Massachusetts Department of Revenue Form LOA Loan Out

What is the Massachusetts Department of Revenue Form LOA Loan Out

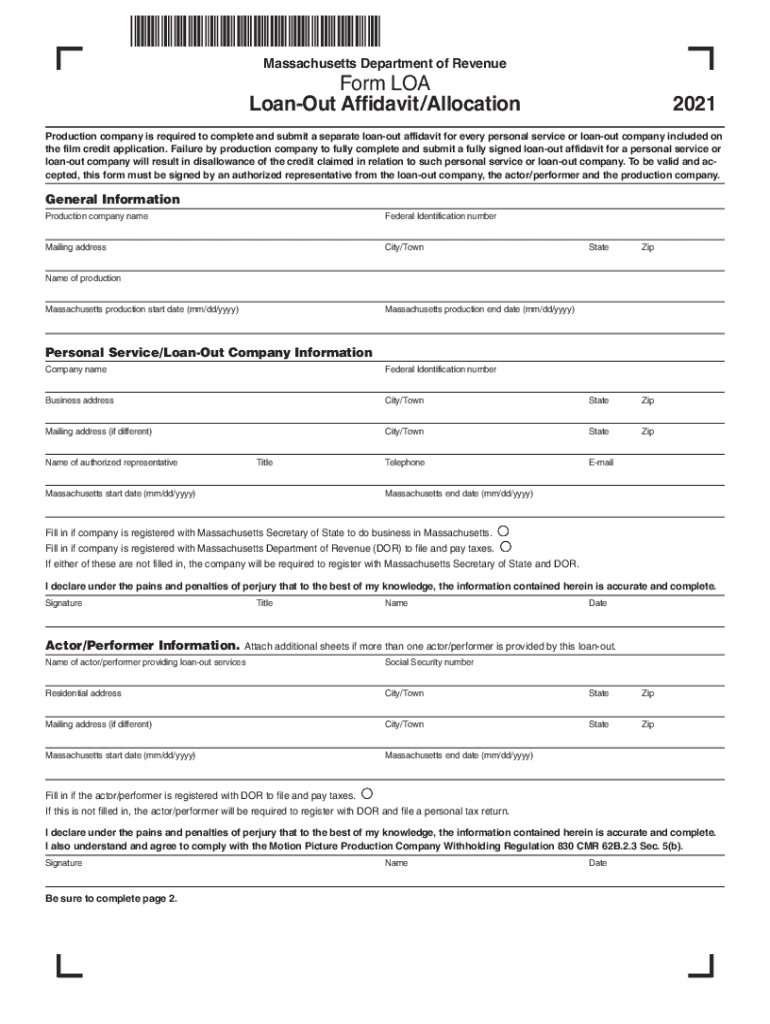

The Massachusetts Department of Revenue Form LOA Loan Out is a specific document used for tax purposes, primarily by individuals and businesses that engage in loan-out arrangements. This form allows entities to report income earned through the loan-out of services, ensuring compliance with state tax regulations. It is essential for accurately reflecting income and expenses associated with these arrangements, helping to avoid potential tax liabilities.

How to use the Massachusetts Department of Revenue Form LOA Loan Out

To effectively use the Massachusetts LOA Loan Out form, individuals and businesses must first gather all necessary financial information related to the loan-out arrangement. This includes income earned, expenses incurred, and any relevant contracts. Once the data is compiled, users can fill out the form, ensuring that all sections are completed accurately. After completing the form, it must be submitted to the Massachusetts Department of Revenue as part of the tax filing process.

Steps to complete the Massachusetts Department of Revenue Form LOA Loan Out

Completing the Massachusetts LOA Loan Out form involves several key steps:

- Gather relevant financial documents, including income statements and contracts.

- Fill out the form with accurate details regarding income and expenses.

- Review the completed form for any errors or omissions.

- Submit the form to the Massachusetts Department of Revenue by the designated deadline.

Legal use of the Massachusetts Department of Revenue Form LOA Loan Out

The legal use of the Massachusetts LOA Loan Out form is crucial for compliance with state tax laws. This form serves as an official record of income derived from loan-out services, which can be subject to specific tax regulations. Properly completing and submitting the form helps individuals and businesses avoid penalties for non-compliance and ensures that they are meeting their tax obligations.

Key elements of the Massachusetts Department of Revenue Form LOA Loan Out

Key elements of the Massachusetts LOA Loan Out form include:

- Identification of the taxpayer and the loan-out entity.

- Detailed reporting of income earned through loan-out services.

- Documentation of related expenses to ensure accurate tax calculations.

- Signature and date to validate the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Massachusetts LOA Loan Out form typically align with the state’s tax filing schedule. It is important for taxpayers to be aware of these dates to avoid late penalties. Generally, the form must be submitted by April 15 for individual taxpayers, but specific deadlines may vary based on individual circumstances or changes in tax law.

Required Documents

When completing the Massachusetts LOA Loan Out form, several documents are required to support the information provided. These may include:

- Income statements from loan-out services.

- Invoices and receipts for related expenses.

- Contracts related to the loan-out arrangement.

- Previous tax returns, if applicable.

Quick guide on how to complete massachusetts department of revenue form loa loan out

Effortlessly Prepare Massachusetts Department Of Revenue Form LOA Loan Out on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and store it securely online. airSlate SignNow equips you with everything you need to create, modify, and electronically sign your documents rapidly with no hold-ups. Handle Massachusetts Department Of Revenue Form LOA Loan Out on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Simplest Way to Edit and Electronically Sign Massachusetts Department Of Revenue Form LOA Loan Out with Ease

- Locate Massachusetts Department Of Revenue Form LOA Loan Out and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your delivery method for the form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or mislocated files, tedious form searches, and mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Massachusetts Department Of Revenue Form LOA Loan Out and ensure exceptional communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the massachusetts department of revenue form loa loan out

The way to create an electronic signature for your PDF online

The way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to make an e-signature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The way to make an e-signature for a PDF document on Android

People also ask

-

What is a Massachusetts LOA form?

The Massachusetts LOA form, or Leave of Absence form, is a document required for employees seeking a temporary leave from work in Massachusetts. Understanding how to properly fill out and submit a Massachusetts LOA form is crucial for compliance with state regulations and organizational policies.

-

How does airSlate SignNow facilitate the signing of a Massachusetts LOA form?

airSlate SignNow provides a streamlined platform for sending and eSigning Massachusetts LOA forms. With our user-friendly interface, you can easily upload your LOA form, add signers, and track the process in real-time, ensuring a smooth experience for all parties involved.

-

Is airSlate SignNow cost-effective for managing Massachusetts LOA forms?

Yes, airSlate SignNow offers a cost-effective solution for managing Massachusetts LOA forms. Our pricing structure is built to accommodate businesses of all sizes, ensuring you can handle all your document signing needs without breaking the bank.

-

What features does airSlate SignNow offer for handling Massachusetts LOA forms?

airSlate SignNow comes equipped with a variety of features for handling Massachusetts LOA forms, including customizable templates, automatic reminders, and secure storage of signed documents. These features not only enhance efficiency but also ensure your documents are compliant with legal standards.

-

Can I integrate airSlate SignNow with other tools for Massachusetts LOA forms?

Absolutely! airSlate SignNow offers integrations with numerous business applications that facilitate the management of Massachusetts LOA forms. You can easily connect with tools like Google Drive, Dropbox, and various CRM platforms, allowing for a seamless workflow.

-

What benefits does using airSlate SignNow provide for Massachusetts LOA forms?

Using airSlate SignNow for Massachusetts LOA forms offers several benefits, including faster turnaround times, increased accuracy, and enhanced document security. Our eSignature solution helps eliminate paperwork hassles, allowing for a more efficient leave process.

-

How can I ensure the security of Massachusetts LOA forms using airSlate SignNow?

AirSlate SignNow prioritizes document security for Massachusetts LOA forms with advanced encryption standards and secure cloud storage. This ensures that your sensitive information remains confidential and protected from unauthorized access.

Get more for Massachusetts Department Of Revenue Form LOA Loan Out

- Marital legal separation and property settlement agreement where no children and parties may have joint property and or debts 497300140 form

- Co marital form

- Legal separation and property settlement agreement with adult children marital parties may have joint property or debts divorce 497300142 form

- Legal separation and property settlement agreement with adult children marital parties may have joint property or debts 497300143 form

- Living trust for husband and wife with no children colorado form

- Living trust for individual as single divorced or widow or widower with no children colorado form

- Living trust for individual who is single divorced or widow or widower with children colorado form

- Living trust for husband and wife with one child colorado form

Find out other Massachusetts Department Of Revenue Form LOA Loan Out

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free