Form 1937 Missouri Fill Online, Printable, Fillable 2020

What is the Form 1937 Missouri?

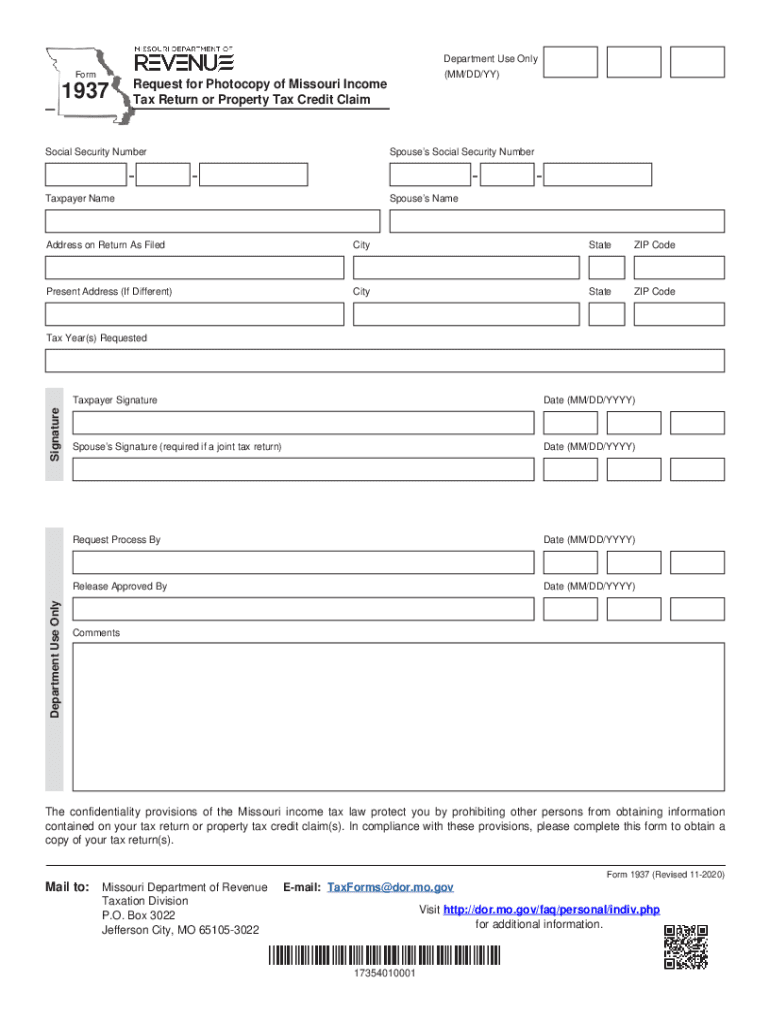

The Form 1937 Missouri, also known as the Missouri Request Tax, is a crucial document used for filing state income taxes in Missouri. This form is specifically designed for individuals and businesses to report their income and calculate their tax liability for the year 1937. It includes sections for personal information, income details, deductions, and credits that may apply to the taxpayer's situation. Understanding the purpose and structure of this form is essential for accurate and compliant tax filing.

Steps to Complete the Form 1937 Missouri

Completing the Form 1937 Missouri involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, including income statements and any relevant deductions. Follow these steps:

- Fill in your personal information, including name, address, and Social Security number.

- Report your total income from all sources, ensuring to include wages, interest, and dividends.

- List any deductions you are eligible for, such as business expenses or educational credits.

- Calculate your total tax liability based on the provided tax rates for the year.

- Review the completed form for any errors or omissions before submission.

Legal Use of the Form 1937 Missouri

The Form 1937 Missouri is legally recognized for tax reporting purposes within the state. To ensure that the form is valid and accepted by the Missouri Department of Revenue, it must be completed accurately and submitted by the designated filing deadline. Compliance with state tax laws is critical, as failure to file or inaccuracies can lead to penalties or legal repercussions. Utilizing reliable electronic tools for submission can enhance the legitimacy of the document.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1937 Missouri are crucial to avoid penalties. Typically, state tax returns must be filed by April 15 of the following year. However, taxpayers should verify specific deadlines for the year 1937, as they may differ due to extensions or special provisions. Marking these dates on your calendar can help ensure timely submission and compliance with state regulations.

Form Submission Methods

The Form 1937 Missouri can be submitted through various methods to accommodate different taxpayer preferences. Options include:

- Online submission through the Missouri Department of Revenue's secure portal.

- Mailing a printed copy of the completed form to the appropriate state office.

- In-person submission at designated state tax offices for those who prefer direct interaction.

Each method has its own requirements and processing times, so it is important to choose the one that best suits your needs.

Required Documents

To successfully complete the Form 1937 Missouri, several documents are typically required. These may include:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for any additional income sources, such as freelance work or interest income.

- Documentation for deductions, such as receipts for business expenses or educational costs.

- Previous year’s tax return for reference and consistency.

Having these documents readily available can streamline the completion process and enhance accuracy.

Quick guide on how to complete form 1937 missouri fill online printable fillable

Complete Form 1937 Missouri Fill Online, Printable, Fillable effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, alter, and eSign your documents quickly without delays. Manage Form 1937 Missouri Fill Online, Printable, Fillable on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form 1937 Missouri Fill Online, Printable, Fillable with ease

- Find Form 1937 Missouri Fill Online, Printable, Fillable and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Decide how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and eSign Form 1937 Missouri Fill Online, Printable, Fillable and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1937 missouri fill online printable fillable

Create this form in 5 minutes!

How to create an eSignature for the form 1937 missouri fill online printable fillable

How to generate an e-signature for your PDF file online

How to generate an e-signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

The best way to make an e-signature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The best way to make an e-signature for a PDF document on Android devices

People also ask

-

What is the significance of Missouri 1937 in the context of document signing?

Missouri 1937 refers to a legal framework that influences how electronic signatures are recognized in the state. Understanding Missouri 1937 is crucial for businesses using airSlate SignNow, as it ensures compliance with local regulations regarding eSigning documents.

-

How does airSlate SignNow comply with the Missouri 1937 regulations?

airSlate SignNow adheres to the Missouri 1937 standards by providing legally binding electronic signatures. Our platform ensures that all signed documents meet the necessary requirements for enforceability in Missouri, giving you peace of mind while managing your paperwork electronically.

-

What features does airSlate SignNow offer that support compliance with Missouri 1937?

Key features include secure document storage, audit trails, and the ability to add custom fields to ensure all requirements of Missouri 1937 are met. Furthermore, our platform offers user-friendly tools that make it simple to create and manage eSignatures compliant with these regulations.

-

Is airSlate SignNow a cost-effective solution for businesses in Missouri?

Absolutely! airSlate SignNow provides a cost-effective solution for businesses in Missouri. With flexible pricing plans tailored to various needs, you can efficiently manage your document signing process without straining your budget, all while being compliant with Missouri 1937.

-

Can airSlate SignNow integrate with other software while ensuring compliance with Missouri 1937?

Yes, airSlate SignNow seamlessly integrates with various software applications. These integrations allow businesses in Missouri to enhance their workflows while maintaining compliance with Missouri 1937 standards, ensuring efficiency and usability in document management.

-

What are the benefits of using airSlate SignNow for Missouri-based businesses?

Using airSlate SignNow streamlines the document signing process, saving time and resources. For Missouri-based businesses, this is especially beneficial as it ensures adherence to Missouri 1937 regulations while facilitating faster transactions and improving overall productivity.

-

How secure are my documents when using airSlate SignNow in accordance with Missouri 1937?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and compliance with Missouri 1937 to protect your electronic signatures and documents, ensuring that they are safe from unauthorized access while maintaining legal integrity.

Get more for Form 1937 Missouri Fill Online, Printable, Fillable

- Letter landlord with form

- Letter from tenant to landlord with demand that landlord remove garbage and vermin from premises connecticut form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles connecticut form

- Letter from tenant to landlord about landlords failure to make repairs connecticut form

- Letter tenant rent form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession connecticut form

- Letter from tenant to landlord about illegal entry by landlord connecticut form

- Letter from landlord to tenant about time of intent to enter premises connecticut form

Find out other Form 1937 Missouri Fill Online, Printable, Fillable

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate