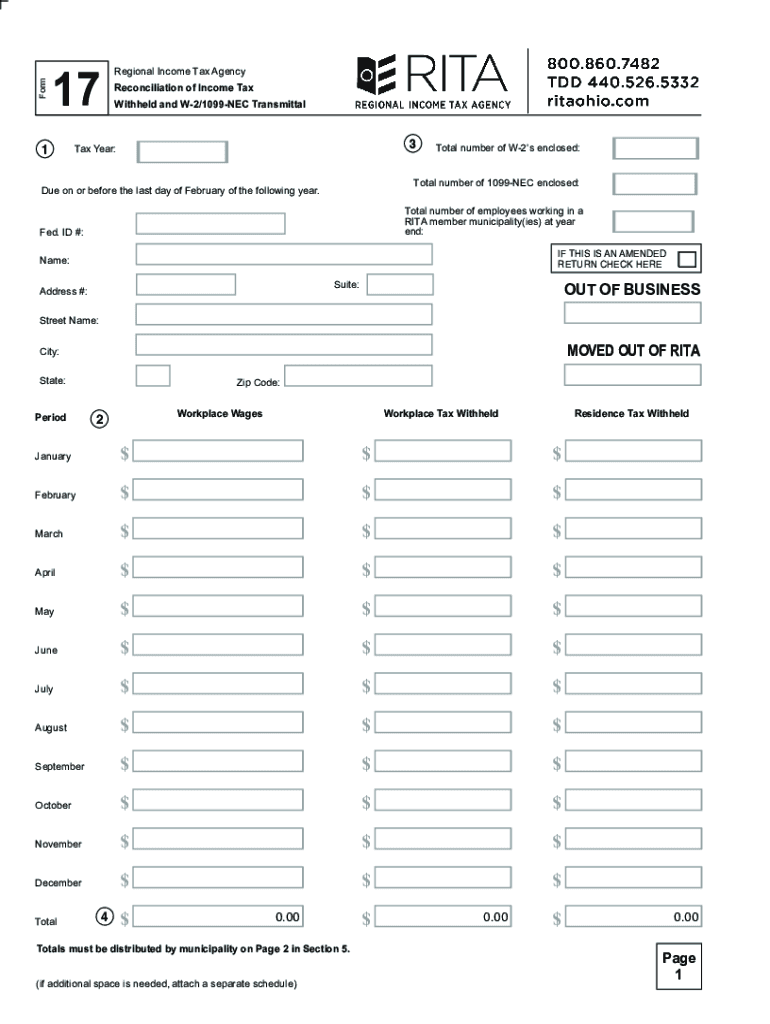

Reconciliation of Income Tax 2020

What is the Reconciliation Of Income Tax

The Reconciliation Of Income Tax is a critical process for individuals and businesses in Ohio to ensure that their tax liabilities are accurately calculated and reported. This process involves reconciling the income reported on various tax forms, including the RITA tax forms, with the actual income earned during the tax year. It helps identify any discrepancies that may arise from underreporting or overreporting income, ensuring compliance with state tax regulations.

How to use the Reconciliation Of Income Tax

Using the Reconciliation Of Income Tax involves several steps. First, gather all relevant financial documents, including W-2s, 1099s, and any other income statements. Next, complete the RITA tax forms, ensuring that all income sources are accurately reported. Once the forms are filled out, review them for accuracy, and then submit them to the appropriate tax authority. Utilizing electronic tools, such as signNow, can streamline this process by allowing for easy e-signatures and secure document management.

Steps to complete the Reconciliation Of Income Tax

Completing the Reconciliation Of Income Tax requires a systematic approach:

- Collect all income documentation for the tax year.

- Fill out the RITA tax forms, ensuring all income is reported.

- Review the forms for accuracy and completeness.

- Submit the forms either online or via mail, depending on your preference.

- Keep copies of submitted forms and any correspondence for your records.

Required Documents

To successfully complete the Reconciliation Of Income Tax, certain documents are essential:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Documentation of any other income sources.

- Previous year’s tax returns for reference.

Filing Deadlines / Important Dates

It is crucial to adhere to filing deadlines to avoid penalties. The typical deadline for submitting the Reconciliation Of Income Tax in Ohio aligns with federal tax deadlines, usually falling on April fifteenth. However, extensions may be available, so it is advisable to check for any updates or changes to these dates annually.

Penalties for Non-Compliance

Failing to comply with the Reconciliation Of Income Tax requirements can lead to various penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential to ensure that all forms are completed accurately and submitted on time to avoid these consequences.

Quick guide on how to complete reconciliation of income tax

Easily Prepare Reconciliation Of Income Tax on Any Device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Reconciliation Of Income Tax on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The simplest way to modify and electronically sign Reconciliation Of Income Tax effortlessly

- Locate Reconciliation Of Income Tax and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your revisions.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Reconciliation Of Income Tax and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct reconciliation of income tax

Create this form in 5 minutes!

How to create an eSignature for the reconciliation of income tax

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the rita tax ohio and how does it affect me?

The rita tax ohio, or Regional Income Tax Agency tax, is a tax on earned income for residents in certain municipalities within Ohio. If you live or work in a municipality that participates in the RITA, you might be liable to pay this tax. Understanding your obligations is essential to avoid penalties and ensure compliance.

-

How can airSlate SignNow help manage rita tax ohio documents?

airSlate SignNow simplifies the process of sending and signing documents related to the rita tax ohio. With its user-friendly interface, you can quickly create, send, and collect electronic signatures for tax forms. This streamlines your tax filing process and ensures all your documents are in order without the hassle of paper.

-

Is there a cost associated with airSlate SignNow for rita tax ohio filings?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs, including those that handle rita tax ohio filings. The pricing is competitive and provides value through features that enhance document workflow efficiency. It is essential to evaluate the plans to choose the best fit for your requirement.

-

What features does airSlate SignNow provide for rita tax ohio documentation?

AirSlate SignNow includes features like eSignature, document templates, and workflow automation to help with rita tax ohio documentation. These features make it easier to process tax forms and capture signatures quickly and securely. Moreover, the platform keeps track of document status, ensuring you never miss a deadline.

-

Can I integrate airSlate SignNow with my existing accounting software for rita tax ohio?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to manage your rita tax ohio filings efficiently. Whether you're using QuickBooks, Xero, or other platforms, you can sync your document workflows to ensure all tax-related paperwork is captured accurately.

-

What benefits does airSlate SignNow offer for handling rita tax ohio?

The primary benefits of using airSlate SignNow for rita tax ohio include enhanced efficiency and reduced turnaround time for document processing. Its eSigning capabilities signNowly cut down on the time needed for approvals, helping you meet important tax deadlines. Additionally, the platform ensures legal compliance and document security.

-

How secure is airSlate SignNow for managing rita tax ohio documents?

AirSlate SignNow prioritizes security, employing advanced encryption and secure storage protocols for all documents, including rita tax ohio paperwork. You can trust that your sensitive tax information is safe while using our platform. Compliance with industry standards further ensures that your data remains confidential and secure.

Get more for Reconciliation Of Income Tax

- Warranty deed from individual to two individuals as joint tenants colorado form

- Co deed trust form

- Quitclaim deed for two individuals to husband and wife as joint tenants colorado form

- Grant deed trust to a trust colorado form

- Quitclaim deed husband and wife to an individual colorado form

- Warranty deed for husband and wife to individual colorado form

- Quitclaim deed individual to individual colorado 497300765 form

- Quitclaim deed husband and wife to three individuals colorado form

Find out other Reconciliation Of Income Tax

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast