Alc37 2015

What is the Alc37

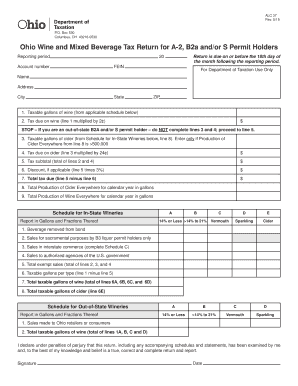

The Ohio Alc37 is a form used for tax purposes, specifically related to the reporting of certain financial information to the state of Ohio. This form is essential for individuals and businesses to ensure compliance with state tax regulations. It captures various details that the Ohio Department of Taxation requires to assess tax liabilities accurately.

How to use the Alc37

Using the Alc37 involves several steps, starting with gathering the necessary information about your financial activities. Once you have the required data, you can fill out the form either digitally or on paper. It is crucial to ensure that all information is accurate and complete to avoid any issues with the Ohio Department of Taxation. After completing the form, it should be submitted according to the specified guidelines, which may include online submission, mailing, or in-person delivery.

Steps to complete the Alc37

Completing the Alc37 requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, including income statements and expense records.

- Access the Alc37 form from the Ohio Department of Taxation website or your tax preparation software.

- Fill out the form, ensuring that all fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form through the designated method, ensuring you meet any deadlines.

Legal use of the Alc37

The Alc37 is legally binding when completed and submitted according to Ohio tax laws. It is important to understand that providing false information on this form can lead to penalties, including fines or legal action. Therefore, ensuring compliance with all relevant laws and regulations when using the Alc37 is crucial for both individuals and businesses.

Required Documents

To complete the Alc37, several documents may be required, including:

- Income statements for the reporting period.

- Expense receipts that support the claims made on the form.

- Previous tax returns, if applicable.

- Any additional documentation requested by the Ohio Department of Taxation.

Form Submission Methods

The Alc37 can be submitted through various methods, ensuring convenience for taxpayers. These methods typically include:

- Online submission via the Ohio Department of Taxation's e-filing system.

- Mailing the completed form to the designated tax office address.

- In-person submission at local tax offices or designated locations.

Penalties for Non-Compliance

Failing to comply with the requirements of the Alc37 can result in significant penalties. These may include:

- Fines imposed by the Ohio Department of Taxation for late or inaccurate submissions.

- Interest on any unpaid taxes that accrue over time.

- Potential legal action for willful non-compliance or fraud.

Quick guide on how to complete alc37

Complete Alc37 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to generate, modify, and electronically sign your documents swiftly without any delays. Manage Alc37 on any device using the airSlate SignNow applications for Android or iOS, and streamline any document-related tasks today.

The easiest method to edit and electronically sign Alc37 with ease

- Locate Alc37 and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to store your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Alc37 while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alc37

Create this form in 5 minutes!

People also ask

-

What is Ohio ALC 37 and how can it benefit my business?

Ohio ALC 37 is a unique feature of airSlate SignNow that streamlines the process of signing documents electronically. This powerful tool enhances productivity by allowing businesses to send and eSign documents quickly and securely. Implementing Ohio ALC 37 can signNowly reduce turnaround times and improve overall efficiency.

-

How much does it cost to use the Ohio ALC 37 feature?

The pricing for airSlate SignNow, including the Ohio ALC 37 feature, is competitive and offers various plans tailored to business needs. You can choose from monthly or annual subscriptions, which provide flexibility based on usage. For specific pricing details related to Ohio ALC 37, please visit our pricing page.

-

What features are included with the Ohio ALC 37 package?

The Ohio ALC 37 package includes various features such as automated workflows, customizable templates, and advanced security measures. Additionally, it allows for real-time tracking and notifications, ensuring that your documents are handled promptly. These features work together to enhance your overall document management experience.

-

Is the Ohio ALC 37 feature secure?

Absolutely, Ohio ALC 37 is designed with security in mind. It offers encryption, compliance with industry standards, and comprehensive audit trails to ensure the integrity of your documents. With Ohio ALC 37, you can rest assured that your sensitive information remains protected.

-

Can I integrate Ohio ALC 37 with other software?

Yes, Ohio ALC 37 seamlessly integrates with various software applications to enhance your workflow. You can link it with CRM systems, cloud storage, and project management tools for a more cohesive experience. This flexibility allows you to streamline document processes across different platforms.

-

How does Ohio ALC 37 improve document turnaround times?

Ohio ALC 37 signNowly improves document turnaround times by simplifying the signing process. With its user-friendly interface, clients can eSign documents from anywhere at any time. This not only expedites approvals but also minimizes the delays often associated with traditional signing methods.

-

Who can benefit from using Ohio ALC 37?

Businesses of all sizes can benefit from Ohio ALC 37, as it caters to various industries including healthcare, finance, and real estate. Whether you're a small startup or a large corporation, this feature offers the tools needed to enhance your document management. The versatility of Ohio ALC 37 makes it an essential asset for any organization.

Get more for Alc37

- Page 1 4 transplantrelay permit application august 11 form

- Fillable online behavioralhealthresources referral bformb

- Data use agreement for academic year 2019 20 form

- Pd 407 161 applicant record checkindd form

- Apd 29 form

- Application for license to carry a concealed umatilla county form

- Reston teen center participant registration form life ticket church

- Netl f 1421 1a form

Find out other Alc37

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document