Form it 241 Claim for Clean Heating Fuel Credit Tax Year

What is the Form IT 241 Claim For Clean Heating Fuel Credit Tax Year

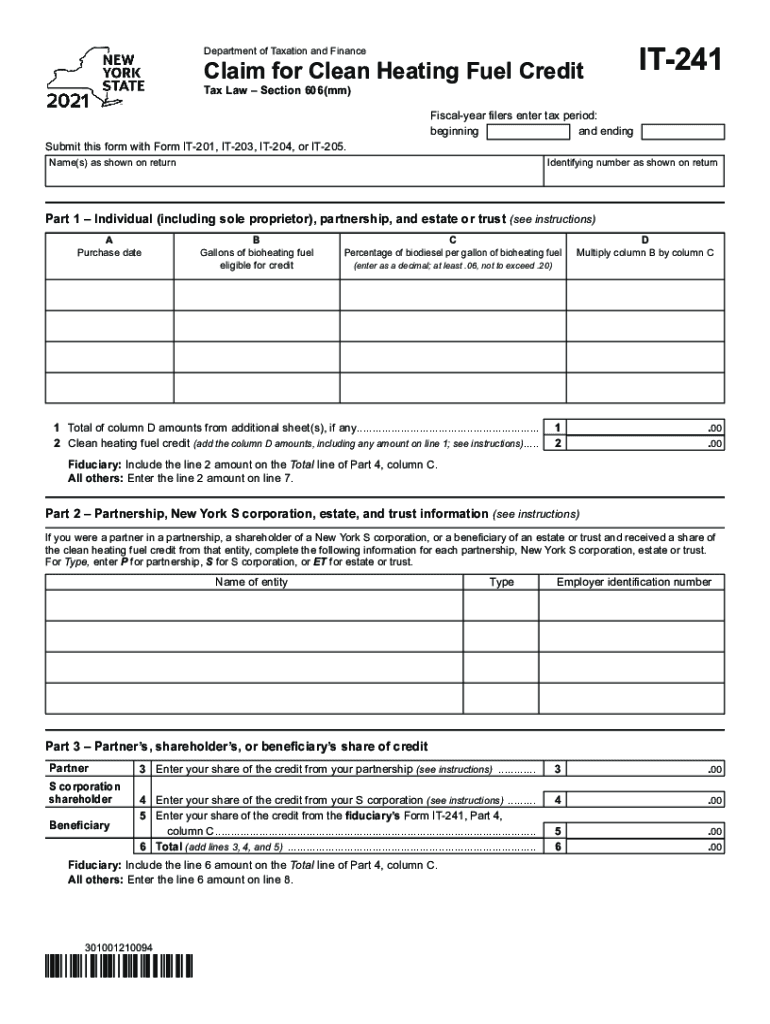

The Form IT 241 is a tax document used by residents of New York to claim a credit for clean heating fuel. This form is specifically designed for taxpayers who have purchased clean heating fuels, such as biofuels or other environmentally friendly heating options, during the tax year. The credit aims to incentivize the use of cleaner energy sources, thereby reducing environmental impact. Understanding the purpose of the IT 241 form is essential for eligible taxpayers looking to benefit from the associated tax credits.

How to use the Form IT 241 Claim For Clean Heating Fuel Credit Tax Year

Using the Form IT 241 involves several steps to ensure accurate completion and submission. Taxpayers must first gather all necessary documentation related to their clean heating fuel purchases. This includes receipts and invoices that detail the amount of fuel purchased and the associated costs. Once the required information is collected, taxpayers can fill out the form, providing details such as their personal information, the total amount of clean heating fuel purchased, and the credit amount being claimed. After completing the form, it must be submitted according to the guidelines set by the New York State Department of Taxation and Finance.

Steps to complete the Form IT 241 Claim For Clean Heating Fuel Credit Tax Year

Completing the Form IT 241 involves a systematic approach to ensure all information is accurate and complete. Here are the steps to follow:

- Gather necessary documents, including receipts for clean heating fuel purchases.

- Enter your personal information, including your name, address, and taxpayer identification number.

- Detail the total amount of clean heating fuel purchased during the tax year.

- Calculate the credit amount based on the guidelines provided by the New York State Department of Taxation and Finance.

- Review the completed form for accuracy before submission.

- Submit the form by the specified deadline, either online or by mail.

Eligibility Criteria

To qualify for the credit claimed on the Form IT 241, taxpayers must meet specific eligibility criteria. These criteria typically include:

- Residency in New York State during the tax year.

- Purchase of eligible clean heating fuels, such as biofuels.

- Submission of the form within the designated filing period.

- Compliance with any additional requirements set forth by the New York State Department of Taxation and Finance.

Required Documents

When filing the Form IT 241, taxpayers must provide certain documents to support their claims. Required documents may include:

- Receipts or invoices for clean heating fuel purchases.

- Proof of residency in New York State, if necessary.

- Any additional documentation requested by the tax authorities to verify eligibility for the credit.

Form Submission Methods

Taxpayers have various options for submitting the Form IT 241. The available methods include:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if applicable.

Quick guide on how to complete form it 241 claim for clean heating fuel credit tax year 2021

Complete Form IT 241 Claim For Clean Heating Fuel Credit Tax Year effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Manage Form IT 241 Claim For Clean Heating Fuel Credit Tax Year on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to change and eSign Form IT 241 Claim For Clean Heating Fuel Credit Tax Year with ease

- Locate Form IT 241 Claim For Clean Heating Fuel Credit Tax Year and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Alter and eSign Form IT 241 Claim For Clean Heating Fuel Credit Tax Year and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 241 claim for clean heating fuel credit tax year 2021

How to generate an electronic signature for your PDF in the online mode

How to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the taxation 241 form and why is it important?

The taxation 241 form is a critical document used for reporting tax information which can impact your overall tax strategy. Understanding how to properly fill it out can help ensure compliance with tax regulations and potentially optimize your tax outcomes. Utilizing tools like airSlate SignNow can simplify the eSigning process for such important documents.

-

How can airSlate SignNow help with the taxation 241 form?

airSlate SignNow provides an efficient solution for electronically signing and managing your taxation 241 form. Our platform offers features like templates and secure cloud storage, making it easy to complete and share your form in compliance with legal standards. This streamlines the entire process while maintaining accuracy and speed.

-

Is there a cost associated with using airSlate SignNow for the taxation 241 form?

Yes, airSlate SignNow offers various pricing plans that are designed to cater to different business needs, including usage for the taxation 241 form. We provide a cost-effective solution that ensures you get the best value for your document management needs. Visit our pricing page to find the plan that’s right for you.

-

Can I integrate airSlate SignNow with other applications for managing the taxation 241 form?

Absolutely! airSlate SignNow supports numerous integrations that can enhance your workflow when preparing the taxation 241 form. By connecting with applications like Google Drive, Salesforce, and many others, you can streamline the document management process and improve efficiency.

-

What features does airSlate SignNow offer for handling the taxation 241 form?

airSlate SignNow offers an array of features to assist with the taxation 241 form, including document templates, secure signatures, and customizable workflows. These features help ensure that your tax documents are processed quickly and securely. Additionally, our platform provides real-time tracking for all your document interactions.

-

Is airSlate SignNow compliant with legal requirements for the taxation 241 form?

Yes, airSlate SignNow is fully compliant with legal standards for eSignature, making it a reliable choice for handling the taxation 241 form. Our platform utilizes top-tier security measures to ensure that every document signed adheres to relevant regulations. This gives you peace of mind as you manage your important tax documents.

-

What are the benefits of using airSlate SignNow for the taxation 241 form compared to traditional methods?

Using airSlate SignNow for the taxation 241 form offers numerous benefits over traditional methods, such as faster processing times and enhanced accessibility. The digital platform eliminates the need for printing, scanning, or mailing, providing a more environmentally friendly approach. Additionally, you can access and sign documents from anywhere, streamlining your workflow.

Get more for Form IT 241 Claim For Clean Heating Fuel Credit Tax Year

Find out other Form IT 241 Claim For Clean Heating Fuel Credit Tax Year

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer