D 101a Form 1 ES Instructions Estimated Income Tax for

What is the WI 101A Form and Its Purpose?

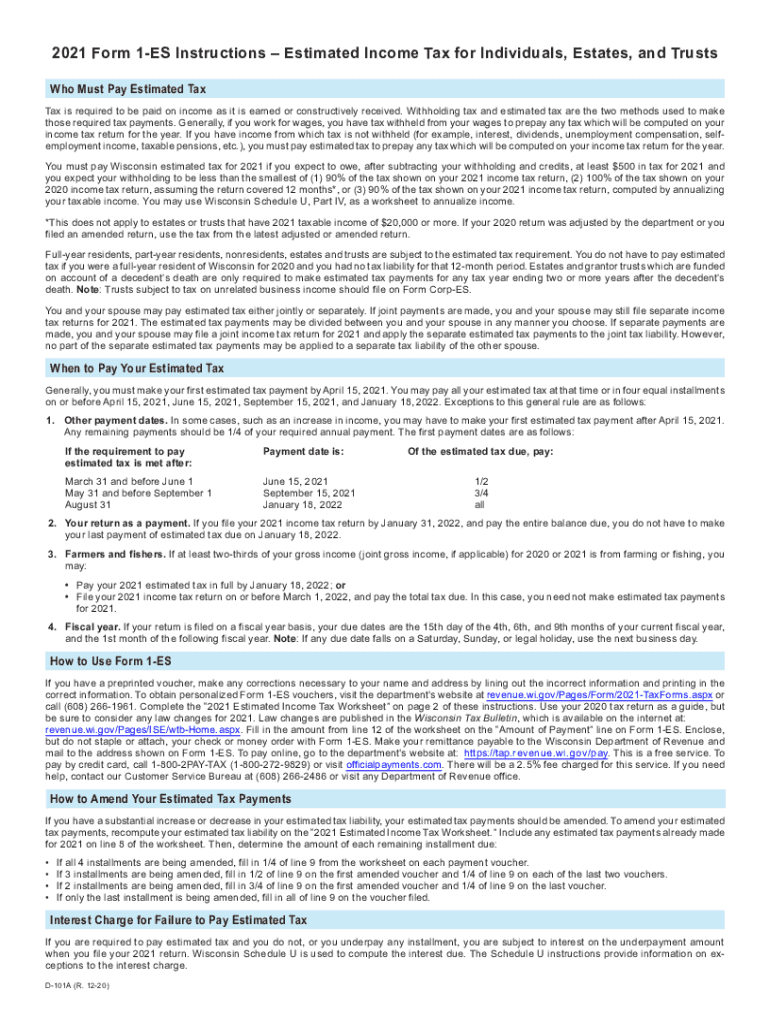

The WI 101A Form, also known as the Wisconsin Estimated Income Tax Form, is designed for individuals and businesses in Wisconsin who expect to owe tax of $500 or more when filing their annual tax return. This form allows taxpayers to estimate their income tax liability and make quarterly payments to avoid penalties. By using the WI 101A, individuals can manage their tax obligations proactively, ensuring that they meet state requirements and avoid any surprises during tax season.

How to Complete the WI 101A Form

Completing the WI 101A Form involves several steps. First, gather all necessary information regarding your expected income, deductions, and credits for the tax year. Next, follow the form's instructions to calculate your estimated tax liability based on your projected income. Be sure to include any applicable credits that may reduce your total tax. Once you have completed the calculations, enter the amounts in the designated fields on the form. Finally, review your entries for accuracy before submitting the form and making your payment.

Filing Deadlines for the WI 101A Form

Timely submission of the WI 101A Form is crucial to avoid penalties. The estimated tax payments are typically due in four installments throughout the year: April 15, June 15, September 15, and January 15 of the following year. It is important to mark these dates on your calendar and ensure that your payments are submitted on time to maintain compliance with Wisconsin tax regulations.

Legal Use of the WI 101A Form

The WI 101A Form is legally binding when completed and submitted according to state guidelines. To ensure its validity, taxpayers must provide accurate information and adhere to the specified deadlines. The form serves as an official document that outlines your estimated tax obligations, and failure to comply with its requirements can result in penalties and interest on unpaid taxes.

Examples of Using the WI 101A Form

Individuals and businesses may encounter various scenarios where the WI 101A Form is applicable. For instance, a self-employed individual expecting to earn significant income throughout the year would use this form to estimate their tax liability and make quarterly payments. Similarly, a small business anticipating profits may utilize the WI 101A to manage their tax obligations effectively. Understanding these examples can help taxpayers recognize the importance of this form in their financial planning.

Obtaining the WI 101A Form

The WI 101A Form can be easily obtained through the Wisconsin Department of Revenue's official website. Taxpayers can download a printable version of the form or complete it online, depending on their preference. It is essential to ensure that you are using the most current version of the form to comply with any updates in tax regulations.

Quick guide on how to complete 2021 d 101a form 1 es instructions estimated income tax for

Effortlessly prepare D 101a Form 1 ES Instructions Estimated Income Tax For on any device

Digital document management has become increasingly popular among businesses and individuals alike. It presents a perfect environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents rapidly without delays. Manage D 101a Form 1 ES Instructions Estimated Income Tax For on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to edit and eSign D 101a Form 1 ES Instructions Estimated Income Tax For effortlessly

- Find D 101a Form 1 ES Instructions Estimated Income Tax For and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the document or redact sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign D 101a Form 1 ES Instructions Estimated Income Tax For and ensure seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2021 d 101a form 1 es instructions estimated income tax for

The way to create an e-signature for a PDF file online

The way to create an e-signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The best way to generate an e-signature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is a wi estimated sample in the context of eSignature solutions?

A wi estimated sample refers to a sample or estimate used in the context of legal documents and eSignatures. In airSlate SignNow, understanding these samples can help businesses streamline their processes and ensure compliance with legal standards while using our eSignature solution.

-

How does airSlate SignNow use wi estimated samples for document management?

airSlate SignNow utilizes wi estimated samples to provide businesses with templates and frameworks that help them efficiently manage their documents. By applying these estimates, users can create and send documents that are tailored to their specific needs, improving workflow efficiency.

-

Can I customize the wi estimated samples provided by airSlate SignNow?

Yes, airSlate SignNow allows users to customize wi estimated samples according to their business requirements. You can modify fields, add branding elements, and adjust the layout to align with your company's standards, ensuring a personalized touch for every document.

-

What pricing options are available for using wi estimated samples with airSlate SignNow?

airSlate SignNow offers flexible pricing plans that include access to wi estimated samples along with all eSignature features. Whether you're a small business or a large enterprise, you can choose a plan that fits your budget and document needs, making it a cost-effective solution.

-

Does airSlate SignNow integrate with other applications when using wi estimated samples?

Yes, airSlate SignNow seamlessly integrates with a variety of applications when utilizing wi estimated samples. This allows users to automate workflows, synchronize data, and enhance productivity by connecting with popular tools such as Google Drive, Dropbox, and CRM systems.

-

What are the benefits of using airSlate SignNow with wi estimated samples?

Using airSlate SignNow with wi estimated samples offers several benefits, including improved accuracy, time savings, and enhanced compliance. By reducing manual errors and automating the signing process, businesses can accelerate their document turnaround times and focus on core activities.

-

Is it easy to learn how to use wi estimated samples with airSlate SignNow?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy for anyone to learn how to use wi estimated samples effectively. The platform provides intuitive navigation, helpful tutorials, and customer support to assist you in getting started and maximizing your document management experience.

Get more for D 101a Form 1 ES Instructions Estimated Income Tax For

- California cancellation form

- California proof form

- Quitclaim deed trust to two individuals california form

- Grant deed two individuals to two individuals california form

- Proof service form

- California rejection form

- Quitclaim deed three individuals to one individual california form

- Grant deed form 497298306

Find out other D 101a Form 1 ES Instructions Estimated Income Tax For

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself