Taxation and Revenue Department Wc Fee Due Who Must File 2021-2026

Understanding the New Mexico Form RPD 41071

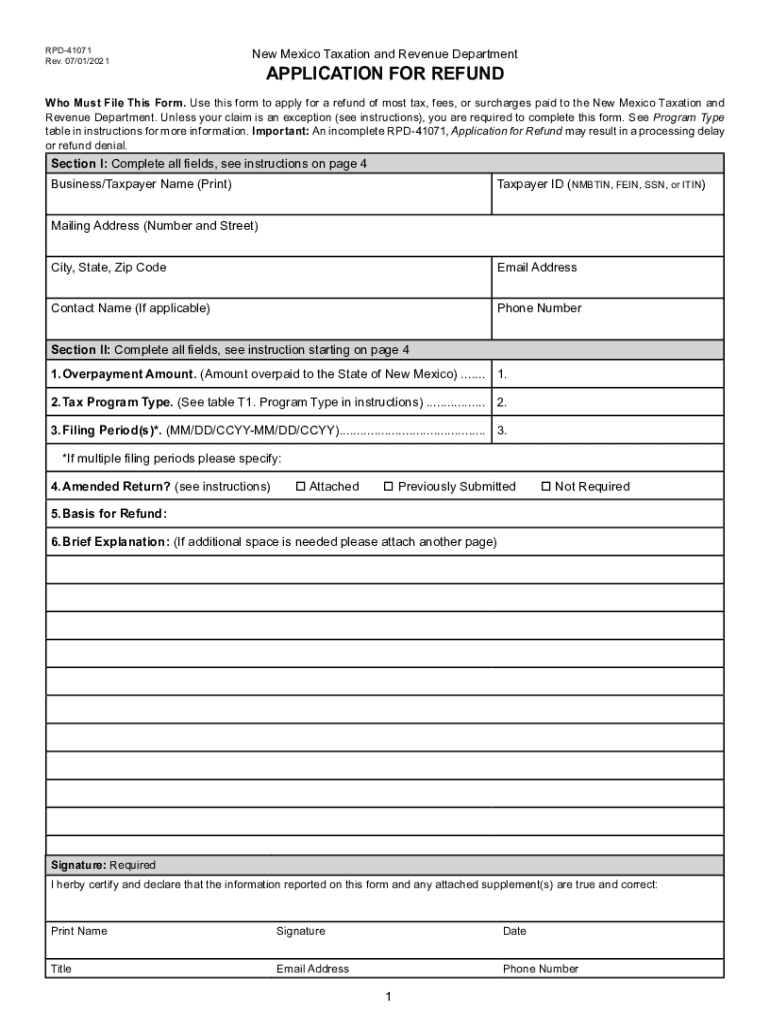

The New Mexico Form RPD 41071 is a crucial document for individuals and businesses seeking a refund of overpaid gross receipts tax. This form is specifically designed for those who have overpaid their tax obligations and wish to reclaim those funds. It is essential to understand the purpose and requirements of this form to ensure a smooth filing process.

Eligibility Criteria for Filing Form RPD 41071

To qualify for filing the New Mexico Form RPD 41071, taxpayers must meet specific eligibility criteria. Generally, this includes having made an overpayment of gross receipts tax during a designated reporting period. Eligible filers may include individuals, corporations, and partnerships that have paid more tax than required. It is important to review the specific guidelines provided by the New Mexico Taxation and Revenue Department to confirm eligibility.

Steps to Complete the New Mexico Form RPD 41071

Completing the New Mexico Form RPD 41071 involves several key steps:

- Gather all necessary documentation, including proof of overpayment and any relevant tax returns.

- Accurately fill out the form, ensuring all sections are completed with the correct information.

- Review the form for accuracy and completeness before submission.

- Submit the form either electronically or via mail, following the guidelines provided by the Taxation and Revenue Department.

Required Documents for Filing

When filing the New Mexico Form RPD 41071, certain documents must accompany the form to support the refund request. These may include:

- Proof of payment for the gross receipts tax.

- Copies of any relevant tax returns.

- Documentation supporting the claim for overpayment.

Having these documents ready will facilitate a smoother review process by the tax authorities.

Form Submission Methods

The New Mexico Form RPD 41071 can be submitted through various methods, providing flexibility for taxpayers. The available submission options include:

- Online submission through the New Mexico Taxation and Revenue Department's website.

- Mailing the completed form to the appropriate address designated for tax refund requests.

- In-person submission at local Taxation and Revenue Department offices.

Choosing the right submission method can affect the processing time, so it is advisable to consider the most efficient option.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the New Mexico Form RPD 41071 can lead to penalties. Taxpayers may face fines or delays in processing their refund if the form is not filled out correctly or if supporting documentation is missing. Understanding these potential consequences can help ensure that all submissions are accurate and complete.

Quick guide on how to complete taxation and revenue department wc fee due who must file

Prepare Taxation And Revenue Department Wc Fee Due Who Must File effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers a superb eco-friendly substitute to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Taxation And Revenue Department Wc Fee Due Who Must File on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Taxation And Revenue Department Wc Fee Due Who Must File without hassle

- Obtain Taxation And Revenue Department Wc Fee Due Who Must File and then click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or black out confidential information with tools that airSlate SignNow offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you want to deliver your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Taxation And Revenue Department Wc Fee Due Who Must File and ensure exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxation and revenue department wc fee due who must file

Create this form in 5 minutes!

How to create an eSignature for the taxation and revenue department wc fee due who must file

How to make an e-signature for your PDF file online

How to make an e-signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the nm form rpd 41071?

The nm form rpd 41071 is a tax form used in New Mexico for reporting personal property and business assets. This form is essential for compliance with state tax regulations and helps businesses accurately report their holdings.

-

How can airSlate SignNow help with completing the nm form rpd 41071?

airSlate SignNow simplifies the process of completing the nm form rpd 41071 by providing easy-to-use eSigning features. You can fill out the form electronically, ensuring accuracy and compliance, while also securely sharing it with other stakeholders.

-

Is there a cost associated with using airSlate SignNow for the nm form rpd 41071?

Yes, airSlate SignNow offers several pricing plans that cater to different needs. With our cost-effective solution, users can access essential features for managing documents, including those required for the nm form rpd 41071.

-

What features does airSlate SignNow offer for the nm form rpd 41071?

AirSlate SignNow provides various features for managing the nm form rpd 41071, including document templates, eSignature capabilities, and secure document sharing. These features streamline the process and save you time.

-

Can I integrate airSlate SignNow with other software for handling the nm form rpd 41071?

Absolutely! airSlate SignNow integrates seamlessly with numerous third-party applications, allowing you to manage the nm form rpd 41071 alongside other business processes. This flexibility enhances productivity and collaboration.

-

What are the benefits of using airSlate SignNow for the nm form rpd 41071?

Using airSlate SignNow for the nm form rpd 41071 offers benefits such as enhanced efficiency, reduced paperwork, and secure document management. It helps businesses maintain compliance while saving time and resources.

-

Is airSlate SignNow user-friendly for completing the nm form rpd 41071?

Yes, airSlate SignNow is designed with user-friendliness in mind. Whether you're tech-savvy or a beginner, you can easily navigate and complete the nm form rpd 41071 without any hassle.

Get more for Taxation And Revenue Department Wc Fee Due Who Must File

Find out other Taxation And Revenue Department Wc Fee Due Who Must File

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF