Form it 606 Claim for QEZE Credit for Real Property Taxes

What is the Form IT 606 Claim For QEZE Credit For Real Property Taxes

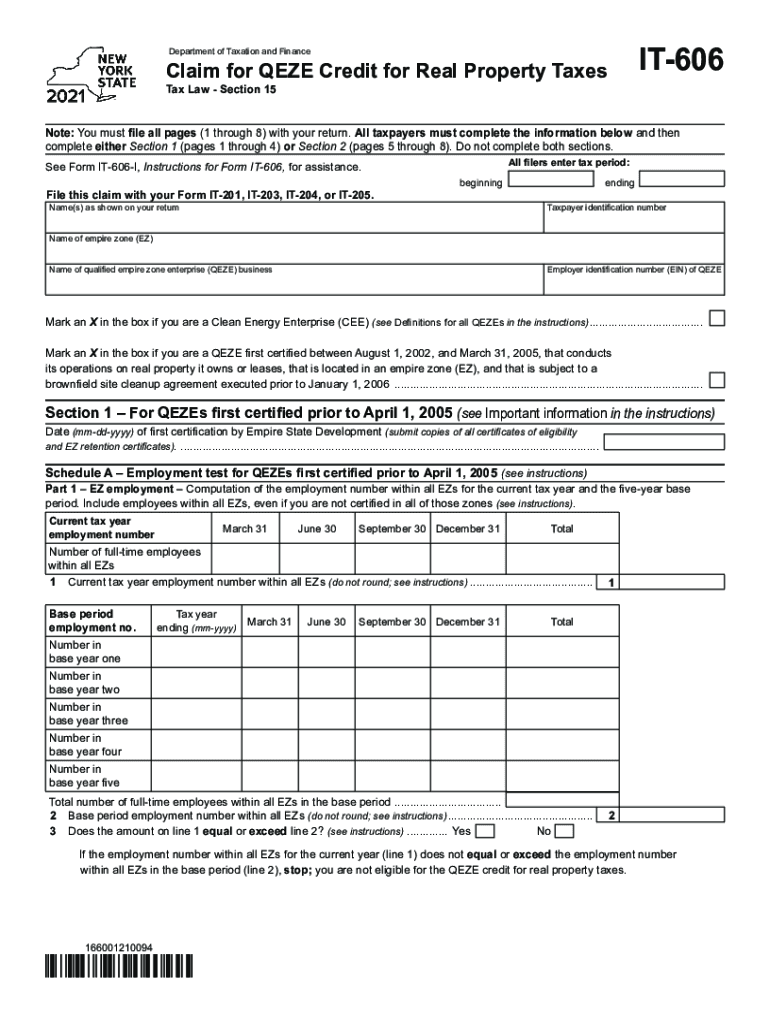

The Form IT 606 is a specific document used in New York State for claiming the Qualified Empire Zone Enterprise (QEZE) credit for real property taxes. This credit is designed to provide tax relief to businesses that operate within designated Empire Zones. The form allows eligible businesses to reduce their property tax burden, thereby supporting economic growth and development in these areas. Understanding the purpose and eligibility criteria for the IT 606 is essential for businesses looking to benefit from this tax incentive.

Steps to Complete the Form IT 606 Claim For QEZE Credit For Real Property Taxes

Completing the Form IT 606 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of eligibility for the QEZE credit. Next, fill out the form with accurate information regarding your business and property details. Pay special attention to the sections that require specific financial data, as these figures will determine the amount of credit you can claim. After completing the form, review it thoroughly to check for any errors before submission.

Legal Use of the Form IT 606 Claim For QEZE Credit For Real Property Taxes

The legal use of the Form IT 606 is governed by New York State tax regulations. To be considered valid, the form must be filled out completely and submitted within the designated filing period. Additionally, it is important to ensure that all claims made on the form are truthful and supported by appropriate documentation. Misrepresentation or failure to comply with legal requirements can result in penalties, including denial of the credit or additional fines.

Eligibility Criteria for the Form IT 606 Claim For QEZE Credit For Real Property Taxes

Eligibility for the Form IT 606 is limited to businesses that meet specific criteria set forth by New York State. Generally, businesses must be located within a designated Empire Zone and must have been in operation for a certain period. Additionally, the business must meet income and employment thresholds to qualify for the QEZE credit. It is advisable for businesses to review the eligibility requirements carefully to ensure compliance and maximize their chances of approval.

Required Documents for the Form IT 606 Claim For QEZE Credit For Real Property Taxes

When filing the Form IT 606, businesses must provide several supporting documents to substantiate their claim for the QEZE credit. These documents typically include proof of business location within the Empire Zone, financial statements, and any relevant tax documentation that demonstrates eligibility for the credit. Ensuring that all required documents are included with the form can help streamline the review process and reduce the likelihood of delays or issues.

Form Submission Methods for the IT 606 Claim For QEZE Credit For Real Property Taxes

The Form IT 606 can be submitted through various methods, depending on the preferences of the business. Options typically include online submission through the New York State Department of Taxation and Finance website, mailing a hard copy of the form, or delivering it in person to a designated office. Each method has its own guidelines and deadlines, so it is important for businesses to choose the most efficient and compliant submission method for their needs.

Quick guide on how to complete form it 606 claim for qeze credit for real property taxes

Complete Form IT 606 Claim For QEZE Credit For Real Property Taxes effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly without delays. Handle Form IT 606 Claim For QEZE Credit For Real Property Taxes on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Form IT 606 Claim For QEZE Credit For Real Property Taxes smoothly

- Find Form IT 606 Claim For QEZE Credit For Real Property Taxes and click on Get Form to begin.

- Make use of the tools we offer to submit your document.

- Identify important parts of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require you to print new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form IT 606 Claim For QEZE Credit For Real Property Taxes and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 606 claim for qeze credit for real property taxes

How to generate an e-signature for a PDF in the online mode

How to generate an e-signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

How to make an e-signature right from your smart phone

The best way to create an e-signature for a PDF on iOS devices

How to make an e-signature for a PDF on Android OS

People also ask

-

What is a 606 form and how is it used?

The 606 form is an essential document that is used for various business purposes, including regulatory compliance and record-keeping. It serves to provide a clear format for documenting transactions and agreements. With airSlate SignNow, you can easily create, send, and eSign your 606 form, streamlining your workflow.

-

How does airSlate SignNow help with 606 forms?

airSlate SignNow simplifies the process of managing 606 forms by offering easy-to-use features for document creation, signing, and tracking. You can securely send your 606 form to recipients who can eSign it from anywhere. This enhances efficiency, reduces errors, and saves time for your business.

-

Is there a cost to use airSlate SignNow for 606 forms?

AirSlate SignNow offers a range of subscription plans that are budget-friendly, allowing businesses of all sizes to manage their 606 forms without breaking the bank. Pricing is flexible and varies based on features you need. You can take advantage of a free trial to explore the platform before committing.

-

What are the key features of airSlate SignNow for 606 forms?

Key features of airSlate SignNow for managing 606 forms include customizable templates, electronic signatures, real-time notifications, and secure document storage. These features ensure that your 606 forms are processed quickly and securely. Plus, the user-friendly interface makes the experience seamless.

-

Can I integrate airSlate SignNow with other applications for 606 forms?

Yes, airSlate SignNow offers integration capabilities with various applications such as CRM systems, cloud storage, and project management tools. This allows you to automate workflows and easily manage your 606 form alongside your other business documents. Integrations enhance functionality and improve efficiency.

-

What are the benefits of using airSlate SignNow for eSigning 606 forms?

Using airSlate SignNow for eSigning your 606 forms provides signNow benefits such as reduced turnaround time and enhanced security. Customers appreciate the ability to sign documents remotely, which increases convenience. Additionally, legally binding eSignatures ensure compliance and validity of your 606 forms.

-

How can I ensure my 606 forms are secure with airSlate SignNow?

AirSlate SignNow prioritizes security by employing encryption and compliance with industry standards to protect your 606 forms. All documents are stored securely in the cloud with access controls. You can trust that your sensitive information remains confidential and protected throughout the eSigning process.

Get more for Form IT 606 Claim For QEZE Credit For Real Property Taxes

- Guardianship juvenile form

- California guardianship rights form

- California removal form

- California status hearing form

- Findings and orders after in home status review hearing child placed with previously noncustodial parent california form

- Six month prepermanency attachment child reunified california form

- Twelve month permanency attachment child reunified california form

- Twelve month permanency attachment reunification services continued california form

Find out other Form IT 606 Claim For QEZE Credit For Real Property Taxes

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement