LODGERS TAX REPORT Form

What is the Lodgers Tax Report?

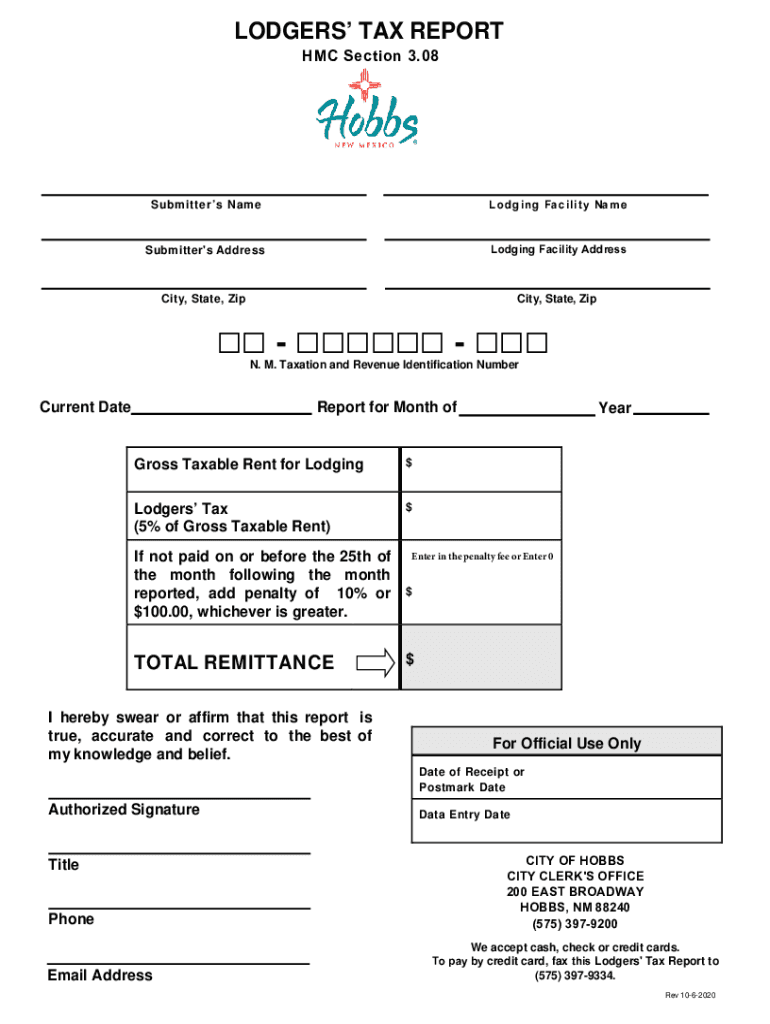

The Lodgers Tax Report is a specific form used to report and remit lodging taxes collected from guests staying at accommodations in Hobbs, New Mexico. This tax is applicable to various types of lodging facilities, including hotels, motels, and short-term rentals. The report outlines the total amount of lodging tax collected during a specified period and ensures compliance with local tax regulations. Understanding this form is crucial for property owners and managers to fulfill their tax obligations and avoid penalties.

Key Elements of the Lodgers Tax Report

The Lodgers Tax Report includes several essential components that must be accurately completed. Key elements typically consist of:

- Property Information: Name and address of the lodging facility.

- Reporting Period: The specific dates for which the tax is being reported.

- Total Revenue: The total income generated from lodging during the reporting period.

- Tax Calculation: The total amount of lodging tax collected, calculated based on the applicable tax rate.

- Signature: An authorized signature to validate the report.

Completing these elements accurately is vital to ensure the report is accepted by local tax authorities.

Steps to Complete the Lodgers Tax Report

Completing the Lodgers Tax Report involves several straightforward steps:

- Gather Required Information: Collect all necessary data regarding revenue and taxes collected.

- Fill Out the Form: Enter the required information into the Lodgers Tax Report, ensuring accuracy.

- Calculate Taxes: Apply the current tax rate to determine the total tax amount due.

- Review the Report: Double-check all entries for accuracy and completeness.

- Submit the Report: File the completed report with the appropriate tax authority, either online or via mail.

Following these steps helps ensure compliance with local regulations and avoids potential penalties.

Legal Use of the Lodgers Tax Report

The Lodgers Tax Report serves as a legally binding document when completed and submitted correctly. It is essential for property owners to understand the legal implications of this report, as it must adhere to local tax ordinances, such as the NM Tax Ordinance 854. Failure to comply with these regulations can result in fines or other legal consequences. Therefore, ensuring that the report is filed accurately and on time is crucial for maintaining compliance.

Form Submission Methods

There are several methods available for submitting the Lodgers Tax Report, catering to different preferences and needs:

- Online Submission: Many jurisdictions allow for electronic filing through their official websites, providing a quick and efficient way to submit the report.

- Mail Submission: Property owners can also choose to print the completed report and send it via postal mail to the designated tax authority.

- In-Person Submission: Some may prefer to deliver the report in person at local tax offices, allowing for immediate confirmation of receipt.

Choosing the right method can help streamline the filing process and ensure that the report is received on time.

Filing Deadlines / Important Dates

Filing deadlines for the Lodgers Tax Report are crucial to avoid penalties. Typically, the report must be submitted monthly or quarterly, depending on local regulations. Property owners should be aware of the specific due dates for their jurisdiction to ensure timely compliance. Keeping a calendar with important dates can help manage these deadlines effectively.

Quick guide on how to complete lodgers tax report

Complete LODGERS TAX REPORT effortlessly on any device

Digital document management has become widespread among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage LODGERS TAX REPORT across any platform with airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The simplest way to modify and eSign LODGERS TAX REPORT with ease

- Find LODGERS TAX REPORT and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you'd like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign LODGERS TAX REPORT and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lodgers tax report

The way to generate an e-signature for a PDF online

The way to generate an e-signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The way to generate an e-signature right from your smartphone

The way to create an e-signature for a PDF on iOS

The way to generate an e-signature for a PDF on Android

People also ask

-

What is the current form for lodgers tax in Hobbs, NM?

The current form for lodgers tax in Hobbs, NM, is a legally required document that allows businesses providing lodging to report and pay their taxes accurately. It is essential to use the latest version to ensure compliance with local regulations. The form can typically be obtained from the local government's website or office.

-

How does airSlate SignNow facilitate the completion of the current form for lodgers tax in Hobbs, NM?

airSlate SignNow offers an easy-to-use platform where users can fill out and eSign the current form for lodgers tax in Hobbs, NM. With its intuitive interface, you can seamlessly input necessary details and submit the form electronically, saving time and ensuring accuracy. This eliminates the hassle of paperwork and provides a streamlined approach to tax submissions.

-

Are there any costs associated with using airSlate SignNow for the current form for lodgers tax in Hobbs, NM?

Yes, while airSlate SignNow offers a cost-effective solution for managing document eSigning, there may be subscription fees depending on the features you select. However, many find that the investment is worthwhile due to the time and resources saved, especially when dealing with crucial documents like the current form for lodgers tax in Hobbs, NM.

-

Can I integrate airSlate SignNow with other software for the current form for lodgers tax in Hobbs, NM?

Absolutely! airSlate SignNow integrates with various software applications to enhance your workflow. Whether you’re using accounting software or property management tools, these integrations allow for seamless handling of the current form for lodgers tax in Hobbs, NM, ensuring all necessary data is easily accessible.

-

Is eSigning the current form for lodgers tax in Hobbs, NM, legally recognized?

Yes, eSigning the current form for lodgers tax in Hobbs, NM, is legally recognized and compliant with federal and state laws. airSlate SignNow ensures that all electronic signatures meet the legal standards, providing you with the confidence to submit your tax forms securely and without issues.

-

What features does airSlate SignNow offer for managing the current form for lodgers tax in Hobbs, NM?

airSlate SignNow offers various features tailored for managing documents, including customizable templates, automated workflows, and real-time status tracking. These features make it easier to handle the current form for lodgers tax in Hobbs, NM, ensuring that submissions are completed efficiently and on time.

-

How can I assure my current form for lodgers tax in Hobbs, NM, is filled out correctly?

To ensure your current form for lodgers tax in Hobbs, NM, is filled out correctly, you can use airSlate SignNow's guided templates and instructions. This platform helps in minimizing errors through built-in validation checks, ensuring that all required fields are properly filled before submission.

Get more for LODGERS TAX REPORT

Find out other LODGERS TAX REPORT

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe