Form it 203 GR ATT B Schedule B Yonkers Group Return for Nonresident Partners Tax Year

What is the Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year

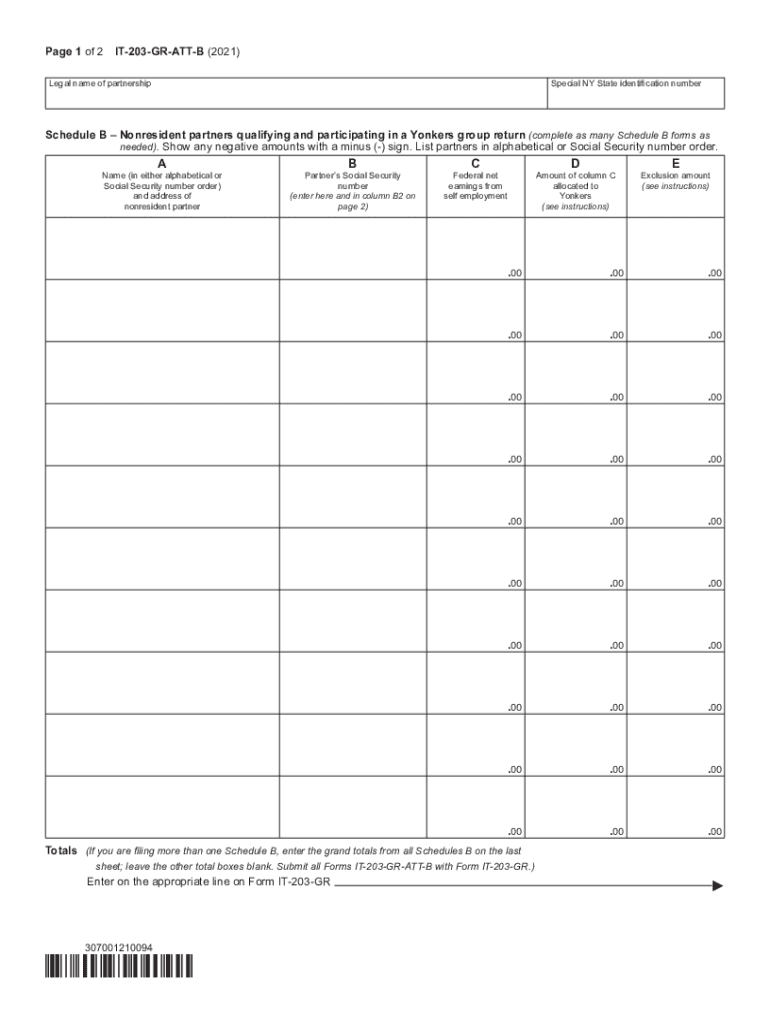

The Form IT 203 GR ATT B is a specific tax form used for filing a Yonkers group return for nonresident partners. This form is essential for partnerships that have nonresident partners earning income in Yonkers, New York. It allows the partnership to report income, deductions, and credits on behalf of its nonresident partners, ensuring compliance with local tax regulations. By using this form, partnerships can simplify the tax filing process for their nonresident partners and ensure that all necessary tax obligations are met in a streamlined manner.

How to use the Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year

Using the Form IT 203 GR ATT B involves several key steps. First, the partnership must gather all relevant financial information, including income earned by nonresident partners and any applicable deductions. Next, the form should be filled out accurately, ensuring that all sections are completed as required. Once the form is filled, it must be submitted to the appropriate tax authority by the specified deadline. Partnerships should ensure that they keep copies of the completed form and any supporting documents for their records.

Steps to complete the Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year

Completing the Form IT 203 GR ATT B requires attention to detail. The following steps outline the process:

- Gather financial documents, including income statements and expense records.

- Fill out the partnership information section, including the name, address, and federal identification number.

- Report the total income earned by the partnership and allocate the appropriate amounts to each nonresident partner.

- Include any deductions that apply to the partnership and its nonresident partners.

- Review the completed form for accuracy and ensure all required signatures are obtained.

- Submit the form by the due date, either electronically or via mail.

Key elements of the Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year

The Form IT 203 GR ATT B contains several key elements that are crucial for accurate tax reporting. These include:

- Partnership Information: Basic details about the partnership, including its name and address.

- Income Reporting: Total income earned by the partnership, broken down by nonresident partner.

- Deductions: Any deductions that can be claimed by the partnership and allocated to nonresident partners.

- Signatures: Required signatures from authorized representatives of the partnership.

Filing Deadlines / Important Dates

Timely filing of the Form IT 203 GR ATT B is essential to avoid penalties. The deadline for submitting this form typically aligns with the federal tax filing deadline, which is usually April fifteenth. However, partnerships may need to check for any specific extensions or changes to deadlines that may apply in Yonkers. It is advisable to mark these important dates on the calendar to ensure compliance and avoid late fees.

Legal use of the Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year

The legal use of the Form IT 203 GR ATT B is governed by New York State tax laws. This form must be completed accurately to ensure that the partnership fulfills its tax obligations on behalf of its nonresident partners. Failure to properly file this form can result in penalties, including fines and interest on unpaid taxes. Additionally, ensuring compliance with local tax regulations helps maintain the partnership's good standing with tax authorities.

Quick guide on how to complete form it 203 gr att b schedule b yonkers group return for nonresident partners tax year 2021

Effortlessly prepare Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year on any device

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Editing and eSigning Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year with ease

- Obtain Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight essential sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that require printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year and ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 203 gr att b schedule b yonkers group return for nonresident partners tax year 2021

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an e-signature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The best way to create an e-signature for a PDF on Android OS

People also ask

-

What is the Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year?

The Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year is a tax form specifically designed for nonresident partners who are part of a Yonkers group return. It allows these partners to report their income and calculate their tax obligations efficiently. This form ensures compliance with local tax laws while providing a straightforward method for filing.

-

How does airSlate SignNow simplify the e-signing process for the Form IT 203 GR ATT B Schedule B?

airSlate SignNow simplifies the e-signing process for the Form IT 203 GR ATT B Schedule B by offering an intuitive platform that allows users to send, sign, and manage documents seamlessly. With advanced features such as templates and reminders, businesses can ensure that all necessary signatures are gathered promptly. This enhances efficiency and reduces the chances of delays in submitting tax forms.

-

What are the pricing options for using airSlate SignNow for the Form IT 203 GR ATT B Schedule B?

AirSlate SignNow provides flexible pricing plans that cater to various business needs. Depending on the volume of documents and the number of users, you can select a plan that offers the best value for utilizing the Form IT 203 GR ATT B Schedule B. The cost-effective solutions make it accessible for businesses of all sizes to manage their e-signatures effectively.

-

What features does airSlate SignNow offer that are beneficial for handling tax forms like the Form IT 203 GR ATT B Schedule B?

AirSlate SignNow offers a suite of features tailored for handling tax forms like the Form IT 203 GR ATT B Schedule B, including document templates, in-app notifications, and secure storage. Users can easily customize tax forms, track changes, and ensure secure transmission of sensitive information. These features streamline the process, minimizing errors and simplifying compliance.

-

Can I integrate airSlate SignNow with other software for tax reporting?

Yes, you can integrate airSlate SignNow with various accounting and tax reporting software to streamline your workflow. This integration allows for easy import and export of data related to the Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year. By combining tools, you can enhance productivity and ensure accuracy in your tax reporting.

-

Is airSlate SignNow secure for filing sensitive documents like the Form IT 203 GR ATT B Schedule B?

Absolutely, airSlate SignNow employs industry-leading security measures to ensure that all sensitive documents, including the Form IT 203 GR ATT B Schedule B, are protected. Data encryption, secure cloud storage, and compliance with regulations like GDPR mean that your documents are safe from unauthorized access. This provides peace of mind when managing such critical tax documentation.

-

What benefits can businesses expect when using airSlate SignNow for the Form IT 203 GR ATT B Schedule B?

Businesses can enjoy numerous benefits when using airSlate SignNow for the Form IT 203 GR ATT B Schedule B, including time savings, increased efficiency, and improved compliance. With the ability to send, sign, and store documents electronically, companies can reduce paper waste and enhance their overall workflow. This leads to more streamlined operations and better management of tax responsibilities.

Get more for Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year

Find out other Form IT 203 GR ATT B Schedule B Yonkers Group Return For Nonresident Partners Tax Year

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple