Form ST 809 New York State and Local Sales and Use Tax Return for Part Quarterly Monthly Filers Revised 1021

Overview of the ST 809 Form for Sales and Use Tax

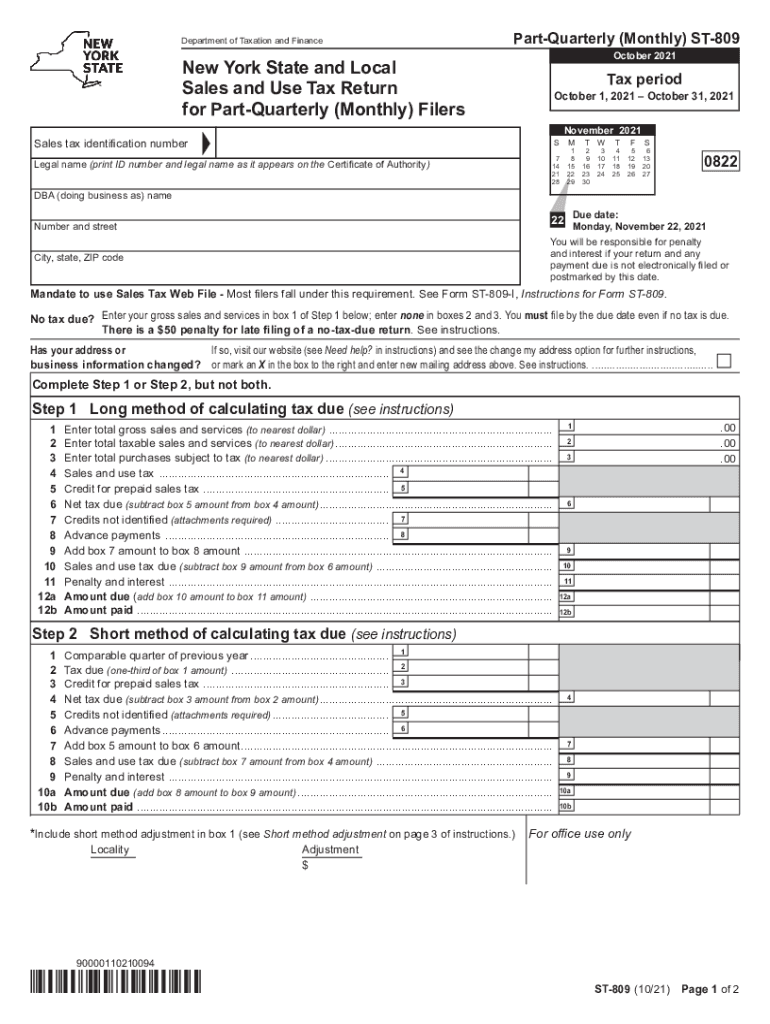

The ST 809 form is a crucial document used for reporting New York State and local sales and use tax. It is specifically designed for businesses that are required to file on a monthly or quarterly basis. This form allows taxpayers to report their taxable sales, calculate the amount of tax owed, and ensure compliance with state tax regulations. Understanding the purpose and requirements of the ST 809 is essential for maintaining accurate tax records and fulfilling legal obligations.

Steps to Complete the ST 809 Form

Completing the ST 809 form involves several key steps to ensure accuracy and compliance. Here is a straightforward approach to filling out the form:

- Gather necessary information: Collect all relevant sales records, including receipts and invoices.

- Calculate total sales: Determine the total taxable sales for the reporting period.

- Compute sales tax: Apply the appropriate sales tax rates to the taxable sales amount.

- Fill out the form: Enter the calculated figures into the designated fields on the ST 809 form.

- Review for accuracy: Double-check all entries to ensure they are correct before submission.

Legal Use of the ST 809 Form

The ST 809 form must be completed and submitted in accordance with New York State tax laws. It serves as a legal document that verifies the sales and use tax obligations of a business. Proper use of the form ensures that taxpayers meet their compliance requirements, avoiding potential penalties for inaccuracies or late submissions. It is important to adhere to the guidelines set forth by the New York State Department of Taxation and Finance when using this form.

Filing Deadlines for the ST 809 Form

Timely filing of the ST 809 form is essential to avoid penalties. The deadlines for submission vary based on the filing frequency selected by the taxpayer:

- Monthly filers: The ST 809 must be filed by the 20th day of the month following the reporting period.

- Quarterly filers: The due date is the 20th day of the month following the end of the quarter.

It is advisable to keep track of these deadlines to ensure timely compliance with state tax regulations.

Form Submission Methods

Taxpayers have several options for submitting the ST 809 form. These methods include:

- Online submission: Utilizing the New York State Department of Taxation and Finance website for electronic filing.

- Mail: Sending a completed paper form to the appropriate tax office address.

- In-person: Delivering the form directly to a local tax office if preferred.

Choosing the right submission method can streamline the filing process and ensure that the form is received on time.

Key Elements of the ST 809 Form

Understanding the key elements of the ST 809 form is vital for accurate completion. The form includes sections for:

- Taxpayer information: Basic details about the business, including name and address.

- Sales information: Total sales, taxable sales, and exemptions claimed.

- Tax calculation: The total amount of sales tax owed for the reporting period.

Each section must be filled out accurately to ensure compliance with state tax laws and to avoid issues during audits.

Quick guide on how to complete form st 809 new york state and local sales and use tax return for part quarterly monthly filers revised 1021

Complete Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1021 seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the features required to create, alter, and eSign your documents swiftly without delays. Manage Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1021 on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

The easiest way to alter and eSign Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1021 effortlessly

- Obtain Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1021 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1021 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 809 new york state and local sales and use tax return for part quarterly monthly filers revised 1021

The way to make an e-signature for your PDF file online

The way to make an e-signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is st 809 and how does it relate to airSlate SignNow?

st 809 refers to a specific document format that can be easily eSigned through airSlate SignNow. Our platform supports seamless integration of st 809 documents, allowing users to send, sign, and manage their documents efficiently.

-

What features does airSlate SignNow offer for managing st 809 documents?

airSlate SignNow provides a variety of features for managing st 809 documents, including customizable templates, secure cloud storage, and real-time collaboration. These tools simplify the signing process and enhance overall productivity.

-

How does pricing work for airSlate SignNow when using st 809?

Pricing for airSlate SignNow is flexible and accommodates businesses of all sizes. Whether you are sending st 809 documents occasionally or in bulk, our plans are designed to provide cost-effective options tailored to your needs.

-

What are the benefits of using airSlate SignNow for st 809 eSigning?

Using airSlate SignNow for st 809 eSigning streamlines your workflow, enhances document security, and reduces turnaround times. Our platform is user-friendly, allowing you to complete tasks faster while maintaining compliance with legal standards.

-

Can I integrate airSlate SignNow with other applications for st 809 management?

Yes, airSlate SignNow offers integrations with popular applications such as CRM and document management systems. This feature allows for seamless handling of st 809 documents across various platforms, boosting efficiency and collaboration.

-

Is it easy to track the status of st 809 documents in airSlate SignNow?

Absolutely! airSlate SignNow provides robust tracking features that allow you to monitor the status of your st 809 documents in real-time. You can see who has signed, who needs to sign, and set reminders to ensure timely completion.

-

What security measures does airSlate SignNow have for st 809 documents?

airSlate SignNow prioritizes document security with features such as encryption and secure cloud storage. Your st 809 documents are protected against unauthorized access, ensuring that sensitive information remains confidential.

Get more for Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1021

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497296414 form

- Ar letter tenant form

- Arkansas failure form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497296417 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497296418 form

- Arkansas landlord in form

- Letter from landlord to tenant for failure to keep all plumbing fixtures in the dwelling unit as clean as their condition 497296420 form

- Arkansas landlord tenant 497296421 form

Find out other Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1021

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed