Ohio Wine and Mixed Beverage Tax Return for a 2, B 2a, S 1 2021-2026

What is the Ohio Wine And Mixed Beverage Tax Return For A 2, B 2a, S 1

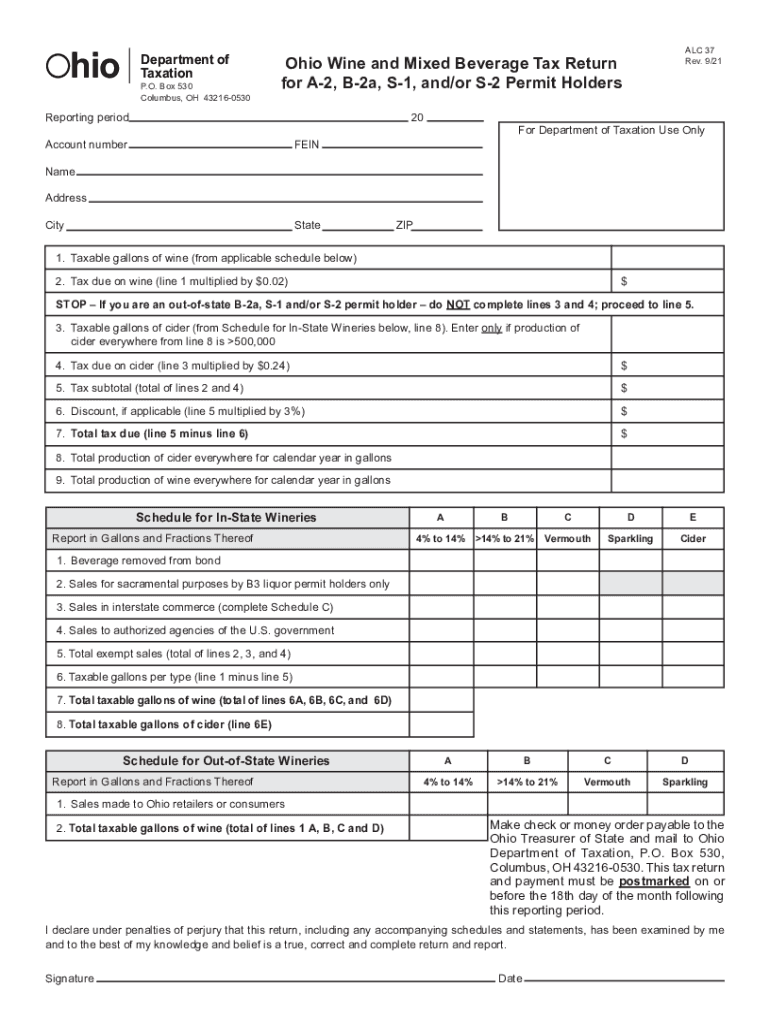

The Ohio Wine and Mixed Beverage Tax Return for a 2, B 2a, S 1 form is a tax document required for businesses engaged in the sale of wine and mixed beverages in Ohio. This form is essential for reporting the amount of tax owed on alcoholic beverages sold within the state. It is designed to ensure compliance with state tax regulations and to facilitate the accurate collection of taxes from businesses operating in the alcohol industry. The form includes specific sections for reporting sales, tax calculations, and any applicable deductions or credits.

Steps to Complete the Ohio Wine And Mixed Beverage Tax Return For A 2, B 2a, S 1

Completing the Ohio Wine and Mixed Beverage Tax Return involves several key steps:

- Gather necessary financial records, including sales receipts and previous tax returns.

- Fill out the form with accurate sales figures, ensuring that all sections are completed as required.

- Calculate the total tax owed based on the applicable rates for wine and mixed beverages.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Submit the form by the designated deadline, either online or via mail, depending on your preference.

Legal Use of the Ohio Wine And Mixed Beverage Tax Return For A 2, B 2a, S 1

The legal use of the Ohio Wine and Mixed Beverage Tax Return is governed by state tax laws. It serves as an official record of tax obligations and compliance for businesses in the alcohol sector. Properly completing and submitting this form is crucial for avoiding penalties or fines associated with non-compliance. The form must be signed and dated to validate its authenticity, and it is essential to maintain copies for your records in case of audits or inquiries from state tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio Wine and Mixed Beverage Tax Return are typically set on a quarterly basis. Businesses must be aware of these deadlines to ensure timely submission. Important dates include:

- Quarterly filing due dates: January 31, April 30, July 31, and October 31.

- Annual reconciliation deadlines, if applicable.

It is advisable to check for any updates or changes in deadlines each year to remain compliant with state regulations.

Required Documents

To complete the Ohio Wine and Mixed Beverage Tax Return, several documents are necessary:

- Sales records detailing the volume of wine and mixed beverages sold.

- Previous tax returns for reference and accuracy.

- Any documentation supporting deductions or credits claimed on the return.

Having these documents organized and accessible will facilitate a smoother filing process and help ensure compliance with state tax laws.

Form Submission Methods (Online / Mail / In-Person)

The Ohio Wine and Mixed Beverage Tax Return can be submitted through various methods, offering flexibility to businesses:

- Online submission via the Ohio Department of Taxation's website, which is often the fastest method.

- Mailing the completed form to the appropriate tax office address provided on the form.

- In-person submission at designated tax offices, if preferred.

Each method has its own processing times, so businesses should choose the option that best fits their needs and timelines.

Quick guide on how to complete ohio wine and mixed beverage tax return for a 2 b 2a s 1

Accomplish Ohio Wine And Mixed Beverage Tax Return For A 2, B 2a, S 1 seamlessly on any device

Online document management has become increasingly favored by enterprises and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents swiftly and without delays. Manage Ohio Wine And Mixed Beverage Tax Return For A 2, B 2a, S 1 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and eSign Ohio Wine And Mixed Beverage Tax Return For A 2, B 2a, S 1 effortlessly

- Obtain Ohio Wine And Mixed Beverage Tax Return For A 2, B 2a, S 1 and click Get Form to initiate the process.

- Employ the tools we provide to complete your document.

- Highlight relevant sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Choose your preferred method to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Ohio Wine And Mixed Beverage Tax Return For A 2, B 2a, S 1 to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ohio wine and mixed beverage tax return for a 2 b 2a s 1

Create this form in 5 minutes!

How to create an eSignature for the ohio wine and mixed beverage tax return for a 2 b 2a s 1

How to generate an electronic signature for your PDF online

How to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is an Ohio wine and mixed beverage tax return?

The Ohio wine and mixed beverage tax return is a specific document that businesses must file to report the sales of wine and mixed beverages within the state. This return helps ensure compliance with Ohio's tax regulations and allows businesses to remit appropriate taxes on their sales.

-

How can airSlate SignNow help with my Ohio wine and mixed beverage tax return?

airSlate SignNow provides an efficient platform to eSign and manage your Ohio wine and mixed beverage tax return documents. With its user-friendly interface, you can quickly prepare, sign, and send tax returns, ensuring timely submission and compliance with state regulations.

-

Are there any fees associated with airSlate SignNow for filing Ohio wine and mixed beverage tax returns?

Yes, airSlate SignNow has a subscription-based pricing model that includes a variety of plans to suit different business needs. These plans are cost-effective and provide access to features that help streamline processes, including filing Ohio wine and mixed beverage tax returns.

-

What features does airSlate SignNow offer for managing tax documents like the Ohio wine and mixed beverage tax return?

airSlate SignNow offers several features including customizable templates, document tracking, and automated reminders. These tools ensure your Ohio wine and mixed beverage tax return is handled efficiently, minimizing errors and ensuring timely compliance.

-

Can airSlate SignNow integrate with accounting software for my Ohio wine and mixed beverage tax return?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions. This integration allows you to import sales data directly into your Ohio wine and mixed beverage tax return, simplifying the process and reducing the chance of calculation errors.

-

Is airSlate SignNow secure for filing sensitive tax documents like the Ohio wine and mixed beverage tax return?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. You can trust that your Ohio wine and mixed beverage tax return and other sensitive documents are safe throughout the eSigning process.

-

What benefits does airSlate SignNow provide for businesses handling Ohio wine and mixed beverage tax returns?

Using airSlate SignNow allows businesses to save time and reduce paperwork associated with filing Ohio wine and mixed beverage tax returns. The platform streamlines the eSigning process, ensuring that the returns are filed efficiently and accurately.

Get more for Ohio Wine And Mixed Beverage Tax Return For A 2, B 2a, S 1

- Buyers home inspection checklist connecticut form

- Sellers information for appraiser provided to buyer connecticut

- Legallife multistate guide and handbook for selling or buying real estate connecticut form

- Subcontractors agreement connecticut form

- Connecticut appearance form

- Option to purchase addendum to residential lease lease or rent to own connecticut form

- Connecticut prenuptial premarital agreement with financial statements uniform premarital agreement act connecticut

- Connecticut without form

Find out other Ohio Wine And Mixed Beverage Tax Return For A 2, B 2a, S 1

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form