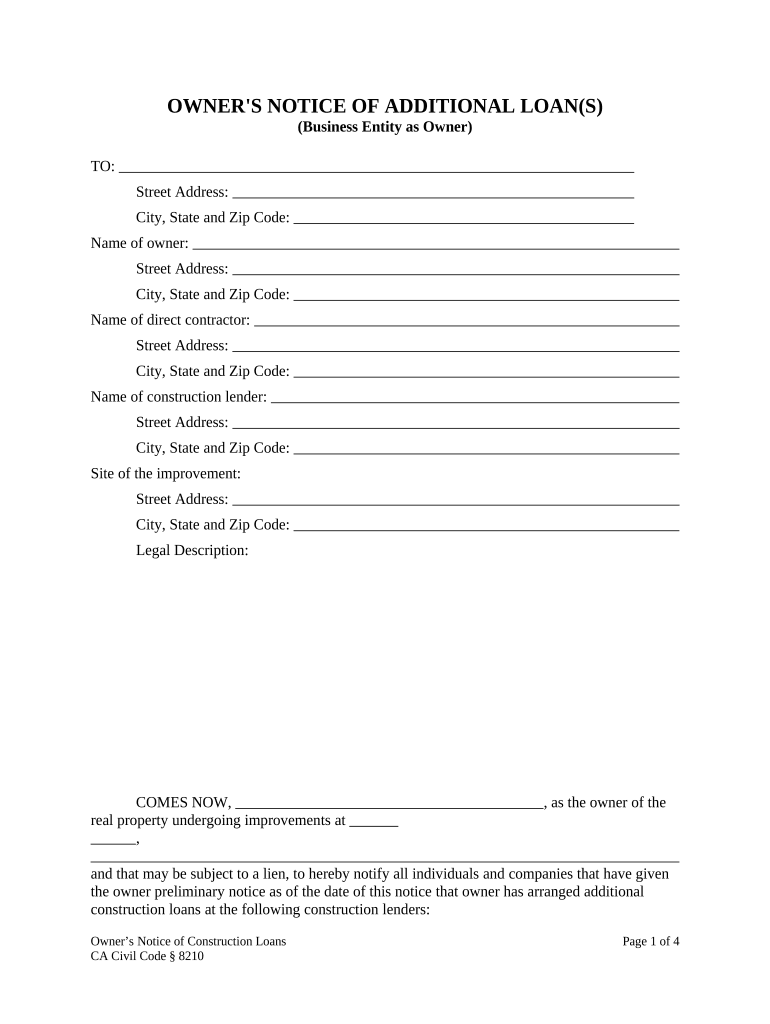

Ca Owner Llc Form

What is the CA Owner LLC?

The CA Owner LLC refers to a limited liability company registered in California. This business structure provides personal liability protection to its owners, known as members, while allowing for flexible management and tax treatment. An LLC combines the benefits of a corporation's limited liability with the tax advantages of a partnership. This makes it a popular choice for entrepreneurs in California looking to establish a business while minimizing personal risk.

How to Use the CA Owner LLC

Using a CA Owner LLC involves several steps, including formation, compliance, and operation. Initially, you need to file the Articles of Organization with the California Secretary of State. Once established, the LLC must adhere to state regulations, including obtaining necessary licenses and permits. Operating the business requires maintaining accurate records, holding regular meetings, and filing annual reports. It's essential to understand these requirements to ensure the LLC operates legally and efficiently.

Steps to Complete the CA Owner LLC

Completing the CA Owner LLC involves a series of structured steps:

- Choose a unique name for your LLC that complies with California naming requirements.

- File the Articles of Organization with the California Secretary of State.

- Obtain an Employer Identification Number (EIN) from the IRS.

- Create an Operating Agreement that outlines the management structure and operating procedures.

- Register for any necessary state and local business licenses and permits.

- File the Statement of Information within 90 days of formation.

Legal Use of the CA Owner LLC

The legal use of a CA Owner LLC is governed by California state law. This includes adhering to the rules set forth in the California Corporations Code. The LLC must operate within the scope of its stated business purpose and comply with tax obligations. It is crucial for members to maintain the LLC's separate legal identity by avoiding commingling personal and business assets, which helps protect personal liability.

Required Documents

To establish a CA Owner LLC, several key documents are required:

- Articles of Organization: This foundational document must be filed with the Secretary of State.

- Operating Agreement: Although not mandatory, this document outlines the management structure and operational guidelines.

- Employer Identification Number (EIN): Required for tax purposes and to open a business bank account.

- Statement of Information: Must be filed within 90 days of formation to provide the state with updated information about the LLC.

Eligibility Criteria

To form a CA Owner LLC, the following eligibility criteria must be met:

- The LLC must have at least one member, who can be an individual or another business entity.

- The chosen name must be distinguishable from existing entities registered in California.

- The members must be of legal age to enter into contracts, typically eighteen years or older.

Quick guide on how to complete ca owner llc 497298201

Complete Ca Owner Llc effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, revise, and eSign your documents promptly without delays. Manage Ca Owner Llc on any platform with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Ca Owner Llc seamlessly

- Find Ca Owner Llc and click Get Form to begin.

- Utilize the features we offer to finalize your form.

- Emphasize essential sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Alter and eSign Ca Owner Llc and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a CA owner LLC and how does it benefit me?

A CA owner LLC is a limited liability company formed in California that provides personal liability protection while allowing for flexible management structures. By establishing a CA owner LLC, you can separate your personal and business assets, which helps in minimizing risk. This structure is advantageous for entrepreneurs looking to protect their personal finances.

-

How can airSlate SignNow assist a CA owner LLC with document management?

AirSlate SignNow provides CA owner LLCs with an intuitive platform for sending and signing documents electronically. This streamlines the document management process, allowing for quicker transactions and improved organization. By utilizing SignNow, CA owner LLCs can enhance productivity and focus on growing their business.

-

What are the pricing plans for airSlate SignNow for CA owner LLCs?

AirSlate SignNow offers competitive pricing plans tailored for CA owner LLCs to accommodate various business sizes and needs. Plans typically include features like unlimited document signing and templates, ensuring you get the best value. You can also take advantage of a free trial to explore all functionalities.

-

Does airSlate SignNow offer integrations for CA owner LLCs?

Yes, airSlate SignNow integrates seamlessly with various applications that CA owner LLCs may already use, such as Google Drive, Dropbox, and Salesforce. These integrations help streamline workflows and improve overall efficiency. By connecting existing tools, a CA owner LLC can optimize operations without major changes to their processes.

-

Can I use airSlate SignNow on mobile devices for my CA owner LLC?

Absolutely! AirSlate SignNow is designed to be fully functional on mobile devices, allowing CA owner LLCs to manage document signing on the go. This flexibility ensures that you can handle your business needs anytime and anywhere, thereby enhancing convenience and operational efficiency.

-

What security measures does airSlate SignNow implement for CA owner LLCs?

AirSlate SignNow prioritizes security for CA owner LLCs by employing advanced encryption protocols and secure data storage. Your documents and personal information are safeguarded at all times, ensuring compliance with legal standards. This commitment to security helps CA owner LLCs maintain trust and integrity with their clients and stakeholders.

-

How does airSlate SignNow enhance collaboration for CA owner LLCs?

AirSlate SignNow enhances collaboration for CA owner LLCs by allowing multiple users to access and sign documents in real time. This feature fosters teamwork among stakeholders, speeding up the decision-making process. Improved collaboration can lead to faster project completion and increased productivity for your CA owner LLC.

Get more for Ca Owner Llc

- Quitclaim deed from corporation to corporation oregon form

- Warranty deed from corporation to corporation oregon form

- Quitclaim deed from corporation to two individuals oregon form

- Warranty deed from corporation to two individuals oregon form

- Oregon deed trust form

- Warranty deed from individual to a trust oregon form

- Oregon warranty form

- Oregon deed trust 497323556 form

Find out other Ca Owner Llc

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now