PDF Form it 204 CP New York Corporate Partner's Schedule K 1 Tax

What is the PDF Form IT 204 CP New York Corporate Partner's Schedule K-1 Tax

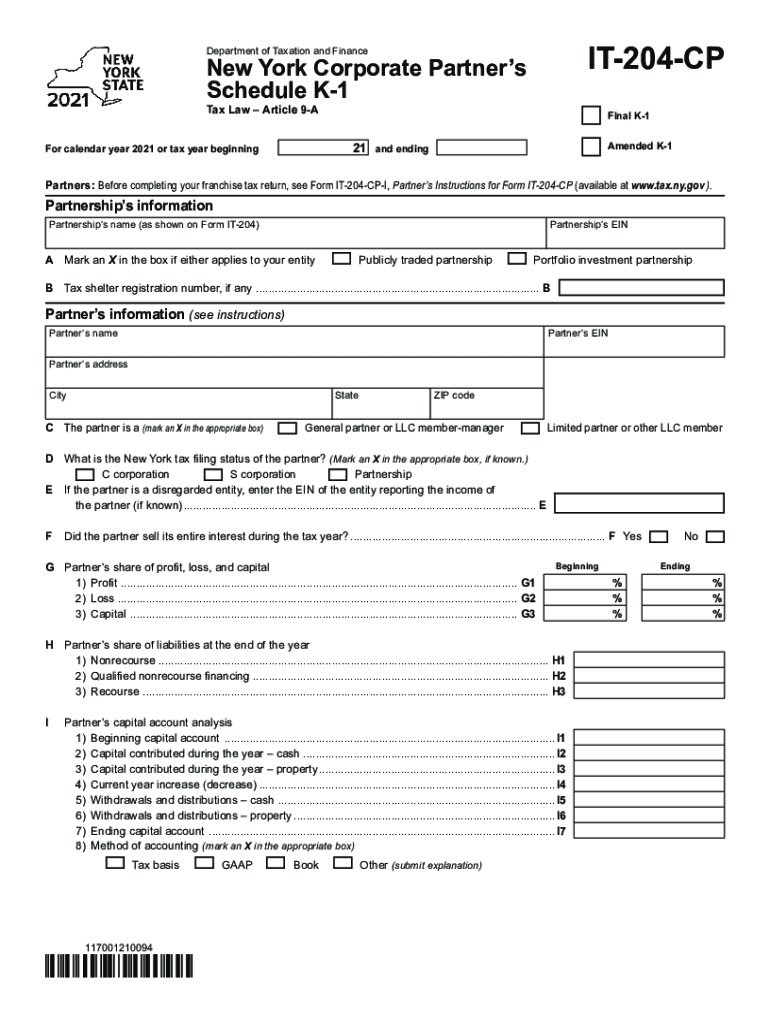

The PDF Form IT 204 CP is a tax document used by corporate partners in New York to report their share of income, deductions, and credits from partnerships. This form is essential for ensuring that partners accurately report their earnings to the New York State Department of Taxation and Finance. The Schedule K-1 provides detailed information about each partner's share of the partnership's income, which is necessary for individual tax filings. Understanding this form is crucial for compliance with state tax regulations.

Steps to complete the PDF Form IT 204 CP New York Corporate Partner's Schedule K-1 Tax

Completing the PDF Form IT 204 CP involves several key steps to ensure accuracy and compliance. First, gather all relevant financial information from the partnership, including income, deductions, and credits. Next, enter the partnership's name, address, and identification number at the top of the form. Then, report your share of the partnership's income and any other relevant financial details in the designated sections. After filling out the form, review all entries for accuracy before submitting it to the appropriate tax authority.

Legal use of the PDF Form IT 204 CP New York Corporate Partner's Schedule K-1 Tax

The legal use of the PDF Form IT 204 CP is governed by New York State tax laws. This form must be accurately completed and submitted to ensure that partners fulfill their tax obligations. Failure to properly use this form can result in penalties or legal repercussions. It is important to adhere to the guidelines set forth by the New York State Department of Taxation and Finance to maintain compliance and avoid any issues during tax audits.

Filing Deadlines / Important Dates

Filing deadlines for the PDF Form IT 204 CP are critical for compliance. Typically, the form must be submitted by the 15th day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is April 15. It is essential for partners to be aware of these dates to avoid late filing penalties and ensure timely processing of their tax returns.

Required Documents

To complete the PDF Form IT 204 CP, several documents are necessary. Partners should have access to the partnership's financial statements, including profit and loss statements, balance sheets, and any relevant tax documents that detail income and deductions. Additionally, previous year tax returns may provide useful information for accurate reporting. Having these documents on hand will facilitate a smoother completion process and ensure compliance with state regulations.

Key elements of the PDF Form IT 204 CP New York Corporate Partner's Schedule K-1 Tax

The key elements of the PDF Form IT 204 CP include sections for reporting the partner's share of income, deductions, and credits. Each partner's identification information, including their name and tax identification number, must be clearly stated. Additionally, the form requires details about the partnership's income distributions and any adjustments that may apply. Understanding these elements is vital for accurate tax reporting and compliance with New York State tax laws.

Who Issues the Form

The PDF Form IT 204 CP is issued by the New York State Department of Taxation and Finance. This agency is responsible for overseeing tax compliance and ensuring that all partnerships and their partners adhere to state tax laws. It is important for partners to obtain the most current version of the form directly from the department to ensure compliance with any updates or changes in tax regulations.

Quick guide on how to complete pdf form it 204 cp new york corporate partners schedule k 1 tax

Prepare PDF Form IT 204 CP New York Corporate Partner's Schedule K 1 Tax easily on any device

Digital document management has become increasingly favored by organizations and individuals. It presents an ideal eco-friendly substitute to conventional printed and signed materials, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without any setbacks. Manage PDF Form IT 204 CP New York Corporate Partner's Schedule K 1 Tax on any platform with the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The easiest method to modify and eSign PDF Form IT 204 CP New York Corporate Partner's Schedule K 1 Tax effortlessly

- Obtain PDF Form IT 204 CP New York Corporate Partner's Schedule K 1 Tax and click on Get Form to get started.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign PDF Form IT 204 CP New York Corporate Partner's Schedule K 1 Tax and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pdf form it 204 cp new york corporate partners schedule k 1 tax

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The best way to generate an e-signature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is the ny cp corporate solution offered by airSlate SignNow?

The ny cp corporate solution by airSlate SignNow is designed to streamline the process of sending and signing documents electronically. It caters specifically to businesses in New York, providing an easy-to-use platform for document management, ensuring compliance and security needs are met for corporate clients.

-

How much does the ny cp corporate plan cost?

The pricing for the ny cp corporate plan is competitive and tailored to suit the needs of businesses. Interested customers can choose from various subscription levels based on their requirements, ensuring they get value for money while maximizing productivity in document management.

-

What features are included in the ny cp corporate plan?

The ny cp corporate plan includes a variety of features such as document templates, automated workflows, and advanced security measures. Additional tools like team management, reporting, and custom branding are also available to enhance the signing experience for corporate users.

-

How does airSlate SignNow enhance the signing process for ny cp corporate clients?

AirSlate SignNow enhances the signing process for ny cp corporate clients by providing a seamless, intuitive interface that allows for quick and easy document signing. With features like real-time collaboration and notifications, businesses can signNowly reduce the time required for document completion and improve overall efficiency.

-

Can the ny cp corporate solution integrate with other business tools?

Yes, the ny cp corporate solution is designed to integrate with popular business tools such as CRM systems and project management software. This integration ensures that businesses can work more efficiently by synchronizing their workflows across various platforms, leading to improved productivity.

-

What are the benefits of using airSlate SignNow for ny cp corporate?

Using airSlate SignNow for ny cp corporate offers numerous benefits, including enhanced speed and efficiency in document handling. Businesses can enjoy reduced operational costs and improved compliance with legal regulations while providing a user-friendly experience that their clients will appreciate.

-

Is the ny cp corporate solution secure for sensitive documents?

Absolutely, the ny cp corporate solution prioritizes security with advanced encryption and compliance with industry standards like GDPR and HIPAA. AirSlate SignNow ensures that sensitive documents are protected, giving businesses peace of mind as they utilize electronic signatures.

Get more for PDF Form IT 204 CP New York Corporate Partner's Schedule K 1 Tax

- Blocked account 497299324 form

- Accommodations disabilities form

- Media request to photograph record or broadcast california form

- Order on media request to permit coverage california form

- California clerks office form

- Attorney name state bar number and addressfor court use only form

- Mc 955 form

- In family law cases use form fl 956

Find out other PDF Form IT 204 CP New York Corporate Partner's Schedule K 1 Tax

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself