Georgia State Income Tax Forms and Instructions

What are the Georgia State Income Tax Forms and Instructions?

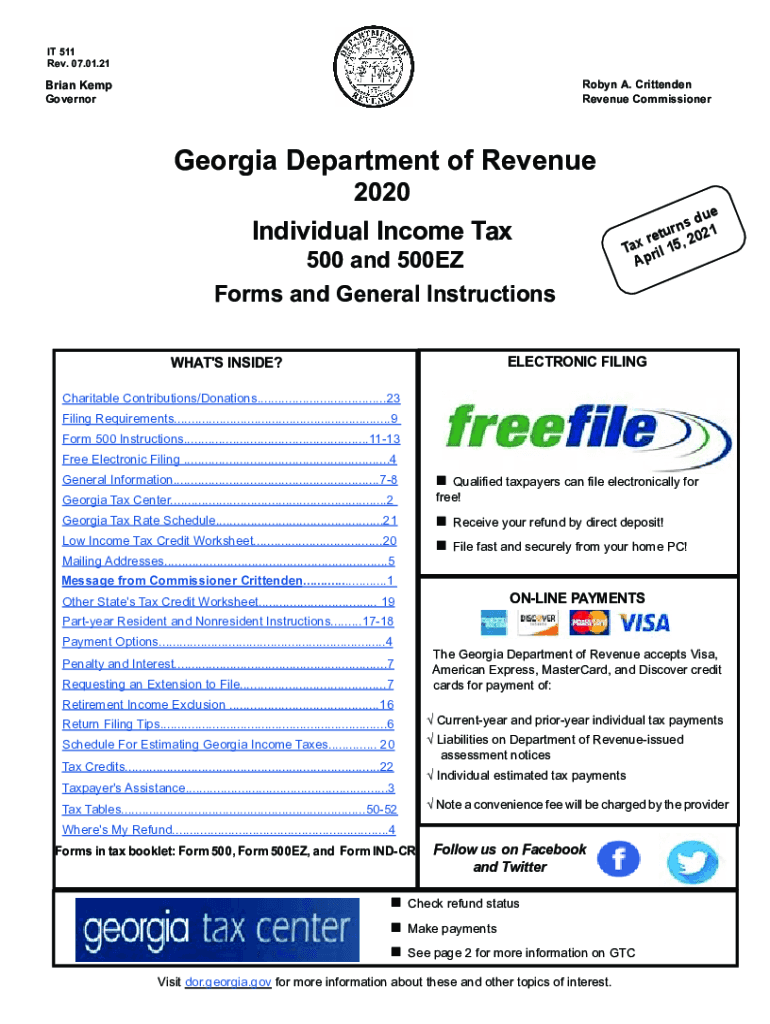

The Georgia State Income Tax Forms are official documents required for filing state income taxes. These forms include the 2021 Georgia IT-511 tax form, which is used by residents to report their income and calculate their tax liability. The forms come with specific instructions that guide taxpayers through the filing process, ensuring compliance with state regulations. Understanding these forms is crucial for accurate tax reporting and avoiding potential penalties.

Steps to Complete the Georgia State Income Tax Forms and Instructions

Completing the Georgia State Income Tax Forms involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Download the appropriate forms, such as the 2021 IT-511 and the 2021 GA-500 instructions, from the Georgia Department of Revenue website.

- Carefully read the instructions provided with each form to understand the requirements and calculations needed.

- Fill out the forms accurately, ensuring all income and deductions are reported.

- Review the completed forms for accuracy before submission.

Legal Use of the Georgia State Income Tax Forms and Instructions

The legal use of the Georgia State Income Tax Forms is governed by state tax laws. To ensure that the forms are legally binding, taxpayers must comply with the requirements set forth by the Georgia Department of Revenue. This includes providing accurate information and adhering to filing deadlines. Using electronic signatures through a reliable platform can also enhance the legal standing of submitted forms, as long as they meet the necessary legal standards.

Form Submission Methods

Taxpayers have several options for submitting their completed Georgia State Income Tax Forms. These methods include:

- Online Submission: Taxpayers can file their forms electronically through the Georgia Department of Revenue's online portal.

- Mail: Completed forms can be printed and sent via postal service to the designated address provided in the instructions.

- In-Person: Taxpayers may also choose to submit their forms in person at local Department of Revenue offices.

Filing Deadlines / Important Dates

Timely filing of the Georgia State Income Tax Forms is essential to avoid penalties. The typical deadline for filing is April 15 of the following year. However, taxpayers should check for any extensions or changes that may apply to specific tax years. It is advisable to mark important dates on a calendar to ensure compliance with filing requirements.

Key Elements of the Georgia State Income Tax Forms and Instructions

Understanding the key elements of the Georgia State Income Tax Forms is vital for accurate completion. These elements typically include:

- Personal Information: Taxpayers must provide their name, address, and Social Security number.

- Income Reporting: All sources of income must be reported, including wages, dividends, and interest.

- Deductions and Credits: Taxpayers should identify any applicable deductions and credits to reduce their tax liability.

- Signature: A signature is required to validate the form, which can be done electronically if using an eSignature solution.

Quick guide on how to complete 2019 georgia state income tax forms and instructions

Complete Georgia State Income Tax Forms And Instructions effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without any delays. Handle Georgia State Income Tax Forms And Instructions on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Georgia State Income Tax Forms And Instructions with ease

- Locate Georgia State Income Tax Forms And Instructions and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important parts of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, laborious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Edit and eSign Georgia State Income Tax Forms And Instructions and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 georgia state income tax forms and instructions

The way to create an e-signature for a PDF document online

The way to create an e-signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The best way to generate an e-signature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What are the main features of the airSlate SignNow platform for handling 2021 Georgia income tax forms?

The airSlate SignNow platform offers comprehensive features for managing 2021 Georgia income tax forms, including eSignature capabilities, document templates, and secure cloud storage. Users can easily customize forms and automate workflows, ensuring a streamlined process for tax submissions. The intuitive interface makes it user-friendly for both individuals and businesses looking to simplify their tax documentation.

-

How does airSlate SignNow help in simplifying the submission of 2021 Georgia income tax forms?

By utilizing airSlate SignNow, users can simplify the entire process of submitting 2021 Georgia income tax forms through electronic signatures and automated reminders. This efficiency reduces the chances of errors and delays that often occur with traditional paper submissions. Plus, with the ability to track document status in real-time, users will always know where their forms stand.

-

Is airSlate SignNow compatible with various tax software for 2021 Georgia income tax forms?

Yes, airSlate SignNow seamlessly integrates with various tax software systems to facilitate the handling of 2021 Georgia income tax forms. This allows users to import and export their tax documents easily, ensuring an efficient workflow. The integration capabilities save time and help users maintain organized records across different platforms.

-

What is the pricing structure for using airSlate SignNow with 2021 Georgia income tax forms?

AirSlate SignNow offers a competitive pricing structure, making it cost-effective for users managing 2021 Georgia income tax forms. With various subscription plans tailored to meet different business needs, users can choose a plan that fits their budget while accessing robust features. There is also a free trial to experience the platform before making a commitment.

-

Can I save time with airSlate SignNow when preparing 2021 Georgia income tax forms?

Absolutely! AirSlate SignNow enables users to prepare 2021 Georgia income tax forms efficiently by providing easy access to templates and automated workflows. This saves signNow time as users can focus on the content of their tax forms rather than the logistics of document management. The rapid turnaround for signatures accelerates the overall process.

-

What security measures does airSlate SignNow implement for 2021 Georgia income tax forms?

AirSlate SignNow prioritizes security when it comes to handling sensitive documents like 2021 Georgia income tax forms. The platform employs bank-grade encryption, secure cloud storage, and compliance with industry standards to protect user data. Users can feel confident that their tax information will be secure while utilizing the platform.

-

How does airSlate SignNow ensure compliance with Georgia tax regulations for 2021 income tax forms?

AirSlate SignNow is designed to adhere to all relevant regulations and guidelines, ensuring compliance when managing 2021 Georgia income tax forms. The platform regularly updates its features to align with changing laws and requirements, providing users with peace of mind. This helps individuals and businesses maintain compliance throughout the tax filing process.

Get more for Georgia State Income Tax Forms And Instructions

Find out other Georgia State Income Tax Forms And Instructions

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation