare your Tax Engagement Letter

If you’re curious about how to complete and submit your Tax Engagement Letter, here are some brief instructions on how to simplify tax processing.

To begin, you just need to set up your airSlate SignNow account to change how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to edit, create, and finalize your tax documents with ease. With its editor, you can alternate between text, check boxes, and eSignatures, and revert to modify responses as needed. Optimize your tax management with advanced PDF editing, eSigning, and intuitive sharing.

Follow the steps below to complete your Tax Engagement Letter in minutes:

- Establish your account and start working on PDFs within moments.

- Utilize our directory to locate any IRS tax form; explore different versions and schedules.

- Click Obtain form to access your Tax Engagement Letter in our editor.

- Complete the necessary fillable areas with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-valid eSignature (if necessary).

- Review your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper can lead to return errors and delays in refunds. Of course, before electronically filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct cube tax service 10711 burnet rd austin tx tax consultants

Create this form in 5 minutes!

How to create an eSignature for the cube tax service 10711 burnet rd austin tx tax consultants

How to make an eSignature for your Cube Tax Service 10711 Burnet Rd Austin Tx Tax Consultants online

How to make an eSignature for your Cube Tax Service 10711 Burnet Rd Austin Tx Tax Consultants in Chrome

How to create an eSignature for signing the Cube Tax Service 10711 Burnet Rd Austin Tx Tax Consultants in Gmail

How to create an eSignature for the Cube Tax Service 10711 Burnet Rd Austin Tx Tax Consultants straight from your smart phone

How to generate an eSignature for the Cube Tax Service 10711 Burnet Rd Austin Tx Tax Consultants on iOS devices

How to generate an electronic signature for the Cube Tax Service 10711 Burnet Rd Austin Tx Tax Consultants on Android devices

People also ask

-

What are tax engagement letters and why are they important?

Tax engagement letters are formal agreements between accountants and their clients outlining the services to be provided. They are essential for setting clear expectations and protecting both parties legally. Utilizing tax engagement letters ensures compliance with professional standards and helps avoid misunderstandings.

-

How can airSlate SignNow assist with creating tax engagement letters?

airSlate SignNow offers customizable templates for tax engagement letters, making the drafting process quick and efficient. You can easily personalize these templates to fit your specific needs. The platform also streamlines the eSigning process, allowing for secure and efficient document management.

-

Are there any costs associated with using airSlate SignNow for tax engagement letters?

Yes, airSlate SignNow offers various pricing plans that scale according to your business size and needs. You can choose a plan that fits your budget while still getting the features necessary for managing tax engagement letters efficiently. Additionally, the cost-effective solution helps save time and resources in document handling.

-

What features does airSlate SignNow provide for managing tax engagement letters?

airSlate SignNow provides features such as customizable templates, secure eSigning capabilities, and document tracking. These features ensure that your tax engagement letters are executed smoothly and securely. The platform also allows for easy collaboration, enabling all parties to complete and sign documents efficiently.

-

Can airSlate SignNow integrate with other accounting software for tax engagement letters?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing for a streamlined workflow. This integration means you can easily pull client information into your tax engagement letters without manual entry, saving time and reducing errors. It's designed to enhance your overall efficiency.

-

How secure are the tax engagement letters signed with airSlate SignNow?

Security is a priority at airSlate SignNow. All tax engagement letters signed through our platform are encrypted and comply with industry standards for data protection. Our robust security measures ensure that your sensitive financial information and signatures are kept safe from unauthorized access.

-

What benefits do I gain from using airSlate SignNow for tax engagement letters?

Using airSlate SignNow for tax engagement letters offers numerous benefits, including expedited document turnaround and enhanced client satisfaction. The ease of use and automation features signNowly reduce administrative burdens. This allows you and your team to focus more on providing quality service to your clients.

Get more for Tax Engagement Letter

- Hopkins modules answers form

- Phonics assessment 2nd edition teacher record doc form

- Bmw lease end inspection form pdf

- Financial disclosure statement cuyahoga county domestic domestic cuyahogacounty form

- How to prepare and present a successful business finance form

- New jersey application form

- Aus178au form

- Auto broker contract template form

Find out other Tax Engagement Letter

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online