Do Not Return This Form to the Vermont Department of Taxes 2020-2026

Understanding the Vermont WHT 436 Form

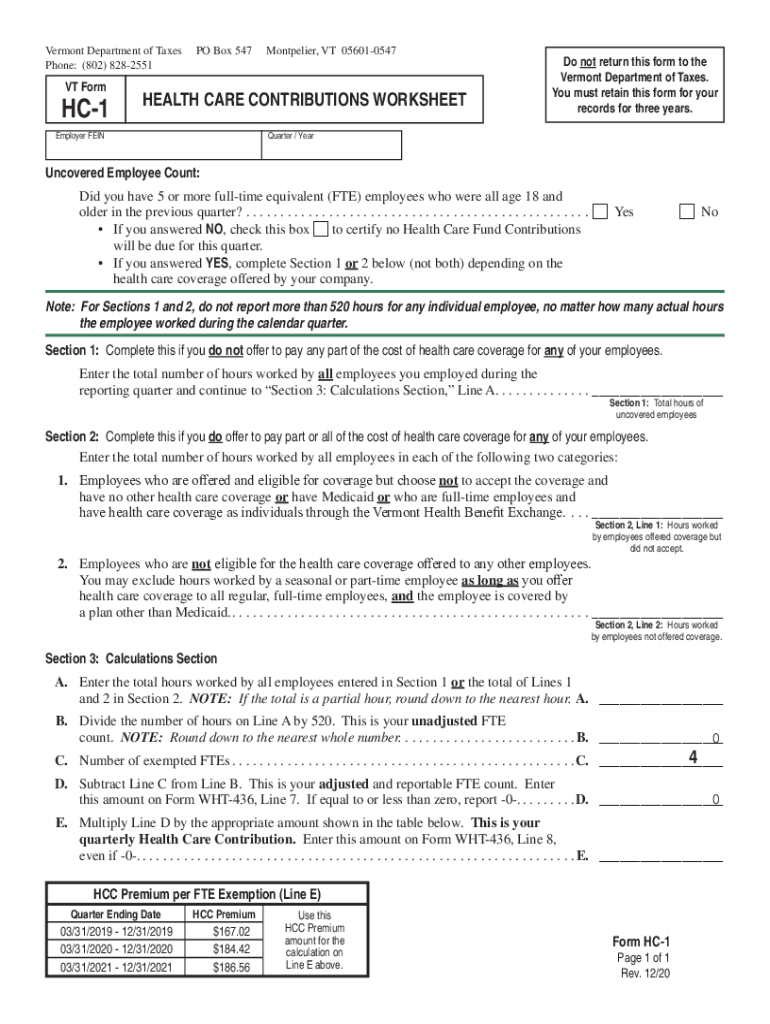

The Vermont WHT 436 form is essential for businesses and individuals to report and reconcile withholding tax obligations. This form is specifically designed for employers to report the amount of income tax withheld from employee wages. It plays a crucial role in ensuring compliance with state tax regulations and helps taxpayers accurately fulfill their tax responsibilities.

Steps to Complete the Vermont WHT 436 Form

Completing the Vermont WHT 436 form involves several key steps to ensure accuracy and compliance:

- Gather all necessary documentation, including employee wage records and previous withholding amounts.

- Fill in the employer identification information, including name, address, and tax identification number.

- Report the total amount of wages paid and the total withholding for the reporting period.

- Double-check all entries for accuracy to avoid potential penalties.

- Sign and date the form to certify its accuracy before submission.

Filing Deadlines for the Vermont WHT 436 Form

Timely filing of the Vermont WHT 436 form is crucial to avoid penalties. The form must be submitted on a quarterly basis, with specific deadlines set by the Vermont Department of Taxes. Generally, the due dates are:

- For the first quarter: April 30

- For the second quarter: July 31

- For the third quarter: October 31

- For the fourth quarter: January 31 of the following year

Legal Use of the Vermont WHT 436 Form

The Vermont WHT 436 form is legally recognized as a valid document for reporting withholding tax. It must be completed accurately to ensure compliance with state tax laws. Failure to file or inaccuracies in reporting can lead to penalties, including fines and interest on unpaid taxes. It is important for employers to understand their legal obligations regarding withholding and reporting.

Form Submission Methods for the Vermont WHT 436

Employers have several options for submitting the Vermont WHT 436 form. The form can be filed:

- Online through the Vermont Department of Taxes website, which offers a streamlined process for electronic submission.

- By mail, sending the completed form to the designated address provided by the state.

- In-person at local tax offices, if preferred.

Key Elements of the Vermont WHT 436 Form

Understanding the key elements of the Vermont WHT 436 form is essential for accurate completion. Important components include:

- Employer information: Name, address, and tax identification number.

- Wage information: Total wages paid during the reporting period.

- Withholding amounts: Total income tax withheld from employee wages.

- Certification: Signature and date to validate the information provided.

Penalties for Non-Compliance with the Vermont WHT 436 Form

Non-compliance with the filing requirements for the Vermont WHT 436 form can result in significant penalties. These may include:

- Fines for late submission or failure to file.

- Interest on unpaid taxes, which accumulates over time.

- Potential audits by the Vermont Department of Taxes.

Quick guide on how to complete do not return this form to the vermont department of taxes

Complete Do Not Return This Form To The Vermont Department Of Taxes effortlessly on any gadget

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Do Not Return This Form To The Vermont Department Of Taxes on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Do Not Return This Form To The Vermont Department Of Taxes with ease

- Find Do Not Return This Form To The Vermont Department Of Taxes and click on Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method of sending your form—via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Alter and eSign Do Not Return This Form To The Vermont Department Of Taxes while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct do not return this form to the vermont department of taxes

Create this form in 5 minutes!

How to create an eSignature for the do not return this form to the vermont department of taxes

How to create an electronic signature for your PDF document online

How to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to wht 436 2024?

airSlate SignNow is a powerful platform that empowers businesses to send and eSign documents seamlessly. The relevance of wht 436 2024 lies in its compliance features ensuring legal validity for electronic signatures, making it a trusted solution for managing documents in this evolving regulatory landscape.

-

What are the key features of airSlate SignNow regarding wht 436 2024 compliance?

Key features of airSlate SignNow include secure eSigning, advanced authentication options, and comprehensive audit trails. These capabilities help organizations meet the requirements set forth in wht 436 2024, ensuring that their electronic signatures are both secure and legally binding.

-

How can airSlate SignNow improve my business's workflow in line with wht 436 2024?

By using airSlate SignNow, businesses can streamline their document processes, signNowly reducing turnaround time. This efficiency aligns with the standards of wht 436 2024, allowing you to focus on growth instead of paperwork.

-

Is airSlate SignNow cost-effective for small businesses preparing for wht 436 2024?

Absolutely, airSlate SignNow offers various pricing plans tailored for small businesses, making it a cost-effective solution. The savings gained from increased efficiency and compliance with wht 436 2024 can signNowly bolster your bottom line.

-

What integrations does airSlate SignNow offer relevant to wht 436 2024?

airSlate SignNow integrates well with commonly used tools like CRM systems, cloud storage platforms, and productivity apps. These integrations facilitate compliance with wht 436 2024, enabling seamless document management across your existing workflows.

-

Can airSlate SignNow be used for remote teams in relation to wht 436 2024?

Yes, airSlate SignNow is designed for remote accessibility, allowing teams to eSign documents from anywhere. This flexibility is crucial for maintaining compliance with wht 436 2024, especially as businesses adopt more remote work policies.

-

What benefits does airSlate SignNow provide regarding the speed of document processing and wht 436 2024?

One of the major benefits of using airSlate SignNow is the acceleration of document processing times. Fast eSigning solutions mean you can stay ahead of deadlines while ensuring compliance with wht 436 2024, giving your business a competitive edge.

Get more for Do Not Return This Form To The Vermont Department Of Taxes

- Name change notification form arkansas

- Commercial building or space lease arkansas form

- Ar legal form

- Arkansas temporary form

- Affidavit of death of joint tenant arkansas form

- Arkansas eastern district bankruptcy guide and forms package for chapters 7 or 13 arkansas

- Arkansas western bankruptcy form

- Bill of sale with warranty by individual seller arkansas form

Find out other Do Not Return This Form To The Vermont Department Of Taxes

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now