Form CR Q1 "Commercial Rent Tax Return" New York City

What is the Form CR Q1 "Commercial Rent Tax Return" New York City

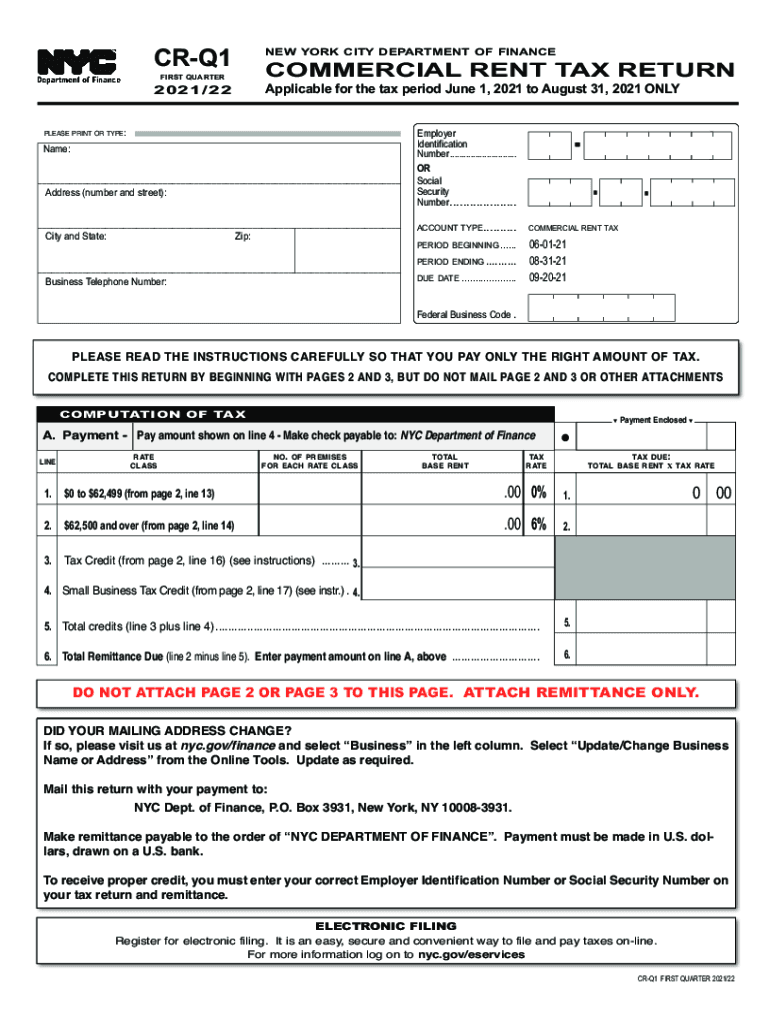

The Form CR Q1, known as the Commercial Rent Tax Return, is a tax document required for businesses operating in New York City that pay rent for commercial space. This form is specifically designed for businesses that meet certain criteria regarding their rental payments. The tax applies to commercial tenants whose annual rent exceeds a specified threshold, making it essential for compliance with local tax regulations.

Steps to complete the Form CR Q1 "Commercial Rent Tax Return" New York City

Completing the Form CR Q1 involves a series of steps to ensure accuracy and compliance. First, gather all necessary financial documents, including lease agreements and payment records. Next, accurately report the total rent paid during the specified period. Be sure to calculate any applicable deductions or exemptions. After filling out the form, review it for completeness and accuracy before submission. Finally, submit the form by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form CR Q1 are critical to avoid late fees and penalties. Typically, the form is due quarterly, with specific deadlines for each quarter. For instance, the first quarter's return is generally due on April 20, covering the period from January 1 to March 31. It is important to stay updated on any changes to these dates, as they can vary from year to year.

Required Documents

When preparing to file the Form CR Q1, certain documents are necessary to support your submission. These include:

- Lease agreements detailing the terms and conditions of the rental.

- Payment records that reflect the total rent paid during the reporting period.

- Any documentation related to deductions or exemptions claimed on the form.

Having these documents ready will streamline the filing process and ensure compliance with tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The Form CR Q1 can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission through the New York City Department of Finance website, which is often the quickest method.

- Mailing a printed copy of the form to the designated address provided by the Department of Finance.

- In-person submission at specified locations, which may be beneficial for those who prefer direct interaction.

Each method has its own guidelines and requirements, so it is important to choose the one that best suits your needs.

Penalties for Non-Compliance

Failure to file the Form CR Q1 on time or inaccuracies in the submitted information can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action. It is crucial for businesses to adhere to filing requirements and deadlines to avoid these consequences. Understanding the implications of non-compliance can help ensure that businesses remain in good standing with tax authorities.

Quick guide on how to complete form cr q1 ampquotcommercial rent tax returnampquot new york city

Effortlessly Prepare Form CR Q1 "Commercial Rent Tax Return" New York City on Any Device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Form CR Q1 "Commercial Rent Tax Return" New York City on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to modify and electronically sign Form CR Q1 "Commercial Rent Tax Return" New York City with ease

- Obtain Form CR Q1 "Commercial Rent Tax Return" New York City and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form CR Q1 "Commercial Rent Tax Return" New York City to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form cr q1 ampquotcommercial rent tax returnampquot new york city

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

The best way to generate an e-signature from your mobile device

The way to create an e-signature for a PDF document on iOS devices

The best way to generate an e-signature for a PDF file on Android devices

People also ask

-

What is q1 rent tax and how does it impact my business?

Q1 rent tax refers to the specific tax obligations on rental income for the first quarter. Understanding this tax is crucial for businesses as it impacts their overall financial planning and cash flow. Implementing solutions like airSlate SignNow can help streamline the documentation needed for accurate tax reporting, including the q1 rent tax.

-

How can airSlate SignNow help with q1 rent tax submissions?

AirSlate SignNow facilitates the efficient eSigning and sending of documents required for q1 rent tax submissions. By using our platform, businesses can ensure that their rental agreements and tax-related documents are securely signed and stored, simplifying the filing process. This streamlining can save valuable time during tax season.

-

What pricing plans does airSlate SignNow offer for businesses managing q1 rent tax?

AirSlate SignNow offers various pricing plans tailored to meet the needs of businesses handling q1 rent tax. Our plans are designed to be cost-effective and cater to different levels of usage, providing essential features for document management and electronic signatures. Explore our plans to find the one that best fits your needs.

-

Are there any specific features of airSlate SignNow that assist with q1 rent tax documents?

Yes, airSlate SignNow includes features that specifically help manage q1 rent tax documents efficiently. Users can create templates for recurring rental agreements and tax-related documents, track the status of documents, and ensure compliance with electronic signature laws. This enhances accuracy and efficiency during tax-related tasks.

-

What are the benefits of using airSlate SignNow for q1 rent tax purposes?

Using airSlate SignNow for q1 rent tax purposes comes with numerous benefits, including increased efficiency and reduced paperwork. With our platform, users can quickly send, sign, and store their tax documents digitally. This not only saves time but also minimizes errors, helping businesses stay compliant with q1 rent tax requirements.

-

Can airSlate SignNow integrate with other accounting software for managing q1 rent tax?

Absolutely! AirSlate SignNow seamlessly integrates with various accounting software, making it easier to manage your q1 rent tax documents alongside your financial data. This integration allows for streamlined workflows, enabling users to automate data transfer between systems and ensuring better organization of tax-related paperwork.

-

Is airSlate SignNow secure for handling sensitive q1 rent tax documents?

Yes, airSlate SignNow prioritizes security, implementing advanced encryption and compliance measures to protect sensitive q1 rent tax documents. Our platform adheres to industry standards to ensure that your documents remain confidential and secure throughout the signing process. You can trust airSlate SignNow with your important tax information.

Get more for Form CR Q1 "Commercial Rent Tax Return" New York City

- Warranty deed for fiduciary california form

- California partnership llc form

- Quitclaim deed from one individual to three individuals as joint tenants california form

- Grant deed joint form

- California grant deed 497299556 form

- Grant deed trust 497299557 form

- California grant deed 497299558 form

- Grant deed joint 497299559 form

Find out other Form CR Q1 "Commercial Rent Tax Return" New York City

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself