Form 41, Corporation Income Tax Return and Instructions

What is the Idaho Form 41, Corporation Income Tax Return?

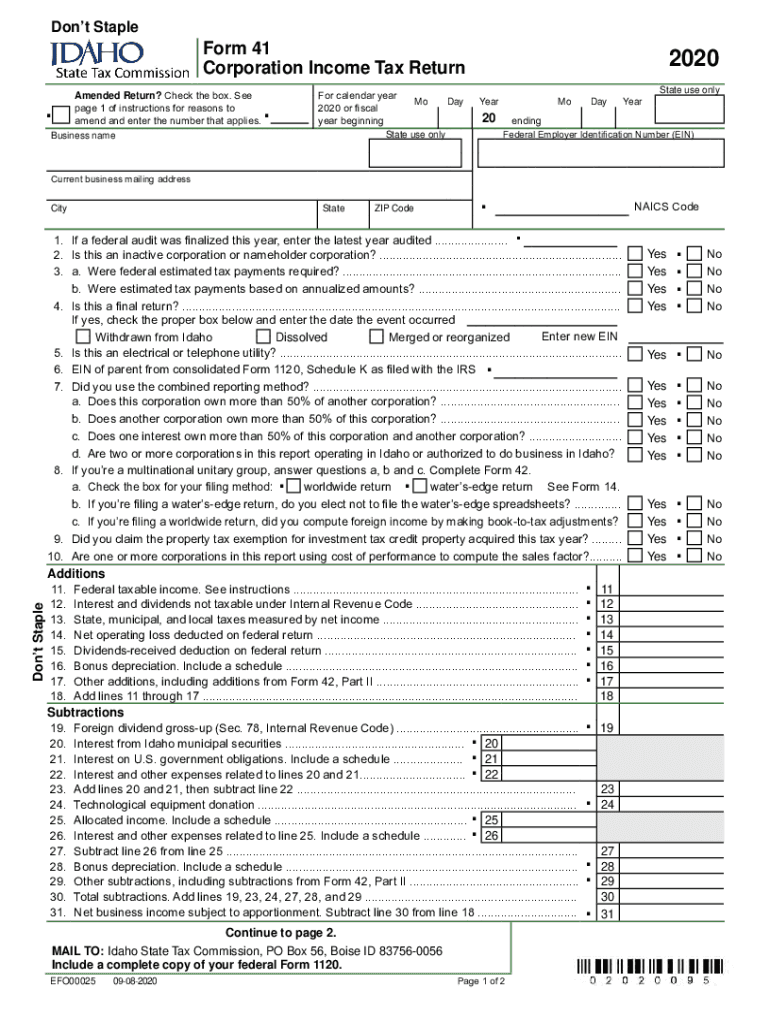

The Idaho Form 41 is the official document used by corporations to report their income and calculate their tax obligations in the state of Idaho. This form is essential for all corporations operating within Idaho, including those that are incorporated in other states but conduct business in Idaho. The Idaho 41 return requires detailed financial information, including revenue, expenses, and deductions, to determine the corporation's taxable income. Properly completing this form ensures compliance with state tax laws and helps avoid potential penalties.

Steps to Complete the Idaho Form 41

Completing the Idaho Form 41 involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, such as income statements, balance sheets, and previous tax returns. Next, follow these steps:

- Fill out the corporation's identifying information, including name, address, and federal employer identification number (FEIN).

- Report total income from all sources, including sales, services, and investments.

- Detail allowable deductions, such as operating expenses, cost of goods sold, and other business-related expenses.

- Calculate the taxable income by subtracting total deductions from total income.

- Determine the tax liability based on the applicable Idaho corporate tax rates.

- Sign and date the form, ensuring that it is submitted by the filing deadline.

Legal Use of the Idaho Form 41

The Idaho Form 41 is legally binding when completed accurately and submitted on time. To ensure its legal validity, corporations must adhere to the guidelines set forth by the Idaho State Tax Commission. This includes providing truthful information and maintaining accurate records to support the figures reported on the form. Additionally, electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that eSigned documents are treated as legally valid.

Filing Deadlines for the Idaho Form 41

Corporations must be aware of the filing deadlines associated with the Idaho Form 41 to avoid penalties. The standard deadline for filing is the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically falls on April 15. Extensions may be available, but they must be requested prior to the original deadline. It is crucial to stay informed about any changes to deadlines or filing requirements from the Idaho State Tax Commission.

Who Issues the Idaho Form 41?

The Idaho Form 41 is issued by the Idaho State Tax Commission, which is responsible for administering the state’s tax laws and regulations. This agency provides guidance on the completion and submission of the form, as well as resources for corporations to understand their tax obligations. The Tax Commission also handles any inquiries or issues related to the filing process, ensuring that businesses have the support they need to comply with state tax requirements.

Required Documents for the Idaho Form 41

To successfully complete the Idaho Form 41, corporations must gather several key documents, including:

- Financial statements, including income statements and balance sheets.

- Records of all income sources, such as sales and services.

- Documentation for all deductions claimed, including receipts and invoices.

- Previous tax returns, if applicable, to ensure consistency and accuracy.

Having these documents readily available will facilitate a smoother filing process and help ensure compliance with state regulations.

Quick guide on how to complete form 41 corporation income tax return and instructions 2020

Complete Form 41, Corporation Income Tax Return And Instructions effortlessly on any gadget

Online document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, as you can easily find the correct template and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without delays. Handle Form 41, Corporation Income Tax Return And Instructions on any gadget using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Form 41, Corporation Income Tax Return And Instructions seamlessly

- Obtain Form 41, Corporation Income Tax Return And Instructions and click Get Form to begin.

- Utilize the tools we offer to complete your template.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced papers, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow manages all your document handling needs in just a few clicks from a device of your choice. Edit and eSign Form 41, Corporation Income Tax Return And Instructions and ensure outstanding communication at any point in your form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 41 corporation income tax return and instructions 2020

How to make an e-signature for a PDF document in the online mode

How to make an e-signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your mobile device

The best way to make an e-signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the Idaho 41 return and how can airSlate SignNow assist with it?

The Idaho 41 return is a tax form that residents of Idaho must complete for their individual income tax. airSlate SignNow simplifies the process by allowing users to eSign documents related to their Idaho 41 return quickly and securely, ensuring compliance and accuracy.

-

What are the pricing options for using airSlate SignNow for Idaho 41 returns?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting from a basic plan to advanced features. Each plan is designed to provide flexibility for managing your Idaho 41 return documents without breaking the bank.

-

Does airSlate SignNow offer features specifically for tax document management, like the Idaho 41 return?

Yes, airSlate SignNow includes features tailored for tax document management, making it ideal for the Idaho 41 return. These features include templates, automated reminders, and secure storage, facilitating a smooth eSigning process.

-

Can airSlate SignNow help me track the status of my Idaho 41 return documents?

Absolutely! With airSlate SignNow, you can easily track the status of your Idaho 41 return documents in real time. This feature ensures you stay updated on who has signed and when the document is completed.

-

How secure is airSlate SignNow when handling my Idaho 41 return information?

Security is paramount at airSlate SignNow, especially for sensitive documents like the Idaho 41 return. The platform employs industry-leading encryption and compliance measures to protect your data during transmission and storage.

-

Can I integrate airSlate SignNow with other tax software for the Idaho 41 return?

Yes, airSlate SignNow supports multiple integrations with popular tax software, making it easier to manage your Idaho 41 return alongside your other financial documents. This seamless integration enhances efficiency and reduces data entry errors.

-

What benefits does using airSlate SignNow provide when filing my Idaho 41 return?

Using airSlate SignNow for your Idaho 41 return streamlines the eSigning process, saves time, and reduces paperwork. It also allows for quick access to documents, ensuring you can file your tax return smoothly and on time.

Get more for Form 41, Corporation Income Tax Return And Instructions

- Living trust for individual who is single divorced or widow or widower with children connecticut form

- Living trust for husband and wife with one child connecticut form

- Living trust for husband and wife with minor and or adult children connecticut form

- Amendment trust form 497301214

- Living trust property record connecticut form

- Financial account transfer to living trust connecticut form

- Assignment to living trust connecticut form

- Notice of assignment to living trust connecticut form

Find out other Form 41, Corporation Income Tax Return And Instructions

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF