8282 2009

What is the 8282

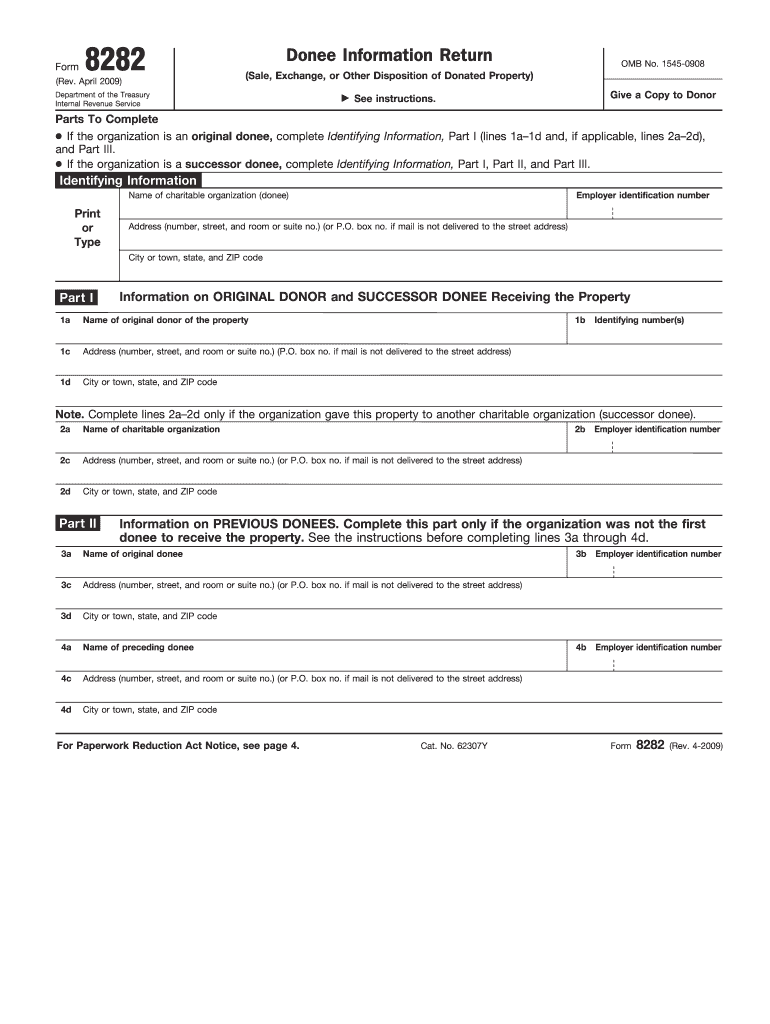

The IRS Form 8282, also known as the Donee Information Return, is a tax form used by organizations that receive charitable donations of property valued at more than five thousand dollars. This form is essential for documenting the details of the donation, ensuring compliance with IRS regulations. The form helps the IRS track the donation process and verify that the donor has claimed the appropriate tax deductions. It is particularly relevant for non-profits and charities that accept significant contributions of goods or property.

How to use the 8282

To effectively use the IRS Form 8282, the donee must complete the form accurately and submit it to the IRS. The form requires information about the donor, the property donated, and the date of the donation. It is crucial to ensure that all details are correct to avoid complications with tax deductions for the donor. Once completed, the form must be filed within a specified timeframe, typically within 125 days of the donation. This ensures that both the donor and the donee maintain compliance with IRS regulations.

Steps to complete the 8282

Completing the IRS Form 8282 involves several steps:

- Gather necessary information about the donor and the donated property.

- Fill out the form with accurate details, including the fair market value of the property.

- Sign and date the form to certify that the information provided is correct.

- Submit the completed form to the IRS within the required timeframe.

Ensuring that each step is followed carefully will help maintain compliance and facilitate the donation process.

Legal use of the 8282

The legal use of the IRS Form 8282 is governed by IRS regulations that require accurate reporting of significant charitable donations. The form must be filed by the donee to document the receipt of property donations. This legal requirement helps prevent tax fraud and ensures that donors can substantiate their claims for tax deductions. Failure to file the form or providing inaccurate information may lead to penalties for both the donor and the donee.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of Form 8282. These guidelines include instructions on what constitutes a reportable donation, how to determine the fair market value of the donated property, and the necessary timelines for filing. It is essential for organizations to familiarize themselves with these guidelines to ensure compliance and avoid potential issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for IRS Form 8282 are critical for compliance. The form must be submitted within 125 days of the donation date. This timeline is important for both the donor and the donee to ensure that tax records are accurate and up to date. Organizations should keep track of these deadlines to avoid late submissions, which could result in penalties or complications with tax filings.

Quick guide on how to complete 8282

Complete 8282 effortlessly on any device

Digital document management has increased in popularity among businesses and individuals. It offers an excellent environmentally friendly option to traditional printed and signed paperwork, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your documents swiftly without any delays. Handle 8282 on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and eSign 8282 with ease

- Obtain 8282 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choosing. Edit and eSign 8282 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8282

Create this form in 5 minutes!

How to create an eSignature for the 8282

The way to make an eSignature for a PDF in the online mode

The way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

How to make an eSignature for a PDF document on Android OS

People also ask

-

What is the significance of the number 8282 in airSlate SignNow?

The number 8282 represents our commitment to providing businesses with a seamless eSigning experience. airSlate SignNow is designed to enhance document management and eSigning processes, ensuring that customers can easily integrate the features they need.

-

How does airSlate SignNow pricing work for the 8282 plan?

The 8282 plan offers a competitive pricing structure that caters to businesses of all sizes. By choosing the 8282 plan, you can access advanced features at a cost-effective rate, ensuring you get maximum value for your investment in document management.

-

What features are included in the airSlate SignNow 8282 plan?

The 8282 plan includes features such as customizable templates, real-time tracking, and secure document storage. These capabilities are integral to enhancing user experience and ensuring that your eSigning process is both efficient and effective.

-

What are the benefits of using airSlate SignNow’s 8282 plan?

Using the 8282 plan allows businesses to streamline their document workflow, reducing time spent on signing paperwork. The benefits of the 8282 plan also include improved collaboration among team members and enhanced compliance with legal standards, making it a smart choice for any organization.

-

Can airSlate SignNow integrate with other software for the 8282 plan?

Yes, the airSlate SignNow 8282 plan offers various integration options with popular software tools like Google Drive, Salesforce, and more. This ensures that your eSigning process can seamlessly connect with existing workflows, enhancing productivity.

-

Is airSlate SignNow secure when using the 8282 plan?

Absolutely! The airSlate SignNow 8282 plan adheres to industry-leading security protocols to protect your documents and signatures. With features like encryption and secure cloud storage, you can trust that your data is in good hands.

-

How can I get started with the airSlate SignNow 8282 plan?

Getting started with the 8282 plan is simple. Visit our website, choose the 8282 plan, and follow the prompts to set up your account. Our user-friendly interface will guide you through the initial setup, allowing you to begin eSigning documents in no time.

Get more for 8282

Find out other 8282

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online