Apps Irs Gov App PicklistForms and Publications PDF IRS Tax Forms 2021-2026

IRS Guidelines for the Donee Form

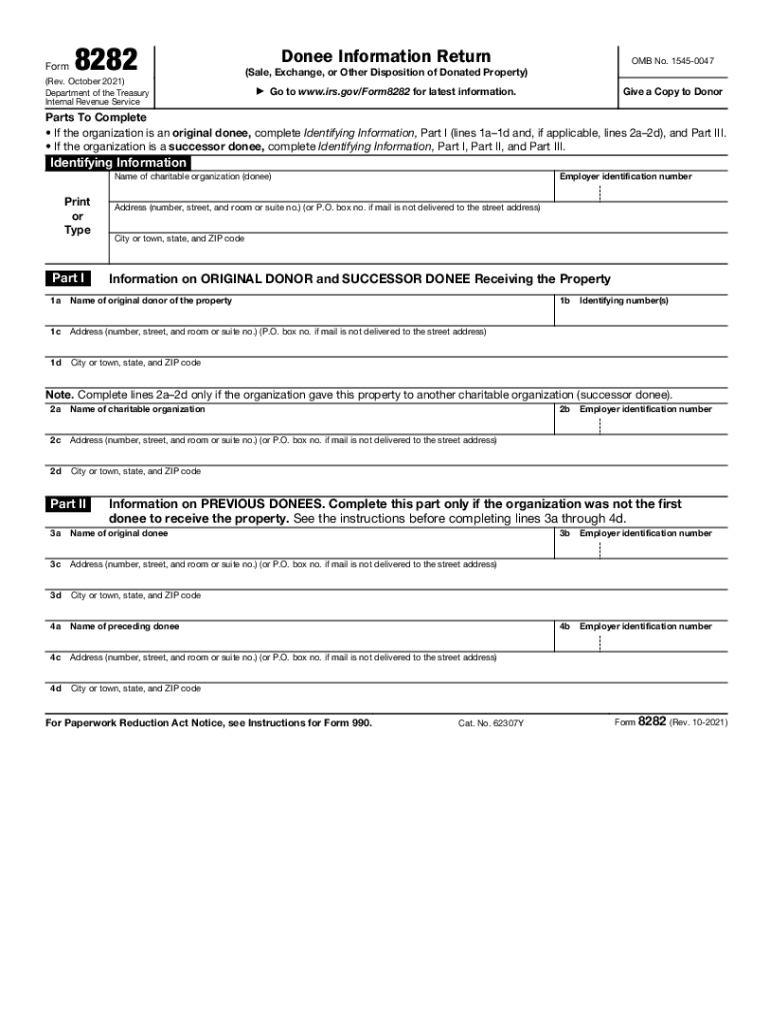

The IRS provides specific guidelines for the use of the irs donee form, particularly Form 8282, which is required when a donor disposes of donated property. Understanding these guidelines is crucial for both donors and donees to ensure compliance and avoid penalties. The form must be completed accurately, reflecting the fair market value of the property at the time of donation. This ensures that both parties are protected and that the transaction is recognized legally by the IRS.

Steps to Complete the IRS Donee Form

Completing the irs donee form involves several steps to ensure accuracy and compliance. First, gather all necessary information about the donated property, including its description, fair market value, and the date of the donation. Next, fill out Form 8282, ensuring that all fields are completed accurately. After filling out the form, review it for any errors or omissions. Finally, submit the form to the IRS as instructed, either electronically or via mail, depending on the requirements for the tax year.

Filing Deadlines for the IRS Donee Form

Filing deadlines for the irs donee form are critical to avoid penalties and ensure compliance with IRS regulations. Generally, Form 8282 must be filed within a certain timeframe following the donation of property. It is essential to check the IRS guidelines for the specific deadlines applicable to the tax year in question. Missing these deadlines can lead to complications in the tax reporting process for both the donor and the donee.

Required Documents for IRS Donee Submission

When submitting the irs donee form, certain documents are required to support the information provided. These may include a copy of the appraisal for the donated property, receipts, and any prior correspondence with the IRS regarding the donation. Ensuring that all necessary documentation is included will facilitate a smoother review process and help avoid potential issues with the IRS.

Legal Use of the IRS Donee Form

The legal use of the irs donee form is paramount for both donors and donees. This form serves as a formal declaration of the donation and is essential for tax reporting purposes. Proper completion and submission of Form 8282 provide legal protection and recognition of the donation by the IRS. It is important to adhere to all legal requirements to ensure that the transaction is valid and recognized under U.S. tax law.

Penalties for Non-Compliance with IRS Donee Regulations

Failure to comply with the regulations surrounding the irs donee form can result in significant penalties. These may include fines, denial of tax deductions, or additional scrutiny during audits. It is crucial for both donors and donees to understand their responsibilities and ensure that all forms are completed accurately and submitted on time. Awareness of these penalties can motivate compliance and protect both parties involved in the donation process.

Quick guide on how to complete appsirsgov app picklistforms and publications pdf irs tax forms

Effortlessly Prepare Apps irs gov App PicklistForms And Publications PDF IRS Tax Forms on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to generate, edit, and electronically sign your documents promptly without any delays. Manage Apps irs gov App PicklistForms And Publications PDF IRS Tax Forms on any device using airSlate SignNow’s Android or iOS applications and enhance any document-driven workflow today.

How to edit and eSign Apps irs gov App PicklistForms And Publications PDF IRS Tax Forms with ease

- Obtain Apps irs gov App PicklistForms And Publications PDF IRS Tax Forms and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or black out sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your document, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Apps irs gov App PicklistForms And Publications PDF IRS Tax Forms and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct appsirsgov app picklistforms and publications pdf irs tax forms

Create this form in 5 minutes!

How to create an eSignature for the appsirsgov app picklistforms and publications pdf irs tax forms

How to generate an e-signature for a PDF file online

How to generate an e-signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to make an e-signature right from your mobile device

The best way to create an e-signature for a PDF file on iOS

The best way to make an e-signature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to 8282?

airSlate SignNow is a powerful eSignature platform that allows businesses to streamline their document signing processes. By incorporating the number 8282 into its system, SignNow enhances security and ensures compliance with industry standards. This makes it an ideal solution for companies looking to improve their document workflows.

-

What pricing plans does airSlate SignNow offer for the 8282 solution?

airSlate SignNow provides various pricing plans tailored to meet the needs of different businesses. The 8282 plan offers a cost-effective way to access essential features, ensuring you get value for your investment. You can choose from flexible monthly or annual subscriptions to find the plan that best fits your budget.

-

What features does airSlate SignNow include in its 8282 plan?

The 8282 plan includes various features such as template creation, unlimited document signing, and real-time tracking. These features simplify the process of eSigning and document management, making it easy for teams to collaborate efficiently. Additionally, the plan supports integrations with other popular tools to enhance your workflow.

-

How can airSlate SignNow benefit my business under the 8282 framework?

airSlate SignNow, under the 8282 framework, enables businesses to increase productivity and reduce turnaround times for important documents. By using this platform, companies can streamline their operations, minimize paper use, and enhance customer satisfaction. The cost-effective nature of the 8282 solution allows for a strong return on investment.

-

Does airSlate SignNow support integrations with other software when using the 8282 plan?

Yes, airSlate SignNow provides seamless integrations with various software applications while utilizing the 8282 plan. This includes popular services like Google Drive, Dropbox, and CRM platforms. These integrations allow businesses to maintain a smooth workflow and enhance their operational efficiency.

-

Is airSlate SignNow secure for handling sensitive documents under the 8282 plan?

Absolutely! airSlate SignNow prioritizes security by employing advanced measures such as encryption and authentication protocols under the 8282 plan. This ensures that your sensitive documents are protected during the signing process, providing peace of mind for businesses that require confidentiality.

-

How does the customer support work for airSlate SignNow users on the 8282 plan?

Customers on the 8282 plan can access dedicated customer support to resolve any issues they encounter. airSlate SignNow offers various support channels, including live chat, email, and phone assistance. This ensures that users can get help promptly and maintain smooth operations.

Get more for Apps irs gov App PicklistForms And Publications PDF IRS Tax Forms

- Trim carpentry contractor package colorado form

- Fencing contractor package colorado form

- Hvac contractor package colorado form

- Landscaping contractor package colorado form

- Commercial contractor package colorado form

- Excavation contractor package colorado form

- Colorado contractor form

- Concrete mason contractor package colorado form

Find out other Apps irs gov App PicklistForms And Publications PDF IRS Tax Forms

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document