Vermont Wht 2017

What is the Vermont WHT

The Vermont WHT, or Vermont Withholding Tax, is a tax form used by employers to report and remit state income tax withheld from employees' wages. This form is essential for ensuring compliance with Vermont state tax laws and is typically required for businesses operating within the state. Employers must accurately calculate the amount of tax to withhold based on employees' earnings and applicable tax rates.

How to use the Vermont WHT

To use the Vermont WHT, employers need to follow a structured process. First, determine the appropriate withholding amount based on the employee's earnings and filing status. Next, complete the Vermont WHT form with the necessary details, including the employer's information and the total amount withheld. Finally, submit the form along with the withheld taxes to the Vermont Department of Taxes by the specified deadlines.

Steps to complete the Vermont WHT

Completing the Vermont WHT involves several key steps:

- Gather employee information, including Social Security numbers and filing statuses.

- Calculate the withholding amount using the Vermont withholding tables or formulas provided by the state.

- Fill out the Vermont WHT form, ensuring all required fields are completed accurately.

- Review the form for any errors before submission.

- Submit the form and remit the withheld taxes to the Vermont Department of Taxes by the due date.

Legal use of the Vermont WHT

The Vermont WHT must be used in accordance with state laws and regulations. Employers are legally obligated to withhold the correct amount of taxes from employees' wages and to report this information accurately. Failure to comply with these requirements can result in penalties and interest charges. It is crucial for employers to stay informed about changes in tax rates and regulations to ensure legal compliance.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the Vermont WHT. Typically, the form is due on a quarterly basis, with deadlines falling on the last day of the month following the end of each quarter. For example, the first quarter's filing deadline is April 30. Employers should also be aware of any additional deadlines for annual reconciliation forms and payments to avoid penalties.

Required Documents

To complete the Vermont WHT, employers need to gather several documents:

- Employee payroll records, including wages and hours worked.

- Previous Vermont WHT filings for reference.

- Any relevant tax tables or guidelines provided by the Vermont Department of Taxes.

Who Issues the Form

The Vermont WHT is issued by the Vermont Department of Taxes. This state agency oversees the administration of tax laws in Vermont, including the collection of withholding taxes from employers. Employers can access the form and related instructions directly from the Department of Taxes' official website or through authorized tax software.

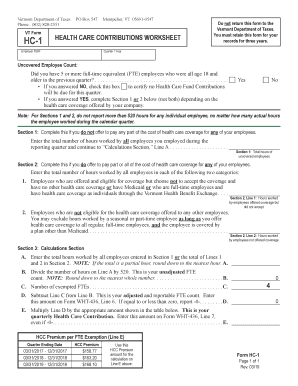

Quick guide on how to complete health care contributions worksheet

Manage Vermont Wht seamlessly on any device

Web-based document management has gained traction among enterprises and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your files promptly without interruptions. Handle Vermont Wht on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and electronically sign Vermont Wht effortlessly

- Find Vermont Wht and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize key sections of the documents or conceal sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunts, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Vermont Wht and ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct health care contributions worksheet

Create this form in 5 minutes!

How to create an eSignature for the health care contributions worksheet

How to generate an eSignature for your Health Care Contributions Worksheet online

How to create an eSignature for your Health Care Contributions Worksheet in Chrome

How to make an eSignature for signing the Health Care Contributions Worksheet in Gmail

How to make an eSignature for the Health Care Contributions Worksheet right from your mobile device

How to generate an eSignature for the Health Care Contributions Worksheet on iOS devices

How to make an eSignature for the Health Care Contributions Worksheet on Android devices

People also ask

-

What is 'vermont wht' in relation to airSlate SignNow?

The term 'vermont wht' refers to features and functionalities offered by airSlate SignNow that cater specifically to the needs of Vermont businesses. It includes tools that ensure secure eSigning and document management while abiding by Vermont regulations. Thus, you can trust airSlate SignNow to keep your documents compliant and efficient.

-

How much does airSlate SignNow cost for Vermont users?

Pricing for airSlate SignNow for Vermont users is designed to be cost-effective, with various plans tailored to different business needs. Whether you're a small business or a larger enterprise, the 'vermont wht' features ensure you only pay for what you need. For detailed pricing, you can visit the airSlate SignNow website or contact their sales team directly.

-

What are the key features of airSlate SignNow?

airSlate SignNow provides a range of features including seamless eSigning, document templates, and secure storage, all highlighted under the 'vermont wht' initiative. These features streamline the signing process, enhancing productivity for businesses in Vermont. Additionally, airSlate SignNow’s user-friendly interface ensures that anyone can easily navigate and utilize these features.

-

How does airSlate SignNow benefit Vermont businesses?

Vermont businesses benefit from airSlate SignNow by saving time and reducing costs associated with document management and eSigning. The 'vermont wht' capabilities promote efficiency and encourage digital transformation. Additionally, with secure access, companies can easily collaborate on documents without the hassle of physical paperwork.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow supports numerous integrations with popular software such as Salesforce, Google Workspace, and more. These integrations enhance the 'vermont wht' offering by allowing businesses to incorporate eSigning into their existing workflows seamlessly. This means that you can enhance productivity without overhauling your current tools.

-

Is airSlate SignNow compliant with Vermont laws?

Absolutely, airSlate SignNow is compliant with Vermont laws regarding electronic signatures, making it a trustworthy choice for Vermont businesses. The 'vermont wht' compliance guarantees that your documents will hold up legally while providing peace of mind. This compliance helps businesses meet regulatory requirements without any additional effort.

-

What types of businesses can benefit from airSlate SignNow?

airSlate SignNow is suitable for various types of businesses in Vermont, from startups to established enterprises. Its 'vermont wht' features cater to diverse industries, including healthcare, legal, and real estate, allowing organizations to adapt the solution to their specific needs. Thus, any business looking to optimize their document process can find value in airSlate SignNow.

Get more for Vermont Wht

Find out other Vermont Wht

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later