Living Trust for Individual as Single, Divorced or Widow or Widower with No Children Colorado Form

What is the Living Trust For Individual As Single, Divorced Or Widow Or Widower With No Children Colorado

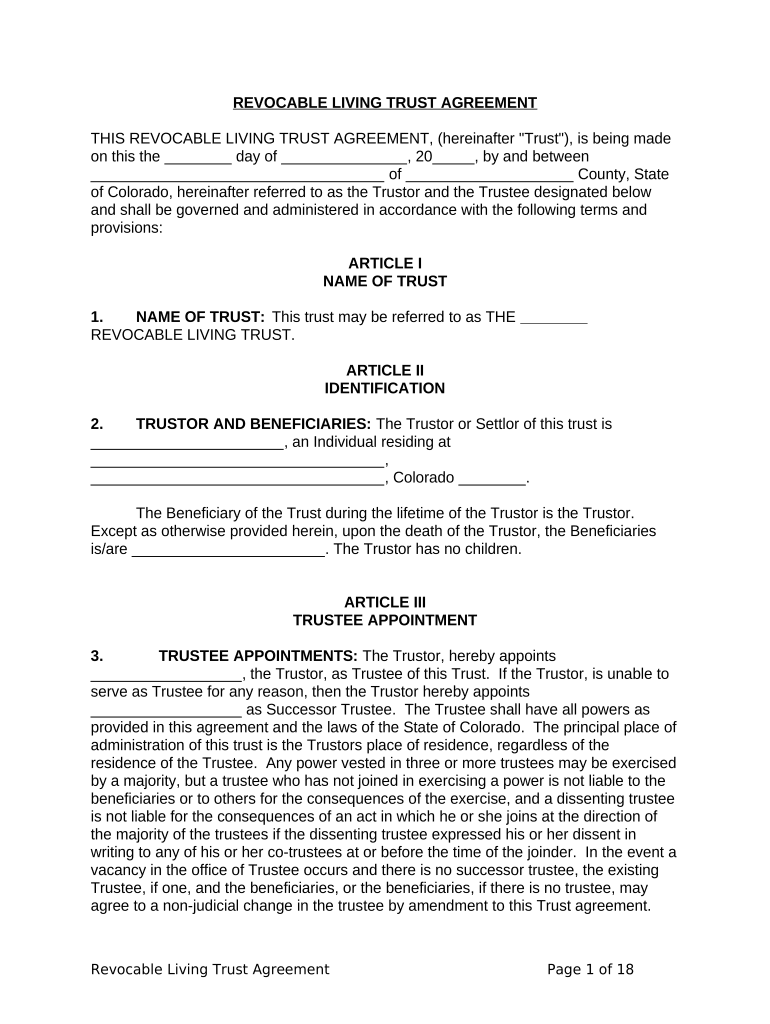

A living trust for individuals who are single, divorced, or widowed without children in Colorado is a legal arrangement that allows a person to manage their assets during their lifetime and specify how those assets will be distributed after their death. This type of trust can help avoid probate, ensuring a smoother transition of assets to beneficiaries, if any, and may provide privacy regarding the distribution of one's estate. It is particularly useful for individuals without children, as it allows for flexibility in naming alternate beneficiaries or charitable organizations.

How to use the Living Trust For Individual As Single, Divorced Or Widow Or Widower With No Children Colorado

Using a living trust involves several steps. First, the individual must create the trust document, which outlines the terms of the trust, including asset management and distribution instructions. Next, the individual transfers ownership of their assets into the trust. This can include real estate, bank accounts, and investments. Once the trust is established and funded, the individual can manage the assets as the trustee, maintaining control during their lifetime. Upon their passing, the successor trustee will follow the instructions laid out in the trust document to distribute the assets accordingly.

Steps to complete the Living Trust For Individual As Single, Divorced Or Widow Or Widower With No Children Colorado

Completing a living trust involves the following steps:

- Determine your assets: List all assets you wish to include in the trust.

- Draft the trust document: This can be done with the help of an attorney or through a reputable online service.

- Designate a trustee: Choose yourself or another trusted individual as the trustee.

- Fund the trust: Transfer ownership of your assets into the trust, ensuring all titles and accounts are updated.

- Review and update: Regularly review the trust to ensure it reflects your current wishes and circumstances.

Key elements of the Living Trust For Individual As Single, Divorced Or Widow Or Widower With No Children Colorado

Key elements of this living trust include:

- Trustee designation: The individual creating the trust often serves as the initial trustee.

- Beneficiary identification: Clear instructions on who will receive the assets after the individual's death.

- Asset list: A comprehensive list of assets included in the trust.

- Revocation clause: A provision allowing the individual to modify or revoke the trust at any time while they are alive.

- Successor trustee: Designation of a successor trustee to manage the trust after the individual's death.

State-specific rules for the Living Trust For Individual As Single, Divorced Or Widow Or Widower With No Children Colorado

In Colorado, living trusts must comply with state laws regarding trust formation and management. This includes the requirement that the trust document must be in writing and signed by the trustor. Additionally, Colorado law allows for revocable living trusts, which can be altered or revoked at any time by the individual. It is essential to ensure that the trust is properly funded and that all assets are titled in the name of the trust to avoid complications during the distribution process.

Legal use of the Living Trust For Individual As Single, Divorced Or Widow Or Widower With No Children Colorado

The legal use of a living trust in Colorado allows individuals to manage their assets effectively while providing clear instructions for asset distribution. This trust type is recognized by Colorado law and can be used to avoid probate, thereby simplifying the transfer of assets to beneficiaries. It is important to ensure that the trust is created and executed according to state laws to maintain its validity and enforceability.

Quick guide on how to complete living trust for individual as single divorced or widow or widower with no children colorado

Complete Living Trust For Individual As Single, Divorced Or Widow Or Widower With No Children Colorado seamlessly on any device

Online document administration has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to generate, modify, and eSign your documents swiftly without delays. Manage Living Trust For Individual As Single, Divorced Or Widow Or Widower With No Children Colorado on any platform through airSlate SignNow's Android or iOS applications and simplify any document-oriented process today.

How to modify and eSign Living Trust For Individual As Single, Divorced Or Widow Or Widower With No Children Colorado effortlessly

- Locate Living Trust For Individual As Single, Divorced Or Widow Or Widower With No Children Colorado and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Highlight relevant sections of the documents or obscure sensitive data with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from a device of your choice. Modify and eSign Living Trust For Individual As Single, Divorced Or Widow Or Widower With No Children Colorado to ensure clear communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for Individual as Single, Divorced or Widow or Widower with No Children in Colorado?

A Living Trust for Individual as Single, Divorced or Widow or Widower with No Children in Colorado is a legal document that helps manage your assets during your lifetime and specifies how they will be distributed after your death. This trust allows you to maintain control over your assets and avoid the probate process, ensuring a smoother transition for your beneficiaries.

-

How does a Living Trust benefit a single person in Colorado?

For a single person in Colorado, a Living Trust can provide peace of mind by protecting your assets and clearly outlining your wishes. It helps eliminate the lengthy probate process, saving time and money, and ensures that your assets are distributed according to your preferences rather than by state law.

-

Are there specific benefits for divorced individuals using a Living Trust in Colorado?

Yes, a Living Trust for Individual as Single, Divorced or Widow or Widower with No Children in Colorado is particularly beneficial for divorced individuals. It allows you to restructure your asset distribution in accordance with your new circumstances and ensures that your estate is managed according to your updated wishes.

-

What are the costs involved in setting up a Living Trust in Colorado?

The costs of setting up a Living Trust for Individual as Single, Divorced or Widow or Widower with No Children in Colorado can vary based on the complexity of your estate and whether you work with an attorney or use an online service. Generally, you might expect to pay between a few hundred to several thousand dollars, depending on the services chosen.

-

Can a Living Trust in Colorado integrate with other estate planning tools?

Yes, a Living Trust for Individual as Single, Divorced or Widow or Widower with No Children in Colorado can be integrated with other estate planning tools such as wills, healthcare directives, and power of attorney documents. This integration ensures all aspects of your estate plan work together seamlessly to provide comprehensive coverage.

-

How do I choose the right trustee for my Living Trust in Colorado?

Choosing the right trustee for your Living Trust for Individual as Single, Divorced or Widow or Widower with No Children in Colorado is crucial. Consider someone who is trustworthy, organized, and understands your values and wishes, ensuring that your assets are managed according to your intentions.

-

Is it possible to update a Living Trust in Colorado?

Yes, a Living Trust for Individual as Single, Divorced or Widow or Widower with No Children in Colorado is revocable, meaning you can update or change the trust terms at any time. Regular updates are recommended to reflect any signNow life changes, such as divorce or changes in financial status.

Get more for Living Trust For Individual As Single, Divorced Or Widow Or Widower With No Children Colorado

Find out other Living Trust For Individual As Single, Divorced Or Widow Or Widower With No Children Colorado

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien