Www State Govincome TaxIncome Tax United States Department of State Form

Understanding the Income Allocation Form

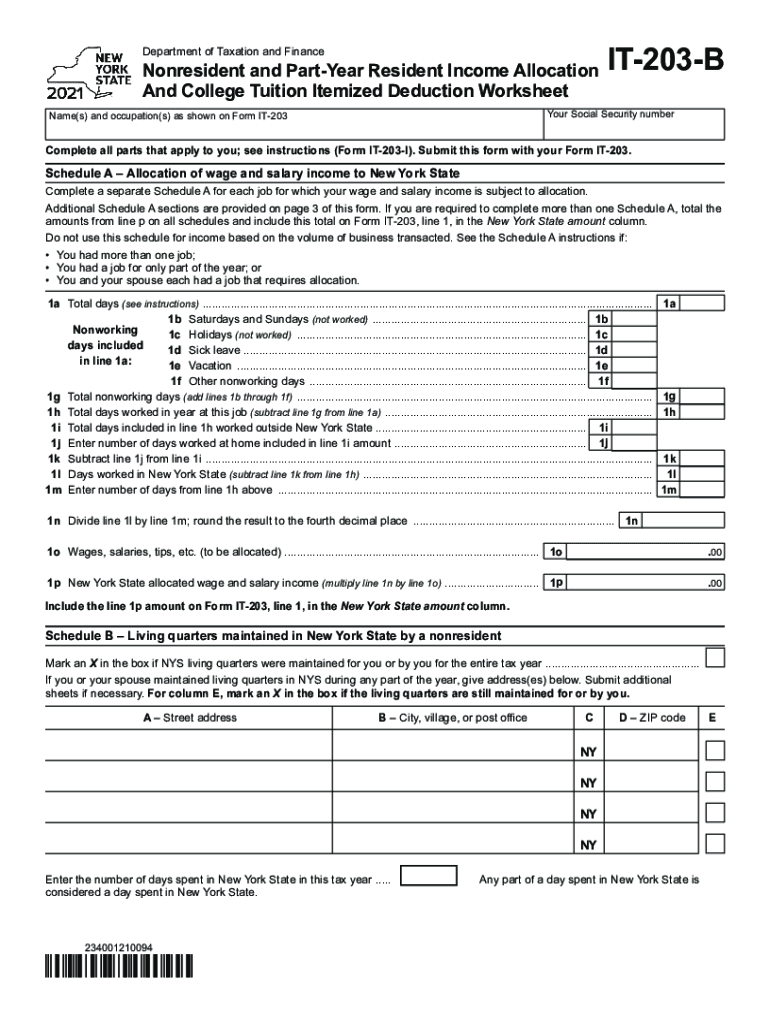

The income allocation form is a crucial document used primarily for tax purposes in the United States. It helps individuals and businesses allocate their income correctly across various categories, ensuring compliance with federal and state tax regulations. This form is particularly important for those who need to report income from multiple sources, such as self-employment, investments, or rental properties. Properly completing this form can help minimize tax liabilities and avoid potential penalties.

Steps to Complete the Income Allocation Form

Filling out the income allocation form involves several steps to ensure accuracy and compliance. Here’s a structured approach:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Identify the different sources of income you need to report, such as wages, dividends, or rental income.

- Carefully fill out each section of the form, ensuring that all income sources are accurately represented.

- Double-check your calculations to ensure that the total income reported matches your financial documents.

- Sign and date the form to validate your submission.

Legal Use of the Income Allocation Form

The income allocation form is legally binding when completed correctly. It must adhere to the regulations set forth by the Internal Revenue Service (IRS) and state tax authorities. Failing to comply with these regulations can lead to audits, fines, or other legal repercussions. Therefore, it is essential to understand the legal implications of the information provided on the form and to ensure that all entries are truthful and accurate.

Required Documents for Submission

To complete the income allocation form, specific documents are necessary. These include:

- W-2 forms from employers, detailing wages and tax withholdings.

- 1099 forms for any freelance or contract work.

- Statements of any investment income, such as dividends or interest.

- Records of rental income and expenses if applicable.

Having these documents on hand will facilitate a smoother completion process and ensure that all income sources are accounted for.

Filing Deadlines and Important Dates

Awareness of filing deadlines is essential to avoid penalties. Generally, the income allocation form must be submitted by April fifteenth for individual taxpayers. However, extensions may be available under certain circumstances. It is advisable to check the IRS website or consult with a tax professional for the most current deadlines and any changes that may occur annually.

Examples of Using the Income Allocation Form

Understanding how to use the income allocation form can be enhanced by reviewing examples. For instance, a self-employed individual may use the form to report income from various freelance projects, ensuring that each source is accurately allocated. Similarly, a homeowner renting out a portion of their property would need to report rental income while deducting related expenses. These examples illustrate the form's versatility in accommodating different financial situations.

Quick guide on how to complete wwwstategovincome taxincome tax united states department of state

Effortlessly Prepare Www state govincome taxIncome Tax United States Department Of State on Any Device

Managing documents online has grown increasingly favored among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents rapidly and without delays. Manage Www state govincome taxIncome Tax United States Department Of State across any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

Easily Edit and eSign Www state govincome taxIncome Tax United States Department Of State Without Any Hassle

- Obtain Www state govincome taxIncome Tax United States Department Of State and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and errors that necessitate printing additional copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device you choose. Edit and eSign Www state govincome taxIncome Tax United States Department Of State to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wwwstategovincome taxincome tax united states department of state

How to make an electronic signature for your PDF online

How to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to create an e-signature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The best way to create an e-signature for a PDF on Android

People also ask

-

What is an income allocation form?

An income allocation form is a document used to designate how income is distributed among different parties or accounts. This form is essential for ensuring transparency in financial management. With airSlate SignNow, you can easily create and eSign your income allocation form for seamless processing.

-

How can airSlate SignNow help with income allocation forms?

airSlate SignNow streamlines the creation and signing of income allocation forms. Our platform allows you to customize your form and collaborate with multiple parties efficiently. This ensures that income distribution is managed accurately and in real-time.

-

Is there a cost associated with using the income allocation form feature?

Yes, airSlate SignNow offers a variety of pricing plans that include the ability to create and manage income allocation forms. Depending on your needs, you can choose a plan that provides the right features for your business. We ensure that our solution is cost-effective for organizations of all sizes.

-

Can I integrate the income allocation form with other software?

Absolutely! airSlate SignNow offers robust integrations with various applications, making it easy to incorporate your income allocation form into your existing workflow. This ensures that your financial processes remain efficient and connected across different platforms.

-

What are the benefits of using airSlate SignNow for income allocation forms?

Using airSlate SignNow for your income allocation forms offers several benefits, including increased efficiency, improved accuracy, and enhanced collaboration. Our eSigning solution also helps expedite the approval process, enabling your organization to manage income distribution without delays.

-

Are income allocation forms legally binding with airSlate SignNow?

Yes, income allocation forms signed with airSlate SignNow are legally binding. Our eSignature technology complies with international and national legal standards, providing you with the confidence that your agreements on income distribution will be recognized legally.

-

Can multiple users sign the income allocation form?

Yes, airSlate SignNow supports multiple users signing your income allocation form. You can easily send the form to various parties for their signatures, making it simple to gather approvals and ensuring that all involved parties are on the same page regarding income distribution.

Get more for Www state govincome taxIncome Tax United States Department Of State

- Wedding planning or consultant package california form

- Hunting forms package california

- Identity theft recovery package california form

- Durable power of attorney for health care california form

- Aging parent package california form

- Sale of a business package california form

- Legal documents for the guardian of a minor package california form

- New state resident form

Find out other Www state govincome taxIncome Tax United States Department Of State

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History