New Tork State Form Ct 54

What is the New York State Form CT-5 4?

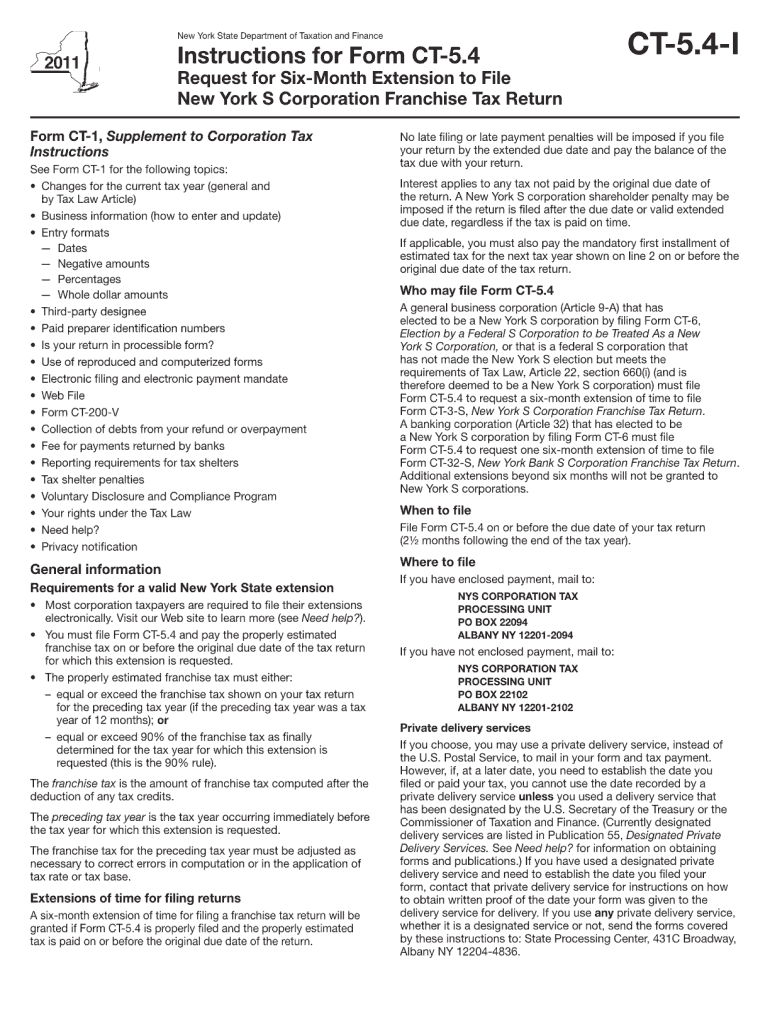

The New York State Form CT-5 4 is a crucial document used for claiming a sales tax exemption for certain purchases made by qualifying organizations. It serves as a formal request for exemption from sales tax, ensuring that eligible entities can conduct their operations without incurring unnecessary tax liabilities. This form is particularly relevant for nonprofit organizations, governmental entities, and other approved groups that meet specific criteria outlined by New York State tax regulations.

Steps to Complete the New York State Form CT-5 4

Completing the New York State Form CT-5 4 involves several key steps to ensure accuracy and compliance with state requirements:

- Gather necessary information: Collect all relevant details about your organization, including its legal name, address, and tax identification number.

- Identify eligible purchases: Clearly outline the items or services for which you are seeking a sales tax exemption.

- Fill out the form: Carefully complete all sections of the CT-5 4, ensuring that all information is accurate and complete.

- Review and sign: Double-check the form for any errors before signing and dating it to validate the request.

Legal Use of the New York State Form CT-5 4

The legal use of the New York State Form CT-5 4 is governed by specific regulations that outline who can use the form and under what circumstances. Organizations must demonstrate their eligibility based on their operational status and the nature of the purchases. Misuse of the form can lead to penalties, including back taxes owed and potential fines. Therefore, it is essential to understand the legal framework surrounding the form to ensure compliance and avoid any legal issues.

Form Submission Methods for CT-5 4

The New York State Form CT-5 4 can be submitted through various methods, providing flexibility for organizations. The available submission options include:

- Online submission: Organizations can submit the form electronically through the New York State Department of Taxation and Finance website.

- Mail: Completed forms can be printed and sent via postal service to the designated tax office.

- In-person: Organizations may also choose to deliver the form directly to a local tax office for immediate processing.

Key Elements of the New York State Form CT-5 4

Understanding the key elements of the New York State Form CT-5 4 is vital for successful completion. Important components include:

- Organization Information: This section requires details about the entity requesting the exemption.

- Purchase Details: A description of the items or services for which the exemption is sought must be provided.

- Certification: The form includes a certification statement that must be signed by an authorized representative of the organization.

Eligibility Criteria for the New York State Form CT-5 4

Eligibility for using the New York State Form CT-5 4 is based on specific criteria that organizations must meet. Generally, the following types of entities may qualify:

- Nonprofit organizations recognized under IRS regulations.

- Governmental entities at the federal, state, or local level.

- Educational institutions that meet state-defined criteria.

Organizations should carefully review these criteria to determine their eligibility before completing the form.

Quick guide on how to complete new tork state form ct 54 2015

Effortlessly Prepare New Tork State Form Ct 54 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to swiftly create, modify, and electronically sign your documents without delays. Manage New Tork State Form Ct 54 on any platform using airSlate SignNow's Android or iOS applications and enhance your document-centric workflows today.

The Easiest Way to Modify and eSign New Tork State Form Ct 54 Seamlessly

- Obtain New Tork State Form Ct 54 and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize key sections of the documents or redact sensitive details with the tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and eSign New Tork State Form Ct 54 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

I am 2015 passed out CSE student, I am preparing for GATE2016 from a coaching, due to some reasons I do not have my provisional certificate, am I still eligible to fill application form? How?

Yes you are eligible. There is still time, application closes on October 1 this year. So if you get the provisional certificate in time you can just wait or if you know that you won't get it in time, just mail GATE organising institute at helpdesk@gate.iisc.ernet.in mentioning your problem. Hope it helps.

Create this form in 5 minutes!

How to create an eSignature for the new tork state form ct 54 2015

How to create an electronic signature for your New Tork State Form Ct 54 2015 in the online mode

How to make an electronic signature for your New Tork State Form Ct 54 2015 in Chrome

How to create an electronic signature for signing the New Tork State Form Ct 54 2015 in Gmail

How to generate an eSignature for the New Tork State Form Ct 54 2015 right from your smart phone

How to create an electronic signature for the New Tork State Form Ct 54 2015 on iOS

How to create an electronic signature for the New Tork State Form Ct 54 2015 on Android devices

People also ask

-

What is the CT 5 4 feature in airSlate SignNow?

The CT 5 4 feature in airSlate SignNow allows users to streamline their document signing process using advanced automation tools. This feature helps businesses manage multiple eSignatures effortlessly, improving efficiency and reducing turnaround times.

-

How does airSlate SignNow pricing structure work for CT 5 4?

airSlate SignNow offers competitive pricing options for the CT 5 4 feature, catering to businesses of all sizes. Subscription plans are designed to be cost-effective, ensuring that you receive value without sacrificing quality or user experience.

-

What benefits does CT 5 4 provide for businesses?

CT 5 4 enhances collaboration and increases productivity by allowing multiple stakeholders to sign documents quickly. The feature is designed for ease of use, which means less training time and faster adoption across your teams.

-

Can CT 5 4 integrate with other applications?

Yes, CT 5 4 in airSlate SignNow seamlessly integrates with various software applications including CRM systems, project management tools, and cloud storage services. This flexibility enhances your workflow and ensures that you can manage documents from a single platform.

-

Is CT 5 4 suitable for small businesses?

Absolutely! The CT 5 4 feature is particularly appealing to small businesses looking for a cost-effective solution. It provides the essential tools needed for efficient document management and signing without overwhelming users with unnecessary complexity.

-

How secure is the CT 5 4 feature in airSlate SignNow?

The CT 5 4 feature is designed with top-notch security measures to protect your documents and signatures. airSlate SignNow employs encryption, secure storage, and compliance with regulatory standards to ensure your data remains safe and confidential.

-

What types of documents can I sign using CT 5 4?

CT 5 4 allows users to sign all types of documents, including contracts, agreements, and forms. The versatility of airSlate SignNow ensures that whatever document you need, you can handle it efficiently and effectively.

Get more for New Tork State Form Ct 54

Find out other New Tork State Form Ct 54

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo